14039 Form

What is the 14039?

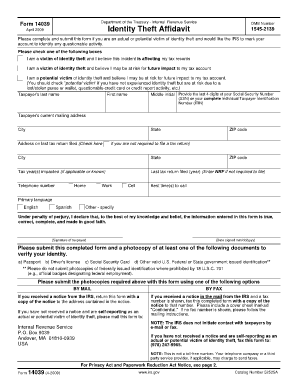

The 14039 form is a specific document used by individuals to report identity theft to the Internal Revenue Service (IRS). This form allows taxpayers to notify the IRS that someone has fraudulently used their Social Security number to file a tax return or claim a refund. By submitting the 14039, individuals can take the necessary steps to protect their tax records and prevent further misuse of their personal information.

How to use the 14039

Using the 14039 form involves several straightforward steps. First, obtain the form from the IRS website or a trusted source. Next, fill out the required fields, including your personal information and a description of the identity theft incident. It is crucial to provide accurate details to ensure the IRS can process your claim effectively. After completing the form, submit it according to the instructions provided, either online or by mail, to alert the IRS of the situation.

Steps to complete the 14039

Completing the 14039 form requires careful attention to detail. Follow these steps:

- Download the form from the IRS website.

- Provide your name, address, and Social Security number at the top of the form.

- Indicate the type of identity theft you experienced, such as fraudulent tax returns.

- Include any relevant documentation that supports your claim, such as police reports or correspondence with the IRS.

- Review the form for accuracy and completeness before submission.

Legal use of the 14039

The 14039 form is legally recognized as a formal notification to the IRS regarding identity theft. When completed correctly, it serves as a protective measure for taxpayers, allowing them to assert their rights and seek recourse against fraudulent activities. It is essential to ensure that all information provided is truthful and accurate, as submitting false information can lead to legal consequences.

Filing Deadlines / Important Dates

While there are no specific filing deadlines for the 14039 form itself, it is crucial to submit it as soon as you suspect identity theft. Prompt reporting helps mitigate potential damage and allows the IRS to take necessary actions. Additionally, be aware of tax filing deadlines to ensure that your legitimate tax return is filed on time, even while addressing identity theft issues.

Form Submission Methods

The 14039 form can be submitted in various ways to accommodate different preferences. Taxpayers can file the form online through the IRS website, which is often the quickest method. Alternatively, the form can be mailed to the appropriate IRS address listed in the instructions. In some cases, individuals may also choose to deliver the form in person at a local IRS office, although this option may vary by location.

Quick guide on how to complete 14039

Complete 14039 effortlessly on any gadget

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct format and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without hindrances. Handle 14039 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign 14039 effortlessly

- Obtain 14039 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device of your choice. Edit and eSign 14039 and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 14039

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the keyword 14039?

airSlate SignNow is an electronic signature solution that enables businesses to send, sign, and manage documents efficiently. The keyword 14039 pertains to our focus on providing seamless eSigning capabilities that help you streamline workflows and optimize document processes.

-

What are the pricing options available for airSlate SignNow related to 14039?

airSlate SignNow offers competitive pricing plans designed to accommodate different business needs. Our plans, referenced by the keyword 14039, come with features that cater to small businesses as well as large enterprises, ensuring you receive the best value for efficient eSigning.

-

Which features does airSlate SignNow offer that incorporate the benefits of 14039?

airSlate SignNow incorporates a range of features under the 14039 keyword, such as document templates, automated workflows, and real-time tracking. These features enhance your eSigning experience by making it faster and more reliable, ensuring all parties are kept in the loop.

-

How can airSlate SignNow help improve my business efficiency related to 14039?

By utilizing airSlate SignNow, businesses can drastically improve their efficiency by simplifying the document signing process. The solution associated with the keyword 14039 reduces turnaround time on contracts and agreements, allowing you to focus on core business activities rather than paperwork.

-

What integrations are available with airSlate SignNow linked to 14039?

airSlate SignNow seamlessly integrates with a variety of third-party applications like Salesforce and Google Drive, enhancing its utility linked to the keyword 14039. These integrations allow your organization to connect its existing tools, streamlining the eSigning process across platforms.

-

Is airSlate SignNow secure and compliant with regulations associated with 14039?

Yes, airSlate SignNow prioritizes security and compliance, ensuring all eSigned documents are legally binding and secure. The reference to 14039 ensures that our platform adheres to industry-standard regulations, providing peace of mind to our users.

-

Can I customize documents for signing using airSlate SignNow related to 14039?

Absolutely! With airSlate SignNow, you can customize documents to fit your specific needs, matching the functionality we highlight with the keyword 14039. This includes adding fields for signatures, dates, and other necessary information to ensure your documents are picture-perfect.

Get more for 14039

- Www indeed comcmpjoyland amusement parkjoyland amusement park salaries how much does joyland form

- Career schools ampamp colleges form csc 072 completer follow up

- Denison police department form

- Attorney fee voucher bell county texas form

- Disciplinary action form 46553874

- Texas application employment form

- City of georgetown fire department form

- Office of the maine ag consumer protection privacy form

Find out other 14039

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors