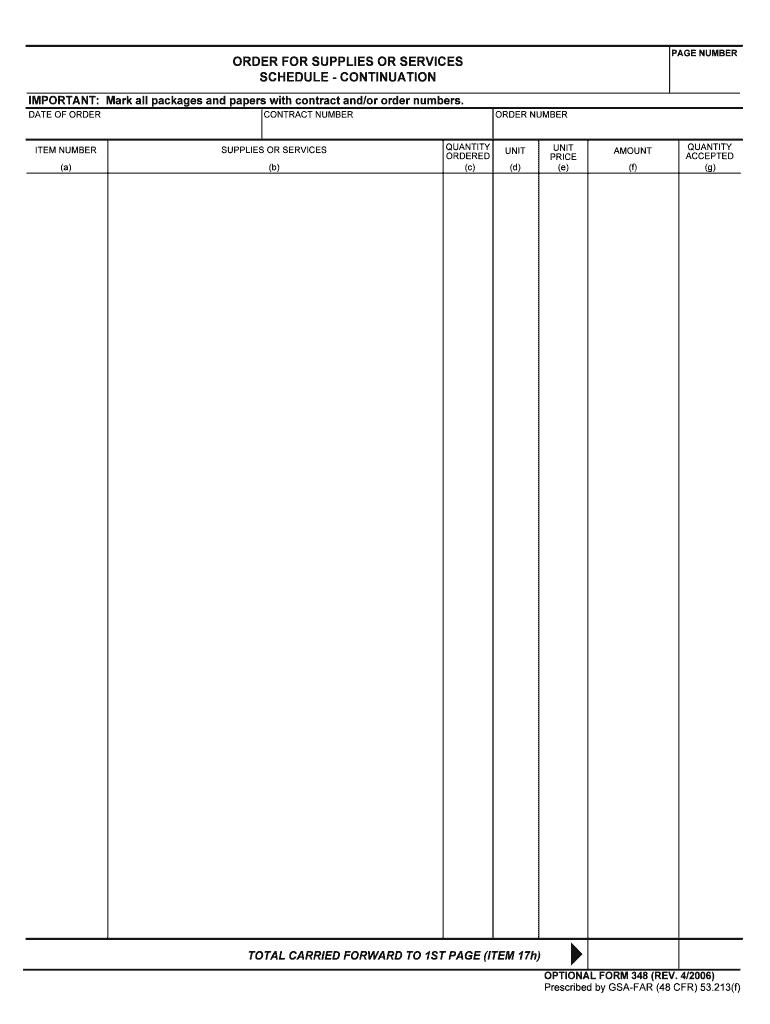

TOTAL CARRIED FORWARD to 1ST PAGE ITEM 17h Form

What is the TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h

The TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h form is a specific document used primarily in tax reporting. It allows taxpayers to report amounts that have been carried forward from previous tax years. This form plays a crucial role in ensuring that taxpayers accurately reflect their financial situation, particularly in relation to deductions and credits that may impact their current tax obligations.

Understanding the purpose of this form is essential for compliance with IRS regulations. It helps in maintaining a clear record of any amounts that need to be considered in the current tax year, thus preventing potential discrepancies during audits or reviews.

Steps to complete the TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h

Completing the TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather all relevant financial documents from previous years, including any carryover amounts.

- Review the instructions provided with the form to understand specific requirements.

- Carefully fill in the required fields, ensuring that all amounts are accurately reported.

- Double-check your entries for any errors or omissions.

- Sign and date the form to validate its authenticity.

Following these steps will help in the proper completion of the form, reducing the risk of errors that could lead to complications with the IRS.

Legal use of the TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h

The TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h form must be used in accordance with IRS guidelines to ensure its legal standing. This includes adhering to specific regulations regarding the reporting of carryover amounts. Failure to comply with these legal requirements can lead to penalties or issues during tax audits.

It is essential to maintain accurate records and documentation supporting the amounts reported on the form. This documentation may be requested by the IRS to verify the legitimacy of the carried forward amounts.

How to obtain the TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h

Obtaining the TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h form is a straightforward process. Taxpayers can typically access this form through the IRS website or through tax preparation software that includes the necessary forms for filing. Additionally, tax professionals can provide this form as part of their services.

It is important to ensure that you are using the most current version of the form to comply with the latest tax regulations. Check for any updates or changes that may have been implemented by the IRS for the current tax year.

Examples of using the TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h

Practical examples of using the TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h form can help clarify its application. For instance, if a taxpayer has unused capital losses from previous years, they can report these losses on the form to offset current year gains. This can significantly reduce the overall tax liability.

Another example includes taxpayers who have carried forward charitable contributions that exceed the annual deduction limit. By accurately reporting these amounts, they can ensure that they receive the full benefit of their charitable donations over multiple tax years.

Filing Deadlines / Important Dates

Filing deadlines for the TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h form align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their federal tax returns by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

It is crucial for taxpayers to be aware of these deadlines to avoid late filing penalties. Additionally, if you are filing for an extension, ensure that you understand how this affects your submission timeline for the form.

Quick guide on how to complete total carried forward to 1st page item 17h

Prepare TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h seamlessly on any device

Web-based document management has become widely embraced by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without hindrance. Manage TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h effortlessly

- Find TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h and select Get Form to begin.

- Use the tools we offer to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, tedious document searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the total carried forward to 1st page item 17h

How to generate an electronic signature for the Total Carried Forward To 1st Page Item 17h online

How to generate an electronic signature for your Total Carried Forward To 1st Page Item 17h in Google Chrome

How to make an eSignature for putting it on the Total Carried Forward To 1st Page Item 17h in Gmail

How to create an electronic signature for the Total Carried Forward To 1st Page Item 17h from your mobile device

How to create an eSignature for the Total Carried Forward To 1st Page Item 17h on iOS devices

How to make an electronic signature for the Total Carried Forward To 1st Page Item 17h on Android

People also ask

-

What is the total carried forward to 1st page item 17h in airSlate SignNow?

The total carried forward to 1st page item 17h refers to the cumulative values that need to be included on the first page of your documentation process. This feature ensures that all crucial data is automatically inputted, streamlining the eSigning process. With airSlate SignNow, businesses can enhance their workflows by seamlessly managing such values.

-

How does airSlate SignNow handle pricing for total carried forward to 1st page item 17h?

Pricing for features related to total carried forward to 1st page item 17h is competitive and aligned with our tiered subscription model. We offer flexible pricing that fits businesses of various sizes, ensuring you only pay for features that enhance your document workflow. Explore our plans to find one that meets your specific needs.

-

What features are included in the total carried forward to 1st page item 17h?

The features related to total carried forward to 1st page item 17h include automated data population, customizable templates, and real-time collaboration tools. These features are designed to streamline workflows and minimize errors, allowing teams to focus on what really matters. AirSlate SignNow empowers users with tools that enhance productivity and document management.

-

Can total carried forward to 1st page item 17h integrate with other tools?

Yes, airSlate SignNow offers integrations with various applications, allowing users to enhance the functionality of total carried forward to 1st page item 17h. Seamless integration with tools like CRM systems, project management software, and cloud storage solutions simplifies document management. This interoperability fosters efficiency and a cohesive workflow.

-

What are the benefits of using total carried forward to 1st page item 17h within airSlate SignNow?

Using the total carried forward to 1st page item 17h within airSlate SignNow allows for greater accuracy and efficiency in document management. This feature reduces the risk of errors by automatically populating essential data. It also accelerates the signing process, enabling faster turnaround times for business transactions.

-

Is there customer support available for issues related to total carried forward to 1st page item 17h?

Absolutely, airSlate SignNow provides comprehensive customer support for any queries related to total carried forward to 1st page item 17h. Our dedicated support team is available via chat, email, or phone to assist you with any issues or questions. We prioritize customer satisfaction to ensure you get the most out of our eSigning solutions.

-

How can I maximize the use of total carried forward to 1st page item 17h in my business?

To maximize the use of total carried forward to 1st page item 17h, take advantage of airSlate SignNow’s customizable templates and automated workflows. By setting templates tailored to your business needs, you can streamline repetitive tasks and reduce errors signNowly. Additionally, exploring training resources will help your team utilize the software effectively.

Get more for TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h

- Letter of medical necessity golden state medical goldenstatemedical form

- Formulir pendaftaran data communication cbn new cbn net

- Nj dcc 1 form

- Cigna reimbursement form pdf

- Costume plot preliminary notes 0 tqn com form

- Ultimatest grocery list 81610941 form

- Vdrlfhr form

- Oag ca govcharitiesrenewalsannual registration renewal attorney general of california form

Find out other TOTAL CARRIED FORWARD TO 1ST PAGE ITEM 17h

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe