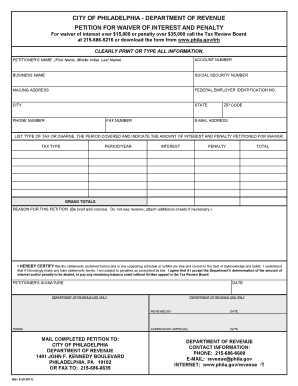

City of Philadelphia Petition for Waiver of Interest and Penalty Form

What is the application for waiver of penalty?

The application for waiver of penalty is a formal request submitted to a governing body, such as a city or state tax authority, seeking relief from penalties associated with late payments or non-compliance with regulations. In the case of the City of Philadelphia, this application specifically addresses penalties related to local taxes or fees. The waiver is typically granted under specific circumstances, such as financial hardship or a reasonable cause for the delay in payment. Understanding the purpose of this application is crucial for individuals or businesses looking to mitigate their financial liabilities.

Steps to complete the application for waiver of penalty

Completing the application for waiver of penalty involves several key steps to ensure that your request is properly submitted and considered. Follow these steps for a successful application:

- Gather necessary information: Collect all relevant documents, including tax statements, payment records, and any correspondence regarding the penalties.

- Fill out the application form: Provide accurate information, including your name, address, and details about the penalties incurred.

- Explain your circumstances: Clearly articulate the reasons for your request, such as financial hardship or other valid justifications.

- Review your application: Double-check for any errors or missing information before submission.

- Submit the application: Follow the specified submission method, whether online, by mail, or in person, as outlined by the local authority.

Eligibility criteria for the application for waiver of penalty

To qualify for a waiver of penalty, applicants must meet certain eligibility criteria set by the governing authority. Generally, these criteria may include:

- Proof of financial hardship: Applicants may need to demonstrate their inability to pay due to unforeseen circumstances, such as job loss or medical emergencies.

- Timeliness of previous payments: A history of timely payments prior to the incident may strengthen the case for a waiver.

- Specific reasons for penalty: Valid justifications, such as errors made by the tax authority or natural disasters, may be considered.

Required documents for the application for waiver of penalty

When submitting the application for waiver of penalty, it is essential to include all required documents to support your request. Commonly required documents may include:

- Tax returns: Copies of relevant tax returns for the periods in question.

- Payment records: Documentation showing previous payments and any penalties incurred.

- Supporting letters: Any letters from employers, medical providers, or other relevant parties that explain your circumstances.

Form submission methods for the application for waiver of penalty

The application for waiver of penalty can typically be submitted through various methods, depending on the local regulations. Common submission methods include:

- Online submission: Many jurisdictions offer online portals for submitting applications electronically.

- Mail submission: Applicants can often print the completed form and send it via postal service to the appropriate office.

- In-person submission: Some individuals may prefer to deliver their application directly to the local tax office for immediate processing.

Legal use of the application for waiver of penalty

The application for waiver of penalty is legally binding once submitted, provided it meets the necessary requirements outlined by the governing authority. It is essential to ensure that all information is accurate and truthful, as providing false information can lead to further penalties or legal repercussions. Understanding the legal implications of this application helps applicants navigate the process with confidence.

Quick guide on how to complete city of philadelphia petition for waiver of interest and penalty

Effortlessly Prepare City Of Philadelphia Petition For Waiver Of Interest And Penalty on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Manage City Of Philadelphia Petition For Waiver Of Interest And Penalty on any device using the airSlate SignNow apps for Android or iOS, and streamline your document processes today.

How to Modify and Electronically Sign City Of Philadelphia Petition For Waiver Of Interest And Penalty Easily

- Find City Of Philadelphia Petition For Waiver Of Interest And Penalty and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or mask sensitive information with the tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and electronically sign City Of Philadelphia Petition For Waiver Of Interest And Penalty and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of philadelphia petition for waiver of interest and penalty

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application for waiver of penalty offered by airSlate SignNow?

The application for waiver of penalty by airSlate SignNow allows businesses to easily manage and submit requests for penalty waivers digitally. It streamlines the process through a user-friendly interface, ensuring you can handle your documentation efficiently without any hassle.

-

How does the application for waiver of penalty simplify the documentation process?

With the application for waiver of penalty, airSlate SignNow automates the creation and tracking of your waiver requests. This minimizes manual errors, saves time, and enhances the overall efficiency of your workflow, ensuring you can focus on more important tasks.

-

Is there a cost associated with using the application for waiver of penalty?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different business needs, including features like the application for waiver of penalty. Review our pricing page for details on plans that best suit your needs and budget.

-

Can I integrate the application for waiver of penalty with other tools?

Absolutely! The application for waiver of penalty can be seamlessly integrated with various third-party applications and services. This allows you to enhance your current workflows and ensure consistent communication across platforms.

-

What benefits does using the application for waiver of penalty provide?

Utilizing the application for waiver of penalty enhances your business's operational efficiency by automating document workflows. It reduces turnaround times and ensures that your requests are processed smoothly, promoting better compliance and record-keeping.

-

How secure is the application for waiver of penalty?

The application for waiver of penalty provided by airSlate SignNow prioritizes security with industry-standard encryption and compliance with relevant regulations. You can trust that your sensitive information is protected throughout the document submission process.

-

Who can benefit from using the application for waiver of penalty?

Businesses of all sizes, from small startups to large enterprises, can benefit from the application for waiver of penalty. It is particularly useful for finance and compliance departments needing to manage penalty waiver requests efficiently.

Get more for City Of Philadelphia Petition For Waiver Of Interest And Penalty

Find out other City Of Philadelphia Petition For Waiver Of Interest And Penalty

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online