Nys 45 Att Form

What is the Nys 45 Att

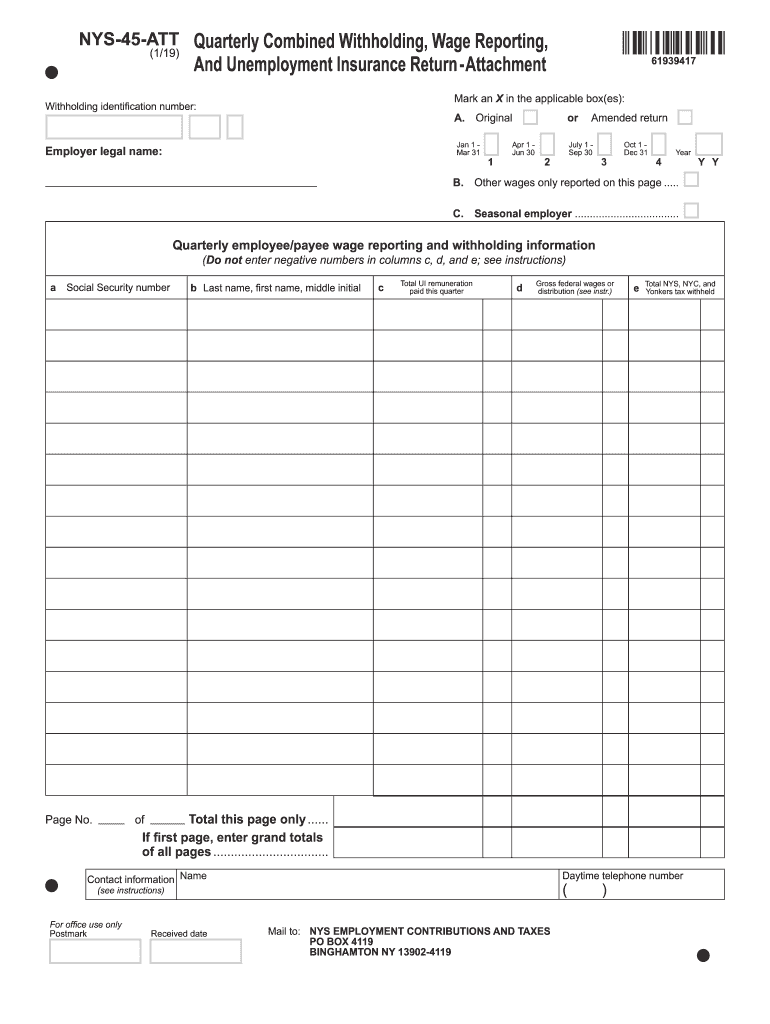

The Nys 45 Att is a specific form used in New York State for reporting wages and withholding taxes. This form is essential for employers to accurately report employee earnings and the taxes withheld from those earnings. The Nys 45 Att is part of the quarterly reporting requirements mandated by the New York State Department of Taxation and Finance. It ensures that the state receives the necessary information to track tax obligations and compliance among employers and employees.

How to use the Nys 45 Att

Using the Nys 45 Att involves several steps to ensure accurate reporting. Employers must first gather all necessary information regarding their employees' wages and tax withholdings for the reporting period. Once the data is compiled, the employer can fill out the form, which includes sections for reporting total wages, taxes withheld, and any adjustments. After completing the form, it can be submitted electronically or via mail, depending on the employer's preference and compliance with state regulations.

Steps to complete the Nys 45 Att

Completing the Nys 45 Att requires careful attention to detail. Here are the steps to follow:

- Gather employee wage data for the reporting quarter.

- Calculate the total wages paid and the total taxes withheld.

- Fill out the Nys 45 Att form, ensuring all sections are accurately completed.

- Review the form for any errors or omissions.

- Submit the completed form electronically through the New York State Department of Taxation and Finance website or by mailing it to the appropriate address.

Legal use of the Nys 45 Att

The Nys 45 Att must be used in compliance with state laws governing tax reporting and employee wage documentation. Legally, employers are required to submit this form quarterly to ensure that they meet their tax obligations. Failure to file the Nys 45 Att accurately and on time can result in penalties and interest charges. It is crucial for employers to understand their responsibilities concerning this form to avoid legal complications.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Nys 45 Att to remain compliant with state regulations. The due date for filing is generally the last day of the month following the end of each quarter. For example, forms for the first quarter (January to March) are due by April 30. It is essential to keep track of these deadlines to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Nys 45 Att can be submitted through various methods, providing flexibility for employers. The primary submission methods include:

- Online: Employers can file the form electronically through the New York State Department of Taxation and Finance website, which is often the fastest option.

- Mail: The completed form can be printed and mailed to the designated address provided by the state.

- In-Person: Some employers may choose to deliver the form in person at local tax offices, although this method is less common.

Quick guide on how to complete form nys 45 att119quarterly combined withholding wage reporting and unemployment insurance return attachmentnys45att

Effortlessly prepare Nys 45 Att on any device

Digital document management has become favored among companies and individuals alike. It offers a suitable environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the features you require to create, edit, and electronically sign your documents swiftly without delays. Manage Nys 45 Att on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The simplest way to edit and electronically sign Nys 45 Att with ease

- Locate Nys 45 Att and click on Get Form to commence.

- Leverage the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Nys 45 Att to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form nys 45 att119quarterly combined withholding wage reporting and unemployment insurance return attachmentnys45att

How to create an eSignature for your Form Nys 45 Att119quarterly Combined Withholding Wage Reporting And Unemployment Insurance Return Attachmentnys45att in the online mode

How to make an eSignature for your Form Nys 45 Att119quarterly Combined Withholding Wage Reporting And Unemployment Insurance Return Attachmentnys45att in Google Chrome

How to create an eSignature for signing the Form Nys 45 Att119quarterly Combined Withholding Wage Reporting And Unemployment Insurance Return Attachmentnys45att in Gmail

How to generate an electronic signature for the Form Nys 45 Att119quarterly Combined Withholding Wage Reporting And Unemployment Insurance Return Attachmentnys45att from your smartphone

How to make an eSignature for the Form Nys 45 Att119quarterly Combined Withholding Wage Reporting And Unemployment Insurance Return Attachmentnys45att on iOS

How to make an electronic signature for the Form Nys 45 Att119quarterly Combined Withholding Wage Reporting And Unemployment Insurance Return Attachmentnys45att on Android devices

People also ask

-

What is the new york nys 45 form and how can airSlate SignNow help with it?

The new york nys 45 form is used for various tax-related purposes in New York State. airSlate SignNow simplifies the process of completing and eSigning this form, ensuring compliance with state regulations. Our platform allows for easy document management and facilitates a seamless workflow to meet your business needs.

-

What are the pricing options for using airSlate SignNow for new york nys 45 documents?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. By using our service for the new york nys 45 form, you can unlock cost savings compared to traditional document handling methods. You can choose a monthly or yearly subscription based on your usage to get the best value.

-

What features does airSlate SignNow offer for managing new york nys 45 forms?

Our platform provides a variety of features tailored for handling new york nys 45 forms, such as customizable templates, real-time status tracking, and secure eSigning capabilities. Additionally, you can easily collaborate with team members, ensuring that everyone is on the same page. The user-friendly interface makes it accessible for individuals and businesses alike.

-

How secure is my information when using airSlate SignNow for the new york nys 45 form?

Security is a top priority at airSlate SignNow. When handling your new york nys 45 form, we implement state-of-the-art encryption and compliance with industry standards to protect your data. Regular security audits are also conducted to ensure the safety and integrity of your sensitive information.

-

Can I integrate airSlate SignNow with other applications for managing new york nys 45 documents?

Yes, airSlate SignNow offers integrations with various applications to streamline your workflow when managing new york nys 45 documents. You can connect with popular platforms such as Google Drive, Slack, and Salesforce to foster collaboration and enhance productivity. These integrations help you centralize document management and eSigning tasks.

-

What benefits does airSlate SignNow provide for businesses using the new york nys 45 form?

Using airSlate SignNow for the new york nys 45 form allows businesses to enhance efficiency and reduce turnaround times for document processing. This eSigning solution ensures accuracy and compliance while minimizing paper use, ultimately leading to cost savings. Our platform accelerates your workflows, allowing your team to focus on core business operations.

-

Is airSlate SignNow suitable for personal use of the new york nys 45 form?

Absolutely! airSlate SignNow is designed to cater to both individual and business needs when dealing with the new york nys 45 form. Whether you’re an independent contractor or managing personal tax documents, our user-friendly software allows for easy eSigning and document management. It's a great choice for anyone looking to simplify their paperwork process.

Get more for Nys 45 Att

- Regulations for officer development rod fo form

- Sure start application pre enrollment procedures for sure start form

- Sarp shapes form

- Opnav 6420 1 form

- Mil hdbk 61a 6 2 engineering change proposal ecp form

- Dodea form 08 shsm h 3 9 student retention of medication

- The document you are trying to load requires adobe form

- Mentor prot g agreement med navy form

Find out other Nys 45 Att

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure