Ohio Department of Taxation Form Et 22

What is the Ohio Department of Taxation Form ET 22

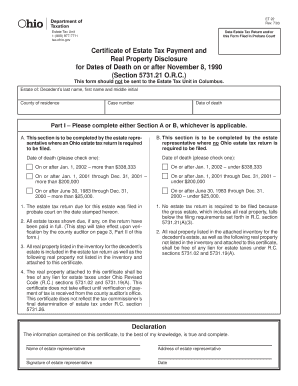

The Ohio Department of Taxation Form ET 22 is a specific tax form used for the purpose of reporting and paying the Ohio estate tax. This form is essential for individuals who are responsible for settling the estate of a deceased person in Ohio. The ET 22 form provides necessary information about the estate's assets, liabilities, and the overall value, which is crucial for determining the tax obligations. Understanding the purpose and requirements of this form is vital for compliance with Ohio tax laws.

How to use the Ohio Department of Taxation Form ET 22

Using the Ohio Department of Taxation Form ET 22 involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents related to the estate, including property valuations, bank statements, and any outstanding debts. Next, fill out the form with the required information, ensuring that all details are accurate and complete. Once the form is filled out, review it thoroughly for any errors before submission. The completed form can be submitted either electronically or by mail, depending on the preferences of the executor or administrator of the estate.

Steps to complete the Ohio Department of Taxation Form ET 22

Completing the Ohio Department of Taxation Form ET 22 requires careful attention to detail. Follow these steps:

- Gather all necessary documents related to the estate.

- Begin filling out the form, starting with the decedent's information.

- Provide a detailed account of the estate's assets, including real estate, bank accounts, and personal property.

- List any liabilities or debts that the estate owes.

- Calculate the total value of the estate and the applicable estate tax.

- Review the completed form for accuracy.

- Submit the form electronically or mail it to the Ohio Department of Taxation.

Legal use of the Ohio Department of Taxation Form ET 22

The legal use of the Ohio Department of Taxation Form ET 22 is governed by state tax laws. This form must be completed accurately to ensure compliance with Ohio estate tax regulations. Failure to submit the form or inaccuracies in the information provided can lead to penalties or legal issues for the executor. It is important to understand the legal implications of this form and to seek professional advice if necessary to navigate the complexities of estate taxation.

Key elements of the Ohio Department of Taxation Form ET 22

Several key elements must be included when completing the Ohio Department of Taxation Form ET 22. These include:

- The decedent's full name and date of death.

- The executor's contact information.

- A comprehensive list of the estate's assets and liabilities.

- The calculated total value of the estate.

- The amount of estate tax owed.

Including all these elements ensures that the form is complete and meets the requirements set forth by the Ohio Department of Taxation.

Form Submission Methods

The Ohio Department of Taxation Form ET 22 can be submitted through various methods. Executors have the option to file the form electronically using the Ohio Department of Taxation's online portal, which may expedite processing times. Alternatively, the form can be printed and mailed to the appropriate address provided by the Ohio Department of Taxation. It is important to choose the method that best suits the needs of the estate and ensures timely submission.

Quick guide on how to complete ohio department of taxation form et 22

Prepare Ohio Department Of Taxation Form Et 22 effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the appropriate form and safely store it online. airSlate SignNow provides all the tools necessary to generate, modify, and eSign your documents swiftly without any interruptions. Handle Ohio Department Of Taxation Form Et 22 on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign Ohio Department Of Taxation Form Et 22 with ease

- Locate Ohio Department Of Taxation Form Et 22 and then click Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to retain your changes.

- Choose how you would prefer to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from a device of your preference. Modify and eSign Ohio Department Of Taxation Form Et 22 and ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio department of taxation form et 22

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ohio department of taxation form et 22?

The ohio department of taxation form et 22 is a specific form used for the exemption of certain business tax obligations. This form allows businesses to apply for an exemption from state taxes based on specific eligibility criteria. Understanding how to properly fill out the form is crucial for compliance.

-

How can airSlate SignNow help with the ohio department of taxation form et 22?

airSlate SignNow streamlines the process of completing and submitting the ohio department of taxation form et 22 by offering a user-friendly platform for electronic signatures and document management. Our solution enables businesses to fill out the form digitally, ensuring accuracy and security in a timely manner.

-

Is there a cost associated with using airSlate SignNow for the ohio department of taxation form et 22?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. While our basic plan is cost-effective, advanced features may entail additional costs. Regardless, our pricing is designed to be affordable and provide value for businesses handling the ohio department of taxation form et 22 and other documents.

-

What features does airSlate SignNow offer to assist with the ohio department of taxation form et 22?

airSlate SignNow includes features such as electronic signatures, automated workflows, and document templates specifically designed to streamline the completion of the ohio department of taxation form et 22. These tools simplify the process and reduce the turnaround time for obtaining necessary approvals.

-

Can I integrate airSlate SignNow with other tools when handling the ohio department of taxation form et 22?

Absolutely! airSlate SignNow offers seamless integrations with various software tools and applications to enhance your workflow. Whether you use CRM systems, cloud storage, or accounting software, our solution can be easily integrated to manage the ohio department of taxation form et 22 efficiently.

-

What are the benefits of using airSlate SignNow for the ohio department of taxation form et 22?

Using airSlate SignNow for the ohio department of taxation form et 22 provides signNow benefits, including increased efficiency, reduced paper usage, and secure document handling. Our platform ensures that your forms are signed, stored, and shared safely while minimizing administrative burdens.

-

Is support available for users completing the ohio department of taxation form et 22 with airSlate SignNow?

Yes, airSlate SignNow provides extensive customer support for users navigating the ohio department of taxation form et 22. Our help center, tutorials, and dedicated support team are available to assist you with any questions or challenges you may encounter during the process.

Get more for Ohio Department Of Taxation Form Et 22

Find out other Ohio Department Of Taxation Form Et 22

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors