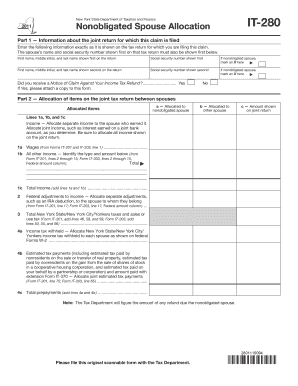

Nonobligated Spouse Allocation, It280 Department of Taxation Form

What is the Nonobligated Spouse Allocation, IT280 Department of Taxation

The Nonobligated Spouse Allocation, IT280, is a tax form utilized by married couples in the United States where one spouse does not have any tax obligations. This form allows the nonobligated spouse to allocate certain tax benefits or credits to the obligated spouse, which can help reduce the overall tax liability for the couple. Understanding this allocation is crucial for effective tax planning and compliance with state tax regulations.

Steps to Complete the Nonobligated Spouse Allocation, IT280 Department of Taxation

Completing the Nonobligated Spouse Allocation involves several key steps:

- Gather necessary documentation, including income statements and tax returns for both spouses.

- Review the eligibility criteria to ensure that the nonobligated spouse qualifies for the allocation.

- Fill out the IT280 form accurately, ensuring all required fields are completed.

- Double-check the information for accuracy, as errors can lead to delays or penalties.

- Submit the completed form along with any required supporting documents to the appropriate tax authority.

Legal Use of the Nonobligated Spouse Allocation, IT280 Department of Taxation

The legal use of the Nonobligated Spouse Allocation is governed by state tax laws. It is essential to comply with these regulations to ensure that the allocation is recognized by tax authorities. The form must be filled out correctly and submitted within the designated time frame to avoid any legal complications. Additionally, maintaining accurate records of the allocation can be beneficial in case of audits or inquiries from tax officials.

Eligibility Criteria for the Nonobligated Spouse Allocation, IT280 Department of Taxation

To qualify for the Nonobligated Spouse Allocation, certain criteria must be met:

- One spouse must have no tax liability for the year in question.

- The couple must file a joint tax return to utilize the allocation.

- Both spouses must provide accurate and complete information on the IT280 form.

Meeting these criteria ensures that the nonobligated spouse can effectively allocate tax benefits, which can lead to potential savings.

How to Obtain the Nonobligated Spouse Allocation, IT280 Department of Taxation

The Nonobligated Spouse Allocation, IT280, can typically be obtained through the state Department of Taxation's official website or by visiting their local office. Many states also provide the form in downloadable PDF format, which can be filled out electronically. It is advisable to check for the most current version of the form to ensure compliance with any recent changes in tax law.

Quick guide on how to complete nonobligated spouse allocation it280 department of taxation

Effortlessly Prepare Nonobligated Spouse Allocation, It280 Department Of Taxation on Any Device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents promptly without any holdups. Manage Nonobligated Spouse Allocation, It280 Department Of Taxation on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Alter and Electronically Sign Nonobligated Spouse Allocation, It280 Department Of Taxation Effortlessly

- Find Nonobligated Spouse Allocation, It280 Department Of Taxation and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, be it via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and electronically sign Nonobligated Spouse Allocation, It280 Department Of Taxation and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nonobligated spouse allocation it280 department of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Nonobligated Spouse Allocation, IT280 Department Of Taxation?

Nonobligated Spouse Allocation, IT280 Department Of Taxation refers to the tax allocation process for a nonobligated spouse's income during tax filing. It allows certain spouses to exclude their income from joint tax returns, effectively reducing taxable income. Understanding this allocation can signNowly impact your financial outcomes.

-

How can airSlate SignNow help with Nonobligated Spouse Allocation, IT280 Department Of Taxation?

airSlate SignNow offers a seamless way to digitally prepare and sign forms related to Nonobligated Spouse Allocation, IT280 Department Of Taxation. With its easy-to-use interface, users can efficiently manage their documents and ensure compliance with tax regulations. This streamlines the process, saving both time and resources.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans catering to various business sizes and needs. Each plan includes features that streamline document management, including those related to Nonobligated Spouse Allocation, IT280 Department Of Taxation. You can choose from a monthly subscription or annual plans that provide cost savings.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow includes features like eSigning, document templates, and integration with cloud storage services. These tools make it easier to handle tax documents, including those for Nonobligated Spouse Allocation, IT280 Department Of Taxation. Efficiently managing these documents helps ensure accuracy and compliance.

-

Can airSlate SignNow integrate with other software relevant to tax filing?

Yes, airSlate SignNow integrates seamlessly with various tax filing software and CRMs. This interoperability is beneficial for managing documents and forms related to Nonobligated Spouse Allocation, IT280 Department Of Taxation. It enhances workflow efficiency by ensuring all your tools work together harmoniously.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation offers numerous benefits, including enhanced security, faster turnaround times, and ease of use. Its focus on facilitating transactions related to Nonobligated Spouse Allocation, IT280 Department Of Taxation ensures compliance and accuracy. Additionally, users can access documents from anywhere, streamlining the tax process.

-

Is there customer support available for assistance with Nonobligated Spouse Allocation, IT280 Department Of Taxation?

Absolutely, airSlate SignNow provides comprehensive customer support to assist users with all their queries, including those related to Nonobligated Spouse Allocation, IT280 Department Of Taxation. Their support team is available via multiple channels to ensure you get the assistance you need. Whether via chat, email, or phone, help is just a signNow away.

Get more for Nonobligated Spouse Allocation, It280 Department Of Taxation

- Ecb vetting overseas 2016 form

- Srg2105 authorisation for pplspllapl qualifying cross country caa co form

- Flight crew training notice 03 2010 completion of form srg 1158 caa co

- Et1 form ni

- How to fill in a stock transfer form con40 2012 2019

- Rt3181 form

- Daycare registration form template

- Paris baguette application form

Find out other Nonobligated Spouse Allocation, It280 Department Of Taxation

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney

- How Do I Electronic signature South Carolina Unlimited Power of Attorney

- How Can I Electronic signature Alaska Limited Power of Attorney

- How To Electronic signature Massachusetts Retainer Agreement Template