Ir526 Online Form

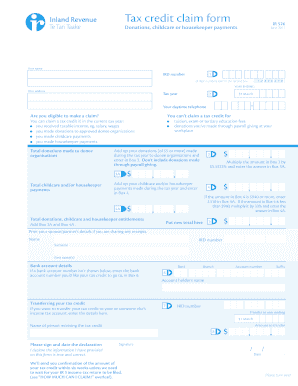

What is the IR526 Online Form?

The IR526 form is a specific document used by individuals and businesses in the United States for tax-related purposes. This form is essential for reporting certain financial activities and ensuring compliance with federal tax regulations. Understanding its purpose and requirements is crucial for accurate filing and to avoid potential penalties. The IR526 form serves as a formal declaration to the Internal Revenue Service (IRS) regarding specific income, deductions, or credits that may apply to the taxpayer's situation.

Steps to Complete the IR526 Online

Completing the IR526 form online involves several straightforward steps to ensure accuracy and compliance. Here is a general outline of the process:

- Access the IR526 form through a reliable digital platform.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Provide details regarding your income, deductions, and any applicable credits.

- Review the form for accuracy, ensuring all required fields are completed.

- Submit the form electronically, following the platform's guidelines for eSigning.

Ensuring each step is completed thoroughly will help avoid delays in processing and potential issues with the IRS.

Legal Use of the IR526 Online Form

The IR526 form can be legally executed online, provided that specific regulations are met. The use of eSignatures is recognized under the ESIGN Act and UETA, which establish the legality of electronic signatures in the United States. To ensure that your digital submission is legally binding, it is important to use a secure platform that adheres to these legal standards. This includes providing a digital certificate that verifies the identity of the signer and maintains an audit trail for accountability.

Required Documents for the IR526 Online Form

When preparing to complete the IR526 form, certain documents are typically required to support the information being reported. These may include:

- Previous tax returns for reference.

- W-2 forms or 1099 forms that report income.

- Receipts for deductible expenses.

- Any relevant documentation related to credits being claimed.

Having these documents ready can streamline the completion process and ensure that all necessary information is accurately reported.

Filing Deadlines for the IR526 Online Form

Filing deadlines for the IR526 form are crucial to avoid penalties and ensure compliance with IRS regulations. Typically, the deadline for submitting the IR526 form aligns with the annual tax filing deadline, which is usually April 15th for most taxpayers. However, it is important to verify specific deadlines for the current tax year, as they may vary based on individual circumstances or changes in tax law. Keeping track of these dates helps ensure timely submission and reduces the risk of incurring late fees.

Examples of Using the IR526 Online Form

The IR526 form can be utilized in various scenarios, depending on the taxpayer's situation. Common examples include:

- Individuals reporting freelance income or self-employment earnings.

- Business owners declaring revenue and expenses for their companies.

- Taxpayers claiming deductions for educational expenses or medical costs.

Understanding how the IR526 form applies to different situations can help taxpayers accurately report their financial activities and optimize their tax filings.

Quick guide on how to complete ir526 online

Complete Ir526 Online effortlessly on any gadget

Digital document administration has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct format and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Ir526 Online on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

The simplest way to modify and electronically sign Ir526 Online without hassle

- Locate Ir526 Online and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize essential sections of the documents or obscure sensitive details using tools that airSlate SignNow provides specifically for such purposes.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to preserve your modifications.

- Choose how you would like to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, frustrating form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ir526 Online and ensure superior communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir526 online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ir526 form and why is it important?

The ir526 form is a crucial document for various business processes that require electronic signatures. It serves as a legal acknowledgment of consent and authorization, ensuring compliance with regulatory standards. Understanding its significance helps businesses effectively navigate their signing processes.

-

How does airSlate SignNow simplify the use of the ir526 form?

airSlate SignNow streamlines the process of handling the ir526 form by providing a user-friendly platform for document creation, signing, and management. With features like customizable templates and automated workflows, businesses can easily prepare and distribute the ir526 form, saving valuable time and reducing errors.

-

What are the costs associated with using airSlate SignNow for the ir526 form?

airSlate SignNow offers competitive pricing plans designed to fit various business needs. Depending on the features you require for managing the ir526 form, you can choose from different subscription options. This ensures that businesses can find a cost-effective solution for their document signing needs.

-

Can I integrate airSlate SignNow with other applications for managing the ir526 form?

Yes, airSlate SignNow supports integration with various applications, allowing for seamless management of the ir526 form alongside your existing tools. Whether you need to connect with CRM systems, cloud storage services, or project management applications, airSlate SignNow makes it easy to create a cohesive workflow.

-

What are the security measures for sending the ir526 form via airSlate SignNow?

Security is a top priority when it comes to handling the ir526 form with airSlate SignNow. The platform employs advanced encryption protocols and secure cloud storage to ensure your documents are protected throughout the signing process. Additionally, audit trails are provided for tracking who signed the document and when.

-

How can businesses benefit from using the ir526 form with airSlate SignNow?

Using the ir526 form with airSlate SignNow brings multiple benefits, including improved efficiency and reduced turnaround time for approvals. The solution enhances collaboration among team members and clients, creating a faster, more organized signing experience. As a result, businesses can focus on their core operations while ensuring compliance.

-

Is there customer support available for issues related to the ir526 form?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any issues related to the ir526 form. Whether you have questions about document management, technical support, or need help navigating the platform, their support team is readily available to ensure your success.

Get more for Ir526 Online

Find out other Ir526 Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer