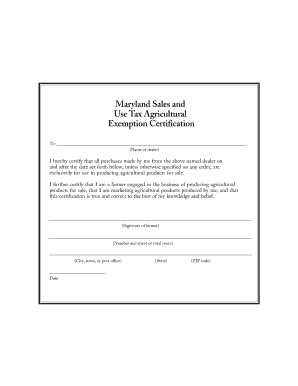

Maryland Agricultural Tax Exemption Form

What is the Maryland Agricultural Tax Exemption Form

The Maryland Agricultural Tax Exemption Form is a document that allows qualifying agricultural businesses to claim exemptions from state sales and use taxes. This form is essential for farmers and agricultural producers who wish to purchase items necessary for their farming operations without incurring sales tax. The exemption applies to various agricultural supplies, equipment, and services that support farming activities, helping to reduce operational costs for eligible entities.

How to Use the Maryland Agricultural Tax Exemption Form

To effectively use the Maryland Agricultural Tax Exemption Form, individuals must first ensure they meet the eligibility criteria defined by the state. Once eligibility is confirmed, the form can be filled out to document purchases that qualify for tax exemption. It is important to present this form to vendors at the time of purchase to avoid being charged sales tax. Retaining copies of the completed form is also advisable for record-keeping and compliance purposes.

Eligibility Criteria

Eligibility for the Maryland Agricultural Tax Exemption Form typically requires that the applicant be engaged in agricultural production. This includes individuals or entities that grow crops, raise livestock, or engage in other agricultural activities. Additionally, the items purchased must be directly related to agricultural operations. It is crucial for applicants to review the specific guidelines provided by the Maryland Comptroller's office to ensure compliance and proper use of the exemption.

Steps to Complete the Maryland Agricultural Tax Exemption Form

Completing the Maryland Agricultural Tax Exemption Form involves several key steps:

- Obtain the form from the Maryland Comptroller's website or authorized distribution points.

- Fill in the required information, including personal or business details and the nature of the agricultural activities.

- List the items for which the exemption is being claimed, ensuring they align with qualifying agricultural supplies.

- Sign and date the form to validate the information provided.

- Provide the completed form to vendors during purchases to claim the exemption.

Legal Use of the Maryland Agricultural Tax Exemption Form

The legal use of the Maryland Agricultural Tax Exemption Form is governed by state tax laws. To be considered valid, the form must be accurately completed and presented at the time of purchase. Misuse of the exemption, such as claiming it for non-qualifying items, can result in penalties or fines. Therefore, it is essential for users to understand the legal implications and ensure that all claims made on the form are legitimate and supported by appropriate documentation.

Form Submission Methods

The Maryland Agricultural Tax Exemption Form can be submitted in various ways depending on the vendor's acceptance policies. Common methods include:

- Presenting the completed form in person at the time of purchase.

- Submitting the form via mail if the vendor allows for remote transactions.

- Utilizing electronic submission methods if the vendor supports digital forms.

It is advisable to confirm with the vendor regarding their preferred submission method to ensure compliance and acceptance of the exemption.

Quick guide on how to complete maryland agricultural tax exemption form

Manage Maryland Agricultural Tax Exemption Form effortlessly on any device

Web-based document management has become a trend among businesses and individuals. It offers an excellent sustainable substitute for conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your documents rapidly without delays. Handle Maryland Agricultural Tax Exemption Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest way to revise and eSign Maryland Agricultural Tax Exemption Form with ease

- Locate Maryland Agricultural Tax Exemption Form and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Maryland Agricultural Tax Exemption Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland agricultural tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Maryland tax exempt form?

A Maryland tax exempt form is a document used by eligible organizations to make tax-exempt purchases in the state of Maryland. This form allows qualifying entities to avoid paying sales tax on items purchased for their exempt purposes. It is essential for organizations to present this form to vendors to ensure compliance with Maryland tax regulations.

-

How can airSlate SignNow help with my Maryland tax exempt form?

airSlate SignNow simplifies the process of managing your Maryland tax exempt form by allowing you to create, send, and eSign documents online. With its user-friendly interface, you can ensure that your tax exempt forms are completed accurately and securely. This helps streamline the process for organizations looking to manage tax-exempt purchases efficiently.

-

Are there any costs associated with using airSlate SignNow for Maryland tax exempt forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, starting with a free trial to test the features. While sending and eSigning Maryland tax exempt forms can be budget-friendly, the specific costs depend on the chosen plan and the number of users. Always review the pricing page for the latest information.

-

What features does airSlate SignNow offer for managing Maryland tax exempt forms?

airSlate SignNow offers features like customizable templates, bulk sending options, and real-time tracking, which are beneficial for managing Maryland tax exempt forms. Additionally, it provides secure storage and the ability to integrate with various apps, making document management seamless and compliant with Maryland tax laws.

-

Can I integrate airSlate SignNow with other applications for handling Maryland tax exempt forms?

Yes, airSlate SignNow offers integrations with a wide range of applications including Google Drive, Dropbox, and Salesforce. This allows you to manage your Maryland tax exempt form alongside your other business documents, creating a more cohesive workflow. Check the integrations page for a complete list of supported applications.

-

Is airSlate SignNow secure for managing sensitive information like Maryland tax exempt forms?

Absolutely! airSlate SignNow prioritizes security, utilizing bank-level encryption to safeguard your documents, including Maryland tax exempt forms. Your data is stored in a secure environment, ensuring that sensitive information remains confidential and protected against unauthorized access.

-

How do I ensure my Maryland tax exempt form is filled out correctly?

To ensure your Maryland tax exempt form is filled out correctly, you should carefully review the guidelines provided by the Maryland Comptroller’s office. Utilizing the customizable templates in airSlate SignNow can help streamline this process, ensuring that all necessary fields are completed and compliant with state regulations.

Get more for Maryland Agricultural Tax Exemption Form

Find out other Maryland Agricultural Tax Exemption Form

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA