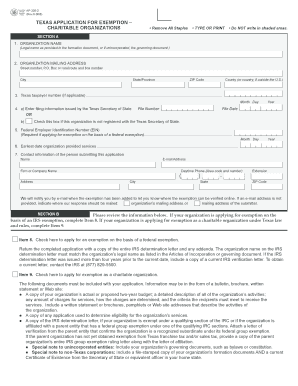

Irs Ap 205 Form

What is the Irs Ap 205 Form

The Irs Ap 205 Form is a document used by taxpayers to request a payment plan for their tax liabilities. This form allows individuals and businesses to propose a structured repayment plan to the Internal Revenue Service (IRS) when they are unable to pay their taxes in full by the due date. It is essential for managing tax debt and avoiding penalties associated with late payments.

How to obtain the Irs Ap 205 Form

To obtain the Irs Ap 205 Form, taxpayers can visit the official IRS website, where the form is available for download. The form can also be requested by calling the IRS directly. Additionally, taxpayers may find the form at local IRS offices or through tax professionals who assist with tax filings. Ensuring you have the most current version of the form is crucial for compliance.

Steps to complete the Irs Ap 205 Form

Completing the Irs Ap 205 Form involves several key steps:

- Provide personal information, including your name, address, and Social Security number.

- Detail your tax liabilities, including the type of tax and the amount owed.

- Indicate your proposed payment plan, including the amount you can pay and the frequency of payments.

- Sign and date the form to certify that the information provided is accurate.

After completing the form, it is important to review it for accuracy before submission.

Legal use of the Irs Ap 205 Form

The Irs Ap 205 Form is legally binding once submitted to the IRS. It is important to ensure that all information is accurate and truthful, as providing false information can lead to penalties. The form serves as a formal request for a payment plan, and the IRS will review it to determine whether to accept the proposed terms. Compliance with all IRS guidelines is essential for the legal validity of the form.

Form Submission Methods

Taxpayers can submit the Irs Ap 205 Form through various methods:

- Online: Submit the form electronically through the IRS website if applicable.

- Mail: Send the completed form to the address specified in the instructions.

- In-Person: Deliver the form directly to a local IRS office for immediate processing.

Choosing the appropriate submission method can affect the processing time and confirmation of receipt.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Ap 205 Form typically align with tax payment deadlines. It is crucial to submit the form before the tax payment due date to avoid penalties. Taxpayers should also be aware of any specific deadlines set by the IRS for payment plan requests, which can vary based on individual circumstances and tax situations.

Quick guide on how to complete irs ap 205 form

Prepare Irs Ap 205 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Irs Ap 205 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Irs Ap 205 Form with ease

- Obtain Irs Ap 205 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Irs Ap 205 Form and ensure outstanding communication throughout all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs ap 205 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Irs Ap 205 Form and why is it important?

The Irs Ap 205 Form is a critical document used for tax purposes, specifically for elections and various applications. It is essential for businesses and individuals to accurately complete this form to ensure compliance with IRS regulations. Properly filing the Irs Ap 205 Form can simplify tax-related processes and prevent costly errors.

-

How does airSlate SignNow help with the Irs Ap 205 Form?

airSlate SignNow streamlines the process of completing and eSigning the Irs Ap 205 Form. With intuitive features, users can easily fill out the form digitally, ensuring accurate information is inputted. The platform also allows for secure storage and sharing of the completed form, making it a reliable choice for managing important documents.

-

Is airSlate SignNow affordable for small businesses looking to manage the Irs Ap 205 Form?

Yes, airSlate SignNow offers a cost-effective solution tailored for small businesses, allowing them to efficiently manage the Irs Ap 205 Form and other documents. With budget-friendly pricing plans, users can access powerful features without breaking the bank. This affordability makes it an attractive option for businesses prioritizing document management.

-

What features does airSlate SignNow offer for handling the Irs Ap 205 Form?

airSlate SignNow provides a robust set of features for handling the Irs Ap 205 Form, including customizable templates, eSigning capabilities, and document tracking. Users can easily create and edit forms while ensuring proper compliance. The platform's user-friendly interface simplifies the entire process, making it accessible for everyone.

-

Can I integrate airSlate SignNow with other software to manage the Irs Ap 205 Form?

Absolutely! airSlate SignNow integrates seamlessly with multiple software applications, enhancing your ability to manage the Irs Ap 205 Form. Whether you are using CRMs, project management tools, or storage solutions, these integrations expand functionality and streamline workflows. This flexibility allows businesses to consolidate their document management processes.

-

What are the benefits of using airSlate SignNow for the Irs Ap 205 Form?

Using airSlate SignNow for the Irs Ap 205 Form offers multiple benefits, including efficiency, accuracy, and security. Users can complete forms quickly and accurately, reducing the risk of errors. Additionally, the platform ensures that sensitive information is protected, meeting compliance standards while simplifying document management.

-

Is there customer support available if I have questions about the Irs Ap 205 Form?

Yes, airSlate SignNow provides dedicated customer support for users with inquiries regarding the Irs Ap 205 Form or other features. You can access resources such as tutorials, FAQs, and direct customer service. This support ensures that you can effectively utilize the platform and navigate any challenges you may encounter.

Get more for Irs Ap 205 Form

- Sanitation inspection request cdss public site form

- Release of information former

- Initial combined assessmentreassessment form care1st health

- 855 202 0879 form

- Emacs sbcounty form

- Transfer on death deed ohio pdf form

- Life insurance beneficiary designation form anthem

- Behavioral health outpatient treatment when complete please fax to 1 form

Find out other Irs Ap 205 Form

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer