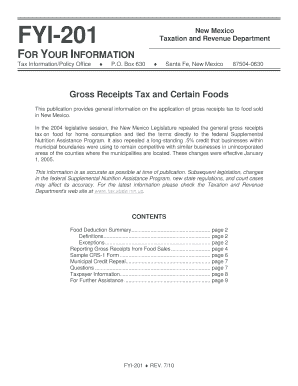

Fyi 201 Crs Taxes New Mexico Form

What is the Fyi 201 Crs Taxes New Mexico Form

The Fyi 201 Crs Taxes New Mexico Form is a state-specific tax document used by businesses and individuals to report and pay certain taxes in New Mexico. This form is essential for those who need to declare their gross receipts and ensure compliance with state tax regulations. It is primarily utilized by businesses operating within the state, allowing them to accurately report their earnings and calculate the taxes owed to the state government.

How to use the Fyi 201 Crs Taxes New Mexico Form

To effectively use the Fyi 201 Crs Taxes New Mexico Form, individuals and businesses must first gather all necessary financial information, including gross receipts and any applicable deductions. The form requires detailed entries of revenue sources, which helps in determining the total tax liability. Once the form is filled out, it can be submitted either online or through traditional mail, depending on the preference of the taxpayer and the submission options available.

Steps to complete the Fyi 201 Crs Taxes New Mexico Form

Completing the Fyi 201 Crs Taxes New Mexico Form involves several key steps:

- Gather financial records, including sales receipts and invoices.

- Fill out the form with accurate gross receipts data.

- Calculate any deductions that may apply to your business.

- Determine the total tax liability based on the reported figures.

- Review the completed form for accuracy before submission.

- Submit the form via the chosen method, either online or by mail.

Legal use of the Fyi 201 Crs Taxes New Mexico Form

The Fyi 201 Crs Taxes New Mexico Form is legally binding when completed and submitted according to state regulations. It is important for users to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. Utilizing a reliable digital platform for eSigning can enhance the legal validity of the document, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Fyi 201 Crs Taxes New Mexico Form vary based on the taxpayer's reporting schedule. Generally, businesses are required to file quarterly or annually, depending on their gross receipts. It is crucial to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important dates can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Fyi 201 Crs Taxes New Mexico Form can be submitted through various methods. Taxpayers have the option to file online using the New Mexico Taxation and Revenue Department's website, which often provides a quicker processing time. Alternatively, the form can be mailed to the appropriate state office or submitted in person at designated locations. Each method has its own set of guidelines and processing times that should be considered when choosing how to submit.

Quick guide on how to complete fyi 201 crs taxes new mexico form

Complete Fyi 201 Crs Taxes New Mexico Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without any delays. Manage Fyi 201 Crs Taxes New Mexico Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Fyi 201 Crs Taxes New Mexico Form with ease

- Locate Fyi 201 Crs Taxes New Mexico Form and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Fyi 201 Crs Taxes New Mexico Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fyi 201 crs taxes new mexico form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fyi 201 Crs Taxes New Mexico Form?

The Fyi 201 Crs Taxes New Mexico Form is a document used for reporting and paying state taxes in New Mexico. This form provides essential information for businesses and individuals to ensure compliance with tax regulations. With airSlate SignNow, you can easily fill out and eSign this form, simplifying the submission process.

-

How can airSlate SignNow help with the Fyi 201 Crs Taxes New Mexico Form?

airSlate SignNow streamlines the process of completing the Fyi 201 Crs Taxes New Mexico Form by providing an easy-to-use interface for document creation and eSignature. This service ensures that your form is completed accurately and submitted on time, which is crucial for avoiding penalties. Additionally, it offers features like templates and secure storage to enhance your filing experience.

-

Is there a cost associated with using airSlate SignNow for the Fyi 201 Crs Taxes New Mexico Form?

Yes, while airSlate SignNow offers a variety of pricing plans, the costs are typically flexible and tailored to fit the needs of different businesses. Customers can choose from basic plans to more comprehensive packages depending on the features they require for managing documents like the Fyi 201 Crs Taxes New Mexico Form. It's advisable to check their official website for the latest pricing details.

-

What features does airSlate SignNow offer for handling the Fyi 201 Crs Taxes New Mexico Form?

airSlate SignNow provides several key features to facilitate the handling of the Fyi 201 Crs Taxes New Mexico Form, including customizable templates, real-time collaboration, and secure eSignatures. These features enhance efficiency, allowing users to fill out forms quickly and track the status of their submissions easily. Additionally, cloud storage ensures that your forms are safe and accessible anytime.

-

Can I integrate airSlate SignNow with other applications for the Fyi 201 Crs Taxes New Mexico Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications like CRM systems and cloud storage services, allowing you to manage the Fyi 201 Crs Taxes New Mexico Form effectively. This integration helps streamline workflows by connecting your existing tools, making it easier to gather necessary information and process your tax documents. Check their website for a complete list of supported integrations.

-

How secure is the eSigning process for the Fyi 201 Crs Taxes New Mexico Form?

The security of the eSigning process for the Fyi 201 Crs Taxes New Mexico Form is a top priority for airSlate SignNow. The platform utilizes advanced encryption technologies and follows industry-standard security protocols to protect your sensitive information. Users can confidently sign and send their forms knowing that their data is secure against unauthorized access.

-

Can I customize the Fyi 201 Crs Taxes New Mexico Form using airSlate SignNow?

Yes, airSlate SignNow allows you to customize the Fyi 201 Crs Taxes New Mexico Form to meet your specific needs. You can add branding elements, adjust fields, and include additional information relevant to your business. This customization feature makes it easier to maintain a professional look while ensuring the form is tailored for efficient filing.

Get more for Fyi 201 Crs Taxes New Mexico Form

- Home checklist form printable

- Sellers information for appraiser provided to buyer arizona

- Legallife multistate guide and handbook for selling or buying real estate arizona form

- Subcontractors agreement arizona form

- Option to purchase addendum to residential lease lease or rent to own arizona form

- Arizona prenuptial premarital agreement with financial statements arizona form

- Arizona prenuptial premarital agreement without financial statements arizona form

- Az prenuptial form

Find out other Fyi 201 Crs Taxes New Mexico Form

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed