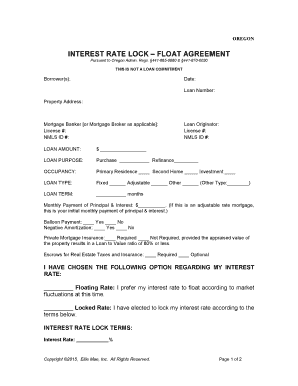

Or ENG INTEREST RATE LOCK FLOAT AGREEMENT Form

Understanding the rate lock agreement

A rate lock agreement is a crucial document in the mortgage process, allowing borrowers to secure a specific interest rate for a defined period. This agreement protects the borrower from potential interest rate increases while they complete their loan application or finalize their home purchase. By locking in a rate, borrowers can plan their finances more effectively, knowing their monthly payments will not change unexpectedly.

Key elements of the rate lock agreement

Several essential components define a rate lock agreement. These include:

- Lock period: The duration for which the interest rate is secured, typically ranging from 30 to 60 days.

- Interest rate: The specific rate that the borrower will receive, which may vary based on market conditions.

- Loan type: The type of mortgage being obtained, such as fixed-rate or adjustable-rate.

- Fees: Any associated costs for locking in the rate, which can vary by lender.

Steps to complete the rate lock agreement

Completing a rate lock agreement involves several key steps:

- Review terms: Carefully read the terms and conditions of the agreement, including the lock period and any fees.

- Provide information: Fill out necessary personal and financial information required by the lender.

- Sign the agreement: Use an electronic signature to finalize the document, ensuring it meets legal requirements.

- Receive confirmation: Obtain a confirmation of the rate lock from the lender, which should include all relevant details.

Legal use of the rate lock agreement

The rate lock agreement is legally binding once signed by both parties. It is essential for borrowers to understand their rights and obligations under the agreement. Compliance with eSignature laws, such as the ESIGN Act and UETA, ensures that electronically signed documents are recognized as valid in the United States. This legal framework protects both the borrower and the lender, providing assurance that the agreement will be upheld in court if necessary.

How to use the rate lock agreement

To effectively use a rate lock agreement, borrowers should first assess their current financial situation and market conditions. It is advisable to lock in a rate when interest rates are favorable. After securing the rate, borrowers should maintain communication with their lender to ensure all requirements are met before the lock period expires. This proactive approach can help avoid any last-minute complications that could jeopardize the locked rate.

State-specific rules for the rate lock agreement

Different states may have specific regulations governing rate lock agreements. It is important for borrowers to familiarize themselves with these rules, as they can affect the terms of the agreement and the rights of the parties involved. Consulting with a local real estate attorney or mortgage professional can provide valuable insights into any state-specific requirements that must be adhered to during the rate lock process.

Quick guide on how to complete or eng interest rate lock float agreement

Easily Create OR ENG INTEREST RATE LOCK FLOAT AGREEMENT on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the proper format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage OR ENG INTEREST RATE LOCK FLOAT AGREEMENT on any device with the airSlate SignNow applications for Android or iOS and streamline any document-centric task today.

How to Edit and eSign OR ENG INTEREST RATE LOCK FLOAT AGREEMENT Effortlessly

- Find OR ENG INTEREST RATE LOCK FLOAT AGREEMENT and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign OR ENG INTEREST RATE LOCK FLOAT AGREEMENT and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the or eng interest rate lock float agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a float agreement in the context of electronic signatures?

A float agreement refers to a flexible contract that allows parties to finalize terms at a later date. With airSlate SignNow, users can create float agreements that streamline the process of signing documents, ensuring that all stakeholders can review and make modifications as needed before finalization.

-

How does airSlate SignNow facilitate the creation of a float agreement?

airSlate SignNow makes it easy to draft a float agreement using customizable templates. Users can include essential clauses and sections, allowing for modifications at any point in the signing process, thus enhancing collaboration among signers.

-

What are the benefits of using airSlate SignNow for float agreements?

Using airSlate SignNow for float agreements offers several advantages, including enhanced efficiency and reduced turnaround times. The platform's intuitive interface makes it simple to manage agreements, ensuring that all parties remain informed and engaged without the hassle of physical documentation.

-

Is there a cost associated with using the float agreement feature on airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including features for creating float agreements. Users can choose from various subscription tiers that include customizable options to suit their budget, ensuring a cost-effective solution.

-

Can I integrate airSlate SignNow with other tools to manage my float agreements?

Yes, airSlate SignNow provides seamless integration with various applications, allowing users to manage float agreements alongside their existing workflows. Whether you use CRM systems or project management tools, you can connect airSlate SignNow to enhance productivity and document management.

-

How secure are float agreements signed through airSlate SignNow?

Security is a top priority at airSlate SignNow. Float agreements signed through our platform benefit from advanced encryption technology and robust authentication measures, ensuring that your documents and user data remain protected at all times.

-

Can I track the status of my float agreements in airSlate SignNow?

Absolutely! airSlate SignNow allows users to monitor the status of all float agreements in real-time. You will receive notifications as each party reviews and signs the document, providing complete visibility into the signing process.

Get more for OR ENG INTEREST RATE LOCK FLOAT AGREEMENT

Find out other OR ENG INTEREST RATE LOCK FLOAT AGREEMENT

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA