STEC CC Rev 1110 Tax Ohio Gov Sales and Use Tax Form

What is the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax

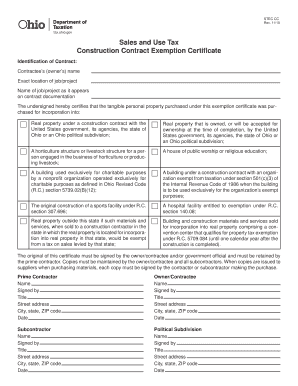

The STEC CC Rev 1110 Tax ohio gov Sales And Use Tax form is a critical document used in Ohio for reporting sales and use tax exemptions. This form allows organizations to claim exemption from sales tax on purchases of tangible personal property or services. It is essential for businesses and individuals who qualify for tax exemptions under specific circumstances, such as non-profit organizations or government entities. Understanding the purpose and requirements of this form is key to ensuring compliance with Ohio tax laws.

How to use the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax

Using the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax form involves several steps. First, ensure you meet the eligibility criteria for tax exemption. Next, accurately fill out the form, providing all necessary details such as the purchaser's information and the nature of the exemption. Once completed, present the form to the vendor at the time of purchase to avoid sales tax charges. It is advisable to keep a copy for your records, as it may be required for future reference or audits.

Steps to complete the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax

Completing the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax form requires careful attention to detail. Follow these steps:

- Gather necessary information, including your organization’s name, address, and tax identification number.

- Identify the specific exemption category that applies to your purchase.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the vendor at the time of purchase to obtain the exemption.

Legal use of the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax

The legal use of the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax form is governed by Ohio tax regulations. To ensure that your use of this form is compliant, it is important to understand the legal framework surrounding sales tax exemptions. The form must be filled out accurately and presented to vendors to validate the exemption claim. Misuse of the form can lead to penalties, including back taxes and fines, so adherence to legal guidelines is crucial.

State-specific rules for the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax

Ohio has specific rules regarding the use of the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax form. These rules outline who is eligible for exemptions and under what conditions. For instance, certain types of organizations, such as educational institutions and charitable organizations, may qualify. It is important to familiarize yourself with these state-specific regulations to ensure that your exemption claim is valid and compliant with Ohio law.

Form Submission Methods (Online / Mail / In-Person)

The STEC CC Rev 1110 Tax ohio gov Sales And Use Tax form can be submitted through various methods, depending on the vendor's preferences. Typically, the form is presented in person at the time of purchase. However, some vendors may accept it via mail or electronically. It is advisable to confirm with the vendor regarding their preferred submission method to ensure the exemption is processed correctly.

Quick guide on how to complete stec cc rev 1110 tax ohio gov sales and use tax

Complete STEC CC Rev 1110 Tax ohio gov Sales And Use Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without any delays. Manage STEC CC Rev 1110 Tax ohio gov Sales And Use Tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign STEC CC Rev 1110 Tax ohio gov Sales And Use Tax with ease

- Locate STEC CC Rev 1110 Tax ohio gov Sales And Use Tax and click Get Form to begin.

- Use the tools we offer to complete your form.

- Select signNow sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign STEC CC Rev 1110 Tax ohio gov Sales And Use Tax and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stec cc rev 1110 tax ohio gov sales and use tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax form?

The STEC CC Rev 1110 Tax ohio gov Sales And Use Tax form is used by businesses in Ohio to claim exemption from sales and use tax for certain purchases. It helps in documenting that the purchased items are meant for resale or for use in exempt activities. Filling this form accurately is essential to comply with state tax regulations.

-

How can airSlate SignNow assist me with the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax filing?

AirSlate SignNow streamlines the process of completing and submitting the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax form electronically. Our platform allows you to easily fill out the form, eSign it, and send it directly to tax authorities, saving you time and reducing errors.

-

What features does airSlate SignNow offer for managing tax-related documents?

AirSlate SignNow provides robust features such as customizable templates, eSignature capabilities, and document tracking, particularly for forms like STEC CC Rev 1110 Tax ohio gov Sales And Use Tax. This ensures you can organize, send, and store your tax documents securely while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for STEC CC Rev 1110 Tax ohio gov Sales And Use Tax forms?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different business needs, which includes features for processing the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax forms. With our competitive pricing, you gain access to a comprehensive solution that enhances efficiency and reduces paperwork.

-

Can I integrate airSlate SignNow with other tools for better handling of the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax?

Absolutely! AirSlate SignNow integrates seamlessly with various CRM and financial software, making it easier for you to manage the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax process within your existing workflows. This integration helps maintain data consistency and enhances productivity.

-

What are the benefits of eSigning the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax form with airSlate SignNow?

eSigning the STEC CC Rev 1110 Tax ohio gov Sales And Use Tax form with airSlate SignNow offers several benefits, including speed, security, and convenience. You can sign documents from anywhere, ensuring quick turnaround times, while maintaining the integrity and confidentiality of your information.

-

How does airSlate SignNow ensure the security of my STEC CC Rev 1110 Tax ohio gov Sales And Use Tax documents?

AirSlate SignNow employs advanced encryption and secure cloud storage to protect your STEC CC Rev 1110 Tax ohio gov Sales And Use Tax documents. This commitment to security ensures that your sensitive tax information remains confidential and safe from unauthorized access.

Get more for STEC CC Rev 1110 Tax ohio gov Sales And Use Tax

Find out other STEC CC Rev 1110 Tax ohio gov Sales And Use Tax

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form