Form 593

What is the Form 593

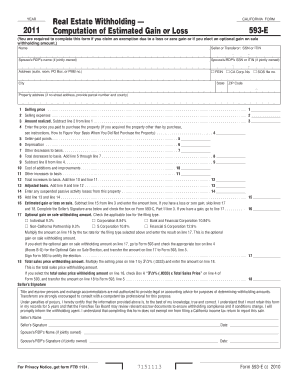

The Form 593, also known as the California Withholding Certificate, is a crucial document used in the state of California. It is primarily used by buyers of real estate to report the withholding of state income tax from the sale of property. This form ensures that the appropriate taxes are collected from sellers who may be subject to California state income tax, particularly non-residents. Understanding the purpose and requirements of the Form 593 is essential for compliance with California tax laws.

How to use the Form 593

Using the Form 593 involves several steps to ensure proper completion and submission. First, the buyer must fill out the form accurately, providing details about the transaction and the seller. It is important to include the seller's information, property details, and the amount of withholding. After completing the form, the buyer submits it to the California Franchise Tax Board along with the payment for the withheld taxes. This process helps facilitate the correct tax collection and reporting for real estate transactions.

Steps to complete the Form 593

Completing the Form 593 requires careful attention to detail. Here are the key steps:

- Gather necessary information, including the seller's name, address, and taxpayer identification number.

- Provide details about the property being sold, including the address and sale price.

- Calculate the amount to be withheld based on the sale price and applicable tax rates.

- Fill out all required sections of the form, ensuring accuracy in all entries.

- Sign and date the form before submitting it to the California Franchise Tax Board.

Legal use of the Form 593

The legal use of the Form 593 is governed by California tax regulations. It is essential for buyers to understand that failing to use this form correctly can result in penalties and interest charges. The form serves as a legal declaration of the withholding amount, and its proper submission ensures compliance with state tax laws. Buyers and sellers should keep copies of the completed form for their records, as it may be required for future tax filings or audits.

Filing Deadlines / Important Dates

Timely submission of the Form 593 is critical to avoid penalties. The form must be filed with the California Franchise Tax Board at the time of the property sale. Buyers should be aware of specific deadlines, which typically align with the closing date of the transaction. It is advisable to check for any updates or changes to filing deadlines, as these can vary based on state regulations or specific circumstances surrounding the sale.

Form Submission Methods (Online / Mail / In-Person)

The Form 593 can be submitted through various methods to accommodate different preferences. Buyers have the option to file the form online, which is often the quickest method. Alternatively, the form can be mailed to the California Franchise Tax Board or submitted in person at designated offices. Each method has its own processing times, so it is important to choose the one that best fits the timeline of the transaction.

Quick guide on how to complete form 593 57080

Complete Form 593 effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Form 593 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Form 593 with ease

- Find Form 593 and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhaustive form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and eSign Form 593 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 593 57080

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 593 e?

airSlate SignNow is a powerful eSignature platform that allows users to send and sign documents seamlessly. The solution, represented by the term '593 e', provides businesses with an easy-to-use, cost-effective way to manage document workflows and improve efficiency.

-

What features does airSlate SignNow offer for 593 e?

airSlate SignNow offers a range of features tailored for '593 e', including customizable templates, team collaboration tools, and automated workflows. These features help streamline the eSignature process, making it simple for users to get documents signed quickly and securely.

-

How much does airSlate SignNow cost for users interested in 593 e?

Pricing for airSlate SignNow varies based on the plan you choose. For customers focusing on '593 e', we offer flexible pricing options that can fit any budget, allowing businesses to select the most cost-effective solution for their needs.

-

Can I integrate airSlate SignNow with my current tools for 593 e?

Yes, airSlate SignNow easily integrates with various applications such as Google Drive, Salesforce, and Microsoft Office to enhance your '593 e' experience. This empowers users to utilize existing tools while benefiting from a streamlined eSigning process.

-

Is there a mobile app for airSlate SignNow related to 593 e?

Absolutely! The airSlate SignNow mobile app facilitates access to the '593 e' services from anywhere, enabling users to send and sign documents on the go. This ensures that the signing process remains efficient, regardless of location.

-

What security measures does airSlate SignNow implement for 593 e transactions?

airSlate SignNow prioritizes security with industry-standard encryption and compliant practices for all '593 e' transactions. This commitment ensures that your sensitive documents are protected during the signing process, giving you peace of mind.

-

How can airSlate SignNow help improve my business workflow for 593 e?

airSlate SignNow streamlines document workflows associated with '593 e', reducing bottlenecks and enhancing efficiency. By utilizing airSlate SignNow, businesses can save time and resources, leading to improved productivity and faster turnaround times.

Get more for Form 593

Find out other Form 593

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now