ADMISSIONSTHEATER TAX RETURN the South Carolina Sctax Form

What is the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax

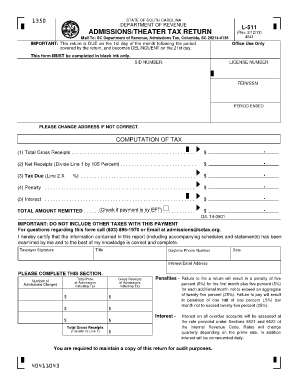

The ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax is a specific tax form utilized by businesses and individuals in South Carolina to report and pay taxes related to admissions and entertainment venues. This form is essential for ensuring compliance with state tax regulations and is designed to capture revenue generated from ticket sales and other admission-related activities. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax

Using the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax involves several key steps. First, gather all necessary financial information related to your admissions revenue. This includes ticket sales, concessions, and any other income derived from admissions. Next, complete the form accurately, ensuring that all figures are correct and supported by documentation. Once completed, the form can be submitted electronically or by mail, depending on your preference and the requirements set by the South Carolina Department of Revenue.

Steps to complete the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax

Completing the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax requires a systematic approach:

- Collect all relevant financial records, including sales data and supporting documents.

- Fill out the form with accurate figures, ensuring all calculations are correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Legal use of the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax

The legal use of the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax is governed by state tax laws. It is important to ensure that the form is filled out in compliance with these laws to maintain its validity. Proper use includes accurate reporting of all admission-related income and timely submission to the appropriate tax authority. Failure to adhere to these legal requirements can result in fines and legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax are crucial for compliance. Typically, the form must be submitted by the end of the month following the end of the reporting period. It is important to check for any specific dates or changes announced by the South Carolina Department of Revenue to ensure timely filing and avoid penalties.

Required Documents

To successfully complete the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax, certain documents are required. These may include:

- Sales records detailing ticket and admission income.

- Invoices related to admissions and entertainment services.

- Any relevant financial statements that support the reported figures.

Quick guide on how to complete admissionstheater tax return the south carolina sctax

Manage ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax effortlessly on any device

Digital document management has become widely embraced by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct template and securely keep it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without delays. Handle ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to edit and electronically sign ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax with ease

- Find ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the admissionstheater tax return the south carolina sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax?

ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax is a tax document specifically for admissions and theater-related taxes in South Carolina. It ensures that businesses comply with state tax regulations while simplifying the filing process. By using airSlate SignNow, you can eSign and submit this document seamlessly.

-

How does airSlate SignNow simplify the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax process?

airSlate SignNow streamlines the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax process by allowing you to create, send, and sign documents electronically. This eliminates the need for physical paperwork and manual signatures, making the process faster and more efficient. Additionally, tracking features help ensure you never miss a deadline.

-

What are the pricing options for using airSlate SignNow for ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax?

airSlate SignNow offers several pricing plans to fit different needs, starting with a free trial. The plans are designed to be cost-effective and cater to businesses of all sizes, allowing you to manage your ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax efficiently. For detailed pricing, visit our website to compare features.

-

Can I integrate airSlate SignNow with other software for my ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax?

Yes, airSlate SignNow easily integrates with various software solutions to enhance your workflow while preparing your ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax. Whether it’s accounting software or CRM systems, these integrations allow for seamless data transfer and improved productivity, ensuring everything is coordinated.

-

Is airSlate SignNow secure for handling ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax?

Absolutely! airSlate SignNow prioritizes security and compliance, utilizing advanced encryption and authentication methods. This ensures that your sensitive information regarding ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax is protected at all times, giving you peace of mind as you eSign and manage your documents.

-

What features does airSlate SignNow offer for completing the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax?

AirSlate SignNow provides a range of features including customizable templates, in-app signing, and document tracking, specifically useful for the ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax. These features help you create professional documents quickly while ensuring all members involved in the signing process are notified in real time.

-

How quickly can I process my ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax with airSlate SignNow?

With airSlate SignNow, you can process your ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax much quicker than traditional methods. Most documents can be sent and signed within minutes, meaning you can meet deadlines without the hassle of printing and mailing forms. This speed helps to keep your business running smoothly.

Get more for ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax

Find out other ADMISSIONSTHEATER TAX RETURN The South Carolina Sctax

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application