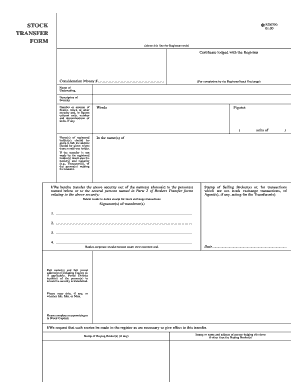

Stock Transfer Form

What is the Stock Transfer Form

The stock transfer form is a legal document used to transfer ownership of shares from one party to another. It serves as a record of the transaction and is essential for updating the ownership records of the issuing company. This form typically includes details such as the names of the transferor and transferee, the number of shares being transferred, and the signature of the transferor. Understanding its purpose is crucial for both individuals and businesses involved in stock transactions.

How to Use the Stock Transfer Form

Using the stock transfer form involves several straightforward steps. First, ensure that you have the correct form, which can often be obtained from the issuing company or financial institution. Next, fill in the required information accurately, including the names of both the seller and buyer, the number of shares, and any other pertinent details. Once completed, the transferor must sign the form to validate the transfer. Finally, submit the form to the appropriate entity for processing, which may include the company’s transfer agent or registrar.

Steps to Complete the Stock Transfer Form

Completing the stock transfer form involves a series of clear steps:

- Obtain the stock transfer form from the issuing company or their website.

- Fill in the transferor's name, the transferee's name, and the number of shares being transferred.

- Include any additional required information, such as the stock certificate number.

- Sign the form as the transferor, ensuring that your signature matches the one on file.

- Submit the completed form to the company’s transfer agent or registrar for processing.

Legal Use of the Stock Transfer Form

The stock transfer form is legally binding when properly executed. It must comply with state laws and regulations governing the transfer of securities. This includes ensuring that the transferor has the right to transfer the shares and that all necessary signatures are obtained. Additionally, electronic signatures are generally accepted, provided they meet legal standards under the ESIGN Act and UETA. It is advisable to consult legal counsel if there are any uncertainties regarding the transfer.

Key Elements of the Stock Transfer Form

Key elements of the stock transfer form include:

- Transferor Information: Name and address of the current shareholder.

- Transferee Information: Name and address of the new shareholder.

- Share Details: Number of shares being transferred and any relevant stock certificate numbers.

- Signatures: Signature of the transferor, and in some cases, the transferee.

- Date: The date on which the transfer is executed.

Examples of Using the Stock Transfer Form

Common scenarios for using the stock transfer form include:

- Transferring shares as a gift to family members or friends.

- Selling shares to another individual or business entity.

- Transferring shares as part of an estate settlement.

- Changing the ownership structure of a business by transferring shares among partners.

Quick guide on how to complete stock transfer form 1480600

Complete Stock Transfer Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, enabling you to access the appropriate forms and securely store them online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Stock Transfer Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Stock Transfer Form easily

- Find Stock Transfer Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you’d like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Stock Transfer Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stock transfer form 1480600

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a stock transfer form?

A stock transfer form is a legal document that facilitates the transfer of ownership of stock shares from one person to another. It typically includes details such as the names of the buyer and seller, the number of shares being transferred, and the signature of the current shareholder. Using a reliable eSignature solution like airSlate SignNow ensures that your stock transfer form is securely signed and legally binding.

-

How do I create a stock transfer form with airSlate SignNow?

Creating a stock transfer form with airSlate SignNow is simple and efficient. You can start with a customizable template or create a new document from scratch. Our user-friendly interface allows you to add necessary fields and eSignature options quickly, ensuring a seamless signing process for all parties involved.

-

Is airSlate SignNow cost-effective for managing stock transfer forms?

Yes, airSlate SignNow is a cost-effective solution for managing stock transfer forms and other document needs. With competitive pricing plans, you can access powerful features without breaking the bank. Additionally, our platform offers flexibility that caters to businesses of all sizes, enhancing your return on investment.

-

What features should I look for in a stock transfer form solution?

When choosing a solution for your stock transfer form, look for features that include customizable templates, robust security measures, and an intuitive user interface. airSlate SignNow provides these features along with advanced tracking capabilities to monitor the status of your documents. This allows you to manage your stock transfer forms effectively and efficiently.

-

Can I integrate airSlate SignNow with other applications for my stock transfer forms?

Absolutely! airSlate SignNow offers seamless integration with a variety of applications, such as CRM systems and document management platforms. This integration streamlines the process of creating and managing stock transfer forms, allowing you to maintain workflow efficiency and eliminate manual data entry.

-

Are stock transfer forms legally binding when signed through airSlate SignNow?

Yes, stock transfer forms signed through airSlate SignNow are legally binding, provided they comply with relevant laws and regulations. Our eSignature solutions adhere to ESIGN and UETA acts, ensuring the legality of your signed documents. You can confidently execute stock transfers, knowing that your forms hold legal weight.

-

What industries can benefit from using a stock transfer form?

Various industries can benefit from using a stock transfer form, including finance, real estate, and tech companies that issue shares. airSlate SignNow's versatile platform caters to different sectors, making it easier for organizations to manage their stock transfer forms efficiently. With tailored solutions, businesses can streamline their document workflows and improve overall productivity.

Get more for Stock Transfer Form

- Structure function and regulation of a subfamily of mouse zinc form

- A program transformation for debugging haskell 98 bernard pope

- Survey shortening form

- Whats up with cupss issue 1 cupss asset management software for drinking water systems and wastewater systems water epa form

- Pc 910 connecticut probate courts form

- It consultant contract template form

- It managed service contract template form

- It employee contract template form

Find out other Stock Transfer Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure