Nys Estimated Tax Forms 2019

What are the NY Estimated Tax Forms?

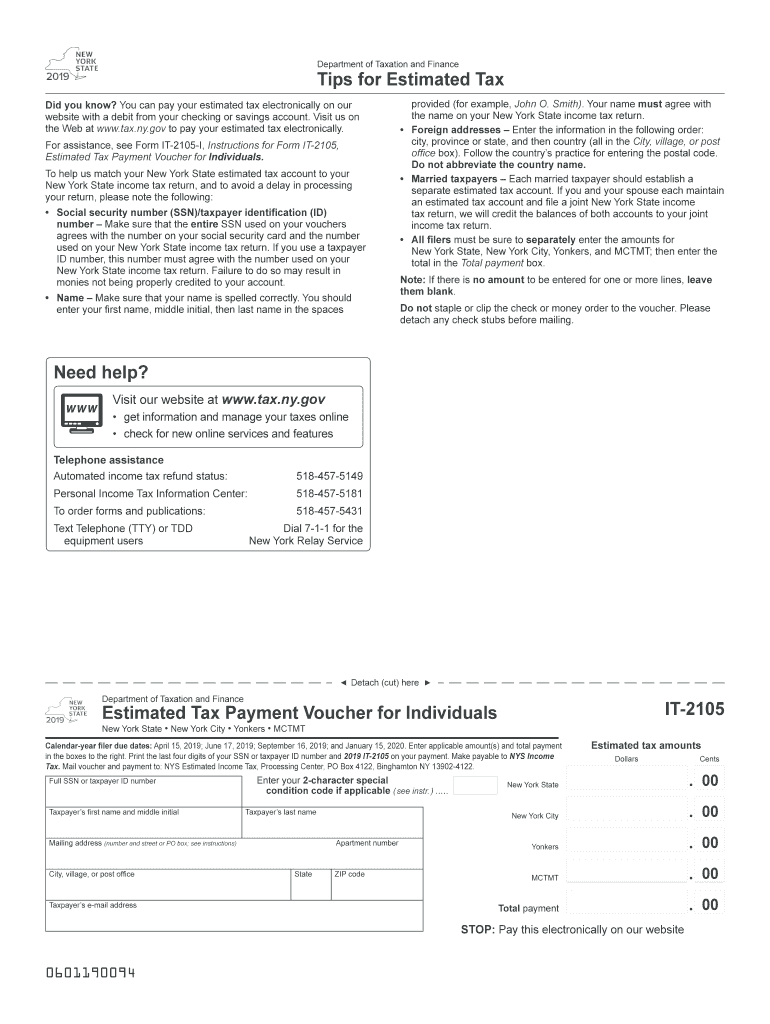

The NY Estimated Tax Forms are essential documents for individuals and businesses in New York who expect to owe tax of $1,000 or more when filing their annual tax return. These forms allow taxpayers to prepay their estimated tax liabilities throughout the year, ensuring compliance with state tax regulations. The most commonly used form for individuals is the IT-2105, while businesses may use the IT-2105-B for their estimated tax payments. Completing these forms accurately helps avoid penalties and interest on unpaid taxes.

How to Use the NY Estimated Tax Forms

Using the NY Estimated Tax Forms involves a few straightforward steps. First, determine your expected income for the year and calculate your estimated tax liability using the appropriate tax rates. Next, fill out the IT-2105 form with your personal information, including your name, address, and Social Security number. After calculating your payment amount, submit the form along with your payment by the due dates specified by the New York State Department of Taxation and Finance. It is important to keep a copy of the completed form for your records.

Steps to Complete the NY Estimated Tax Forms

Completing the NY Estimated Tax Forms requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including your previous year’s tax return and income statements.

- Estimate your total income for the current year, including wages, interest, dividends, and other sources.

- Calculate your estimated tax liability using the current tax rates.

- Fill out the IT-2105 form, ensuring all fields are accurately completed.

- Determine your payment schedule based on the due dates for estimated tax payments.

- Submit the form and payment via your preferred method, whether online, by mail, or in person.

Filing Deadlines / Important Dates

Filing deadlines for the NY Estimated Tax Forms are crucial to avoid penalties. Generally, estimated tax payments are due on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the tax year. For example, for the 2023 tax year, the deadlines are April 15, June 15, September 15, and January 15 of the following year. It is important to mark these dates on your calendar to ensure timely submissions.

Penalties for Non-Compliance

Failure to file or pay estimated taxes on time can result in significant penalties. If you do not pay enough tax throughout the year, you may incur an underpayment penalty. This penalty is calculated based on the amount you underpaid and the length of time the payment was overdue. Additionally, late payments can accrue interest, further increasing your tax liability. Staying compliant with the NY Estimated Tax Forms is essential to avoid these financial consequences.

Who Issues the Form

The NY Estimated Tax Forms, including the IT-2105, are issued by the New York State Department of Taxation and Finance. This department is responsible for administering the state's tax laws and ensuring that taxpayers comply with their obligations. It is advisable to refer to their official resources for the most current forms and instructions, as well as any updates to tax regulations.

Quick guide on how to complete tips for hiring a trustworthy tax preparer department of taxation

Prepare Nys Estimated Tax Forms effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, enabling you to locate the correct template and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Nys Estimated Tax Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and electronically sign Nys Estimated Tax Forms smoothly

- Find Nys Estimated Tax Forms and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and electronically sign Nys Estimated Tax Forms and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tips for hiring a trustworthy tax preparer department of taxation

Create this form in 5 minutes!

How to create an eSignature for the tips for hiring a trustworthy tax preparer department of taxation

How to make an electronic signature for your Tips For Hiring A Trustworthy Tax Preparer Department Of Taxation online

How to make an electronic signature for your Tips For Hiring A Trustworthy Tax Preparer Department Of Taxation in Chrome

How to create an electronic signature for signing the Tips For Hiring A Trustworthy Tax Preparer Department Of Taxation in Gmail

How to generate an eSignature for the Tips For Hiring A Trustworthy Tax Preparer Department Of Taxation straight from your mobile device

How to make an eSignature for the Tips For Hiring A Trustworthy Tax Preparer Department Of Taxation on iOS devices

How to generate an electronic signature for the Tips For Hiring A Trustworthy Tax Preparer Department Of Taxation on Android OS

People also ask

-

What is NY estimated tax and who needs to pay it?

NY estimated tax is a form of tax that self-employed individuals, freelancers, and individuals with signNow income not subject to withholding must pay to the state of New York. This payment is necessary to avoid underpayment penalties and is typically due quarterly. It's crucial for anyone who expects to owe $300 or more in tax for the year.

-

How do I calculate my NY estimated tax payments?

To calculate your NY estimated tax payments, you can use the NY State Department of Taxation and Finance's worksheets or online calculators. You'll need to estimate your total income along with any deductions to find your expected tax liability for the year. Make sure to follow the guidelines for the specific tax year you are filing for, as rates and rules may change.

-

When are the due dates for NY estimated tax payments?

For NY estimated tax, payments are typically due on April 15, June 15, September 15, and January 15 of the following year. These dates apply to individual and corporate tax filers, so it's important to mark your calendar to ensure timely payments. Missing a due date can lead to penalties and interest charges.

-

Can airSlate SignNow help with my NY estimated tax documentation?

Yes, airSlate SignNow can streamline the process of preparing and submitting your NY estimated tax documentation by allowing you to eSign and send important forms quickly and securely. With airSlate SignNow, you can easily collaborate with your accountant or tax professional, ensuring all necessary documents are ready for submission. This efficiency is especially beneficial during tax season when time is of the essence.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents offers several advantages, including enhanced security, ease of use, and quicker turnaround times. You can sign documents digitally from anywhere, which ensures that your NY estimated tax forms are submitted promptly. Additionally, our user-friendly platform helps you stay organized and manage your documents efficiently.

-

Is airSlate SignNow cost-effective for small businesses handling NY estimated tax?

Absolutely! airSlate SignNow provides a cost-effective solution for small businesses managing their NY estimated tax documents. With flexible pricing plans, you can choose an option that fits your budget while benefiting from our robust features designed to simplify the eSigning process. This can save you not only money but also valuable time during tax preparation.

-

How does airSlate SignNow integrate with accounting software for NY estimated taxes?

airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your NY estimated tax documents alongside your financial records. This integration allows for a smoother workflow, ensuring that all your documentation is easily accessible and organized. You can focus on your business while we help streamline your tax filing process.

Get more for Nys Estimated Tax Forms

- Cfone registration form familyforceca familyforce

- Winner claim form wisconsin lottery

- 20 community service hours form

- Fhu 4 form

- Unusual enrollment history form homepage gadsden state gadsdenstate

- Inspection ladder form

- Northern virginia community college transcript request form

- Parenting class registration form fairfax county public schools fcps

Find out other Nys Estimated Tax Forms

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later