B322 Form 2018-2026

What is the B322 Form

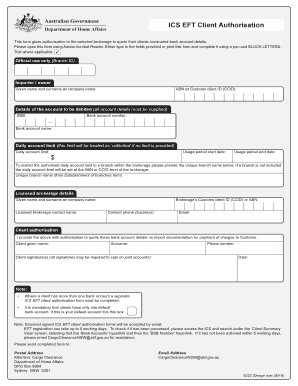

The B322 form, commonly referred to as the EFT form, is a crucial document used for electronic funds transfers. This form facilitates the authorization of direct deposits and withdrawals between bank accounts, making it essential for both individuals and businesses. By completing the B322 form, users can streamline their payment processes, ensuring timely and secure transactions.

How to obtain the B322 Form

Obtaining the B322 form is straightforward. Users can typically download it from official government or financial institution websites. It is important to ensure that the source is legitimate to avoid outdated or incorrect versions of the form. Once downloaded, users can print the form for completion or fill it out digitally, depending on the platform's capabilities.

Steps to complete the B322 Form

Completing the B322 form involves several key steps:

- Begin by entering your personal or business information, including name, address, and contact details.

- Provide your bank account information, including the account number and routing number.

- Clearly indicate whether the form is for direct deposit or withdrawal.

- Review all entered information for accuracy to avoid any processing delays.

- Sign and date the form to validate your authorization.

Legal use of the B322 Form

The B322 form is legally binding once completed and signed. It serves as an official authorization for financial institutions to process electronic transactions as specified. Users must ensure compliance with relevant regulations, such as UETA and ESIGN, to guarantee that their electronic signatures are recognized and enforceable in a court of law.

Key elements of the B322 Form

Several key elements must be included in the B322 form to ensure its validity:

- Personal Information: Full name, address, and contact number.

- Bank Details: Accurate bank account number and routing number.

- Transaction Type: Clear indication of whether the form is for deposits or withdrawals.

- Signature: The user's signature is essential to authorize the transactions.

Form Submission Methods

The B322 form can be submitted through various methods, depending on the requirements of the receiving institution:

- Online Submission: Many institutions allow users to upload the completed form directly through their secure portals.

- Mail: Users can print and send the form via postal service to the designated address.

- In-Person: Some users may prefer to deliver the form in person at their bank or financial institution.

Quick guide on how to complete b322 ics eft client authorisation b322 ics eft client authorisation

A brief guide on preparing your B322 Form

Finding the right template can be difficult when you need to submit official overseas documents. Even if you possess the necessary form, it may prove to be tedious to promptly prepare it according to all specifications if you rely on paper copies instead of managing everything electronically. airSlate SignNow is the online eSignature platform that helps you tackle these issues. It allows you to acquire your B322 Form and swiftly complete and sign it on-site without the need to reprint documents every time you make a typo.

Follow these steps to get your B322 Form ready with airSlate SignNow:

- Hit the Get Form button to upload your document to our editor right away.

- Begin with the first blank field, enter your information, and proceed using the Next tool.

- Complete the empty fields using the Cross and Check tools from the toolbar above.

- Select the Highlight or Line options to emphasize the most important details.

- Click on Image and upload one if your B322 Form requires it.

- Make use of the pane on the right to add more fields for you or others to complete if needed.

- Review your inputs and confirm the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing the form by clicking the Done button and choosing your file-sharing preferences.

Once your B322 Form is prepared, you can share it as you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely archive all your completed documents in your account, organized into folders according to your preferences. Don’t spend time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct b322 ics eft client authorisation b322 ics eft client authorisation

Create this form in 5 minutes!

How to create an eSignature for the b322 ics eft client authorisation b322 ics eft client authorisation

How to generate an eSignature for your B322 Ics Eft Client Authorisation B322 Ics Eft Client Authorisation in the online mode

How to create an electronic signature for the B322 Ics Eft Client Authorisation B322 Ics Eft Client Authorisation in Google Chrome

How to generate an electronic signature for putting it on the B322 Ics Eft Client Authorisation B322 Ics Eft Client Authorisation in Gmail

How to create an electronic signature for the B322 Ics Eft Client Authorisation B322 Ics Eft Client Authorisation right from your smart phone

How to create an electronic signature for the B322 Ics Eft Client Authorisation B322 Ics Eft Client Authorisation on iOS

How to generate an electronic signature for the B322 Ics Eft Client Authorisation B322 Ics Eft Client Authorisation on Android OS

People also ask

-

ইএফটি ফরম ডাউনলোড করার জন্য কি ধরনের ডিভাইস প্রয়োজন?

আপনি যে কোনও ডিভাইসে, যেমন কম্পিউটার, ট্যাবলেট বা স্মার্টফোনে ইএফটি ফরম ডাউনলোড করতে পারেন। airSlate SignNow একটি ক্লাউড ভিত্তিক সেবা, তাই এটি আপনার সমস্ত ডিভাইসে একসাথে কাজ করে। সহজ ডাউনলোড প্রক্রিয়ার মাধ্যমে আপনি দ্রুত আপনার প্রয়োজনীয় ফরম পেয়ে যাবেন।

-

ইএফটি ফরম ডাউনলোডের খরচ কেমন?

airSlate SignNow এ ইএফটি ফরম ডাউনলোডের জন্য খুব মোটামুটি মূল্য নির্ধারণ করা হয়েছে। আপনি আমাদের বিভিন্ন প্রাইসিং প্ল্যানের মাধ্যমে নিবন্ধন করতে পারেন, যেখানে প্রথম মাসের জন্য বিনামূল্যে ট্রায়ালও রয়েছে। বিভিন্ন প্ল্যানে বিভিন্ন সুবিধা পাওয়া যাবে যা আপনার প্রয়োজন অনুযায়ী উপযোগী।

-

আমি কি ইএফটি ফরম ডাউনলোড করার পর সেগুলো ইলেকট্রনিক সাইন করতে পারবো?

হ্যাঁ, airSlate SignNow এর মাধ্যমে আপনি ইএফটি ফরম ডাউনলোড করার পর সেগুলো ইলেকট্রনিক সাইন করতে পারবেন। আমাদের প্ল্যাটফর্মটি ব্যবহার করা খুবই সহজ, এবং আপনি কিভাবে সাইন করতে হবে তা নির্দিষ্ট নির্দেশনা পাবেন। এর ফলে আপনার সময় এবং অর্থ দুটিই সাশ্রয় হবে।

-

ইএফটি ফরম ডাউনলোডের জন্য কি কোনো কাস্টমাইজেশন অপশন রয়েছে?

হ্যাঁ, airSlate SignNow ব্যবহারকারীদের জন্য ইএফটি ফরম ডাউনলোডের সময় কাস্টমাইজেশন অপশন প্রদান করে। ব্যবহারকারীরা তাদের প্রয়োজন অনুযায়ী ফরমের তথ্য সমন্বয় এবং পরিবর্তন করতে পারেন। কাস্টমাইজেশন ব্যবস্থাটি আপনার কাজের প্রক্রিয়াকে আরও গতিশীল এবং কার্যকর করে তুলবে।

-

ইএফটি ফরম ডাউনলোডের পর ডাটা সুরক্ষা কিভাবে নিশ্চিত করা হয়?

airSlate SignNow গৃহীত ডাটা সুরক্ষা পদক্ষেপগুলি অত্যন্ত কঠোর। আপনার ইএফটি ফরম ডাউনলোড ও সঞ্চয়ের সময় SSL এনক্রিপশন প্রযুক্তি ব্যবহার করা হয়। সরকারি মানদণ্ড অনুযায়ী, আপনার সমস্ত সংবেদনশীল তথ্য সুরক্ষিত থাকবে, যা আপনাকে আত্মবিশ্বাসী করে তোলে।

-

ইএফটি ফরম ডাউনলোডের জন্য সাহায্য নিতে কি কোন সাপোর্ট অপরিহার্য?

হ্যাঁ, airSlate SignNow ব্যবহার করার সময় যদি কোন সমস্যা হয়, তবে আমাদের ক্লায়েন্ট সাপোর্ট টিমকে যোগাযোগ করতে পারেন। তারা ২৪/৭ উপলব্ধ এবং যে কোন প্রশ্নের সুস্পষ্ট উত্তর দেয়ার জন্য প্রস্তুত। আপনার ইএফটি ফরম ডাউনলোড ও ব্যবহারে সাহায্য করতে আমরা প্রস্তুত।

-

কিভাবে airSlate SignNow এ একাধিক ফরম ইএফটি ফরম ডাউনলোড করতে পারি?

আপনার যদি একাধিক ইএফটি ফরম ডাউনলোডের প্রয়োজন হয়, তবে airSlate SignNow উদার ব্যবস্থার প্রস্তাব করে। আপনি এক জায়গায় সব ফরম ডাউনলোড করতে পারবেন এবং প্রয়োজন অনুযায়ী ব্যবস্থাপনা করতে পারবেন। এটি আপনার কাজের ক্ষেত্রে দক্ষতা বৃদ্ধি করে এবং আপনার সময় সাশ্রয় করবে।

Get more for B322 Form

- Irs publication 1660 form

- Form 6 9 certificate of construction completion the texas glo texas

- Duproprio offer to purchase pdf 240028558 form

- Project 5 unit 1 test form

- Aisd building use application form

- Group dentaloutpatienthospitalisation benefit claim form

- University of plymouth partner student institution handbook form

- Two member llc operating agreement template form

Find out other B322 Form

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer