WARNING!!! IRS Gov 2016

What is the WARNING!!! IRS gov

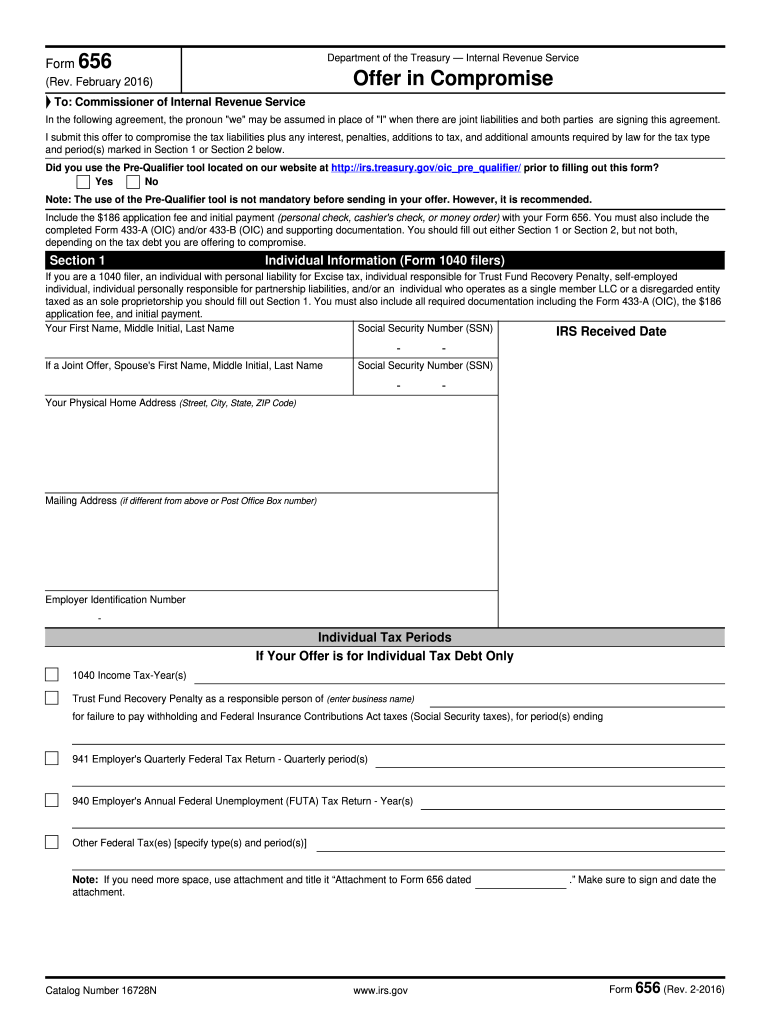

The WARNING!!! IRS gov refers to official notifications issued by the Internal Revenue Service (IRS) that inform taxpayers about critical tax-related issues. These warnings may pertain to potential fraud, changes in tax law, or urgent compliance requirements. Understanding the context of these warnings is essential for maintaining compliance and avoiding penalties. The IRS regularly updates its guidelines, making it crucial for individuals and businesses to stay informed about the latest developments.

How to use the WARNING!!! IRS gov

Utilizing the WARNING!!! IRS gov effectively involves recognizing the nature of the warning and taking appropriate actions. Taxpayers should carefully read the notification to understand the implications for their tax situation. If the warning indicates a need for action, such as filing a specific form or correcting information, it is important to follow the instructions provided. Keeping thorough records and ensuring that all required documents are submitted in a timely manner can help mitigate any potential issues arising from the warning.

Steps to complete the WARNING!!! IRS gov

Completing the requirements associated with the WARNING!!! IRS gov involves several key steps:

- Review the warning carefully to understand the specific requirements.

- Gather all necessary documentation, including previous tax returns and any relevant correspondence.

- Complete any required forms accurately, ensuring that all information is current and correct.

- Submit the completed forms through the appropriate channels, whether online, by mail, or in person, as specified in the warning.

- Keep copies of all submitted documents for your records.

Legal use of the WARNING!!! IRS gov

The legal use of the WARNING!!! IRS gov is paramount for compliance with federal tax laws. Taxpayers must adhere to the instructions outlined in the warning to avoid legal repercussions. Ignoring or misinterpreting these warnings can lead to penalties, including fines or additional scrutiny from the IRS. It is advisable to consult with a tax professional if there is any uncertainty regarding the legal implications of a warning.

Form Submission Methods (Online / Mail / In-Person)

Submitting responses to the WARNING!!! IRS gov can be done through various methods, depending on the nature of the warning and the IRS guidelines. Common submission methods include:

- Online: Many forms can be submitted electronically through the IRS website or authorized e-filing services.

- Mail: Taxpayers may send completed forms via postal service to the address specified in the warning.

- In-Person: Some situations may require in-person submissions at designated IRS offices, particularly for complex issues.

Penalties for Non-Compliance

Failing to comply with the instructions in the WARNING!!! IRS gov can result in significant penalties. These may include:

- Financial penalties, which can accumulate over time.

- Increased scrutiny from the IRS, leading to audits or further investigations.

- Potential legal action for serious infractions, including tax evasion charges.

It is essential to address any warnings promptly to avoid these consequences.

Quick guide on how to complete warning irsgov

Discover the simplest method to complete and sign your WARNING!!! IRS gov

Are you still spending time generating your official documents on paper instead of online? airSlate SignNow offers a superior approach to finishing and signing your WARNING!!! IRS gov and related forms for public services. Our intelligent eSignature solution provides you with all the necessary tools to handle paperwork swiftly and in compliance with formal regulations - comprehensive PDF editing, organizing, securing, signing, and sharing features right at your fingertips within an intuitive interface.

You only need to follow a few steps to complete and sign your WARNING!!! IRS gov:

- Upload the editable template to the editor using the Get Form button.

- Review the information you are required to enter in your WARNING!!! IRS gov.

- Navigate through the fields using the Next button to avoid missing any sections.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Conceal sections that are no longer relevant.

- Click on Sign to generate a legally recognized eSignature using any method of your choice.

- Add the Date next to your signature and finish your task with the Done button.

Store your finalized WARNING!!! IRS gov in the Documents folder within your profile, download it, or transfer it to your chosen cloud storage. Our solution also presents versatile form sharing options. There’s no requirement to print your forms when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct warning irsgov

FAQs

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

Do un-contracted workers have to fill out IRS W4 form?

I have no idea what an “un-contracted worker” is. I am not familiar with that term.Employees working in the U.S. complete a Form W-4.Independent contractors in the U.S. do not. Instead, they usually complete a Form W-9.If unclear on the difference between an employee or an independent contractor, see Independent Contractor Self Employed or Employee

-

How do I get updates about the government jobs to fill out the form?

Employment news is the best source to know the notifications published for govt job vacancy. The details are given in the notices. The news available on net also. One can refer the news on net too. It is published regularly on weekly basis. This paper includes some good article also written by experts which benefits the students and youths for improving their skill and knowledge. Some time it gives information regarding carrier / institution/ special advance studies.

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

Create this form in 5 minutes!

How to create an eSignature for the warning irsgov

How to create an eSignature for your Warning Irsgov in the online mode

How to create an eSignature for the Warning Irsgov in Chrome

How to make an eSignature for putting it on the Warning Irsgov in Gmail

How to generate an eSignature for the Warning Irsgov straight from your smartphone

How to generate an eSignature for the Warning Irsgov on iOS

How to make an eSignature for the Warning Irsgov on Android

People also ask

-

What should I do if I see a WARNING!!! IRS gov notice?

If you encounter a WARNING!!! IRS gov notice, it's crucial to verify its authenticity. Scammers often use the IRS name to create panic. Always contact the IRS directly through their official website for guidance and ensure your tax documents are securely signed using airSlate SignNow.

-

How does airSlate SignNow help with IRS document compliance?

Using airSlate SignNow ensures your eSigned documents meet IRS requirements. Our solution provides secure storage and audit trails, which are essential for compliance. In case of a WARNING!!! IRS gov inquiry, you'll have access to all necessary documentation at your fingertips.

-

Is airSlate SignNow affordable for small businesses?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses. Our plans are designed to provide maximum value without compromising on features. This ensures that you can manage your eSignatures confidently, even if you receive a WARNING!!! IRS gov notice.

-

What features does airSlate SignNow offer for secure document signing?

airSlate SignNow provides a range of features including customizable workflows, secure cloud storage, and advanced encryption. These tools help protect sensitive information, especially when dealing with documents related to WARNING!!! IRS gov matters. Experience peace of mind with our robust security measures.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive and Salesforce. This flexibility allows you to manage your documents efficiently and respond quickly to any WARNING!!! IRS gov inquiries that may arise.

-

How does airSlate SignNow enhance workflow efficiency?

airSlate SignNow streamlines your document signing process, signNowly reducing turnaround time. By automating workflows, you can focus on your core business activities while ensuring that important documents are signed and stored securely, especially when addressing any WARNING!!! IRS gov issues.

-

What benefits does airSlate SignNow provide for remote teams?

For remote teams, airSlate SignNow is an invaluable tool that enables secure eSigning from anywhere. This is particularly useful if your team needs to handle documentation related to WARNING!!! IRS gov. You can collaborate in real-time, ensuring that all signatures are obtained promptly.

Get more for WARNING!!! IRS gov

Find out other WARNING!!! IRS gov

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word