Form WHT 430 Vermont Department of Taxes Vermont Gov Tax Vermont

What is the Form WHT 430 Vermont Department of Taxes?

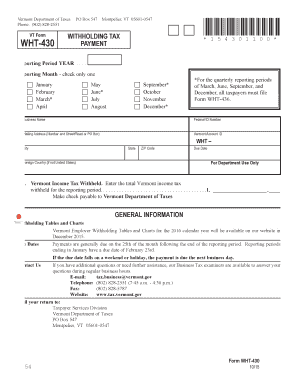

The Form WHT 430 is a tax document issued by the Vermont Department of Taxes. It is primarily used for withholding tax purposes, specifically for businesses that need to report and remit state income tax withheld from employees' wages. This form is essential for ensuring compliance with Vermont tax regulations and helps facilitate the accurate collection of state revenue.

How to use the Form WHT 430 Vermont Department of Taxes

Using the Form WHT 430 involves several key steps. First, businesses must accurately fill out the form with the necessary information, including the total amount of state income tax withheld from employees. Once completed, the form should be submitted to the Vermont Department of Taxes by the specified deadline. It is important to keep a copy of the submitted form for your records, as it serves as proof of compliance with state tax laws.

Steps to complete the Form WHT 430 Vermont Department of Taxes

Completing the Form WHT 430 requires careful attention to detail. The steps include:

- Gather necessary information, such as employee names, Social Security numbers, and the total amount of tax withheld.

- Fill out the form accurately, ensuring all figures are correct.

- Review the form for any errors or omissions.

- Submit the completed form to the Vermont Department of Taxes by the due date.

Legal use of the Form WHT 430 Vermont Department of Taxes

The Form WHT 430 is legally binding when completed and submitted according to Vermont state laws. It must be filled out with accurate information to ensure compliance with tax regulations. Failure to submit the form or providing incorrect information can result in penalties or legal consequences for businesses. Therefore, it is crucial to understand the legal implications of using this form.

Key elements of the Form WHT 430 Vermont Department of Taxes

Key elements of the Form WHT 430 include the identification of the employer, employee details, and the total state income tax withheld. Additionally, the form requires the signature of the employer or authorized representative, affirming that the information provided is accurate and complete. Understanding these elements is vital for proper completion and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form WHT 430 are critical for maintaining compliance with Vermont tax regulations. Typically, the form must be submitted on a quarterly basis, with specific due dates established by the Vermont Department of Taxes. It is essential for businesses to be aware of these deadlines to avoid late fees or penalties.

Quick guide on how to complete form wht 430 vermont department of taxes vermont gov tax vermont

Effortlessly Prepare Form WHT 430 Vermont Department Of Taxes Vermont gov Tax Vermont on Any Device

The management of online documents has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage Form WHT 430 Vermont Department Of Taxes Vermont gov Tax Vermont on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

How to Edit and eSign Form WHT 430 Vermont Department Of Taxes Vermont gov Tax Vermont with Ease

- Find Form WHT 430 Vermont Department Of Taxes Vermont gov Tax Vermont and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically available through airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that necessitate reprinting. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form WHT 430 Vermont Department Of Taxes Vermont gov Tax Vermont and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form wht 430 vermont department of taxes vermont gov tax vermont

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form WHT 430 and why is it needed for compliance?

Form WHT 430 is a state tax form required by the Vermont Department of Taxes for reporting withholding tax. It ensures that employers comply with Vermont's tax regulations. Properly filling out this form helps avoid penalties and ensures that your business remains compliant with Tax Vermont requirements.

-

How can airSlate SignNow assist with completing Form WHT 430?

AirSlate SignNow simplifies the process of completing Form WHT 430 by allowing users to fill out and eSign documents electronically. With an easy-to-use interface, businesses can ensure accuracy and efficiency in their filing. This helps streamline your compliance with the Vermont Department of Taxes and maintains your focus on important tasks.

-

What are the pricing options available for airSlate SignNow?

AirSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Whether you're a small startup or a large enterprise, there's an option that fits your budget while providing access to essential features for managing forms like Form WHT 430. Check our website for the most current pricing details.

-

Are there any features specifically designed for tax documentation?

Yes, airSlate SignNow includes features specifically for managing tax documentation, such as templates for Form WHT 430 and other related forms. Users can create, edit, and eSign these documents quickly, ensuring compliance with Vermont's tax regulations. This functionality simplifies the management of Tax Vermont submissions.

-

What integrations does airSlate SignNow offer?

AirSlate SignNow seamlessly integrates with popular software applications like Google Drive, Microsoft Office, and Salesforce. These integrations enable businesses to manage their tax documentation, including Form WHT 430, alongside their other daily operations. This enhances productivity and simplifies workflows regarding Tax Vermont compliance.

-

How secure is the document signing process with airSlate SignNow?

AirSlate SignNow prioritizes security by employing bank-level encryption to protect all documents, including Form WHT 430. Our platform complies with industry standards to ensure that your sensitive tax information is safe and secure while being transmitted electronically. Confidence in security is essential for successful Tax Vermont compliance.

-

Can I track the status of Form WHT 430 submissions?

Absolutely! AirSlate SignNow offers tracking features that allow you to monitor the status of your Form WHT 430 submissions. Users can receive notifications when a document is viewed, signed, or completed, helping ensure timely compliance with Vermont Department of Taxes and other requirements pertaining to Tax Vermont.

Get more for Form WHT 430 Vermont Department Of Taxes Vermont gov Tax Vermont

Find out other Form WHT 430 Vermont Department Of Taxes Vermont gov Tax Vermont

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document