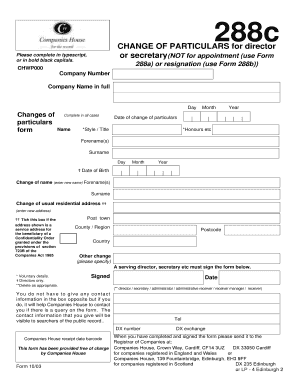

Form 288c

What is the Form 288c

The IRS letter 288c is a notification sent by the Internal Revenue Service to taxpayers regarding their tax return status. This letter typically informs individuals about discrepancies or issues that may require their attention. Understanding the content of this letter is crucial for maintaining compliance with tax regulations and ensuring that any necessary actions are taken promptly.

How to use the Form 288c

Using the IRS letter 288c involves carefully reviewing the information provided. Taxpayers should first identify the specific issues raised in the letter. It is important to gather any relevant documentation that supports your position regarding the discrepancies mentioned. Responding to the letter may require submitting additional information or correcting previous filings. Ensuring that you address the concerns outlined in the letter can help prevent further complications with the IRS.

Steps to complete the Form 288c

Completing the IRS letter 288c involves several key steps:

- Read the letter thoroughly to understand the issues raised by the IRS.

- Gather any necessary documents that pertain to the discrepancies mentioned.

- Prepare a response that addresses each point raised in the letter.

- Submit your response to the IRS by the specified deadline to avoid penalties.

Legal use of the Form 288c

The IRS letter 288c serves as an official communication that outlines legal obligations for taxpayers. Responding to this letter is not only a best practice but also a legal necessity to ensure compliance with tax laws. Failure to address the issues raised can lead to penalties, interest, or further action by the IRS. It is important to understand that the information contained in the letter is legally binding, and taxpayers should treat it with the seriousness it deserves.

IRS Guidelines

The IRS provides specific guidelines for responding to the letter 288c. Taxpayers should adhere to the instructions outlined in the letter, which may include deadlines for response and documentation requirements. Following these guidelines is essential for resolving any issues efficiently and avoiding potential penalties. It is advisable to consult the IRS website or a tax professional for additional guidance on how to navigate the response process.

Filing Deadlines / Important Dates

When dealing with the IRS letter 288c, it is crucial to be aware of any deadlines mentioned in the correspondence. Typically, taxpayers are given a specific timeframe to respond to the letter. Missing these deadlines can result in penalties or additional complications. Keeping track of important dates ensures that you remain compliant and can effectively address any issues raised by the IRS.

Quick guide on how to complete form 288c

Complete Form 288c effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to find the correct form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Form 288c on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign Form 288c with ease

- Find Form 288c and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to deliver your form, via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and eSign Form 288c and ensure effective communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 288c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 288c?

Form 288c is a document used to grant authorization for various purposes within organizations. It often facilitates the eSigning process, allowing for quick and legally binding agreements. Using airSlate SignNow, you can easily create, send, and sign form 288c online.

-

How much does airSlate SignNow cost for using form 288c?

The cost of using airSlate SignNow depends on the chosen subscription plan. Each plan includes different features for managing documents like form 288c, ensuring you find a cost-effective solution that meets your needs. Check our pricing page to find the best option for handling form 288c.

-

What features does airSlate SignNow offer for form 288c?

airSlate SignNow offers a variety of features for handling form 288c, including customizable templates, document sharing, and secure eSigning. Additionally, users can track the status of their form 288c in real-time, ensuring a smooth workflow. These features contribute to faster document completion and improved efficiency.

-

How does airSlate SignNow benefit businesses using form 288c?

Businesses benefit from using form 288c with airSlate SignNow by streamlining their document workflows and reducing the time spent on manual processes. The eSigning feature ensures that agreements are finalized quickly, enhancing productivity. Moreover, this digital approach minimizes errors and increases compliance with document regulations.

-

Can form 288c be integrated with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications, enhancing the functionality of form 288c. By integrating with CRM and project management tools, users can automate workflows and ensure that all related documents are easily accessible. This versatility makes managing form 288c more efficient.

-

Is it easy to send and receive form 288c using airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that simplifies the process of sending and receiving form 288c. You can upload your document, add the necessary signers, and send it out for eSignature in just a few clicks. This ease of use facilitates faster completion of important documents.

-

What security measures does airSlate SignNow have for form 288c?

airSlate SignNow has robust security features to protect your form 288c and other sensitive documents. These include encryption, secure access controls, and comprehensive audit trails that track all document activity. As a result, users can trust that their information is safeguarded throughout the eSigning process.

Get more for Form 288c

Find out other Form 288c

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement