Fatca Full Form

What is the FATCA Full Form?

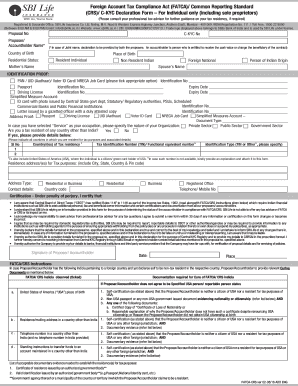

The FATCA full form is the Foreign Account Tax Compliance Act. This U.S. legislation was enacted to combat tax evasion by U.S. taxpayers holding accounts and other financial assets outside the United States. FATCA requires foreign financial institutions to report information about financial accounts held by U.S. taxpayers or foreign entities in which U.S. taxpayers hold substantial ownership. This law aims to enhance transparency in international financial transactions and ensure compliance with U.S. tax obligations.

Steps to Complete the FATCA Full Form

Completing the FATCA form involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary personal information, including your name, address, and taxpayer identification number.

- Identify all foreign financial accounts and assets that fall under FATCA reporting requirements.

- Fill out the FATCA form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate financial institution or the IRS, depending on your situation.

Legal Use of the FATCA Full Form

The legal use of the FATCA form is crucial for compliance with U.S. tax laws. The form serves as a declaration of foreign financial accounts and assets, helping to ensure that U.S. taxpayers fulfill their reporting obligations. Failure to properly complete and submit the FATCA form can lead to significant penalties, including fines and increased scrutiny from tax authorities. It is important to understand that this form must be filled out accurately to maintain compliance with both U.S. and foreign regulations.

Required Documents

When preparing to complete the FATCA form, certain documents are essential to ensure accurate reporting. These may include:

- Identification documents, such as a passport or driver's license.

- Taxpayer Identification Number (TIN) or Social Security Number (SSN).

- Statements from foreign financial institutions detailing account balances and transactions.

- Any relevant tax returns or financial statements that may support your claims.

Form Submission Methods

The FATCA form can be submitted through various methods, depending on the requirements of the financial institution or the IRS. Common submission methods include:

- Online submission through the financial institution's secure portal.

- Mailing a hard copy of the completed form to the appropriate address.

- In-person submission at designated financial institution branches, if applicable.

Penalties for Non-Compliance

Non-compliance with FATCA regulations can result in severe penalties for U.S. taxpayers. These penalties may include:

- Fines for failing to report foreign accounts, which can reach thousands of dollars.

- Increased scrutiny and audits from the IRS.

- Potential criminal charges in cases of willful tax evasion.

Examples of Using the FATCA Full Form

Understanding how to use the FATCA form can be illustrated through various scenarios. For instance:

- A U.S. citizen living abroad must report their foreign bank accounts to comply with FATCA.

- A dual citizen may need to disclose foreign investments held in their home country.

- U.S. residents with foreign retirement accounts must include these in their FATCA reporting.

Quick guide on how to complete fatca full form 395821701

Effortlessly Prepare Fatca Full Form on Any Device

Online document administration has gained signNow traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdups. Manage Fatca Full Form on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to modify and electronically sign Fatca Full Form with ease

- Locate Fatca Full Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Fatca Full Form to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatca full form 395821701

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a FATCA form and why is it necessary?

A FATCA form is a document required by the IRS for foreign financial institutions to report information about U.S. account holders. This form is necessary to comply with tax regulations and avoid penalties. Properly filing a FATCA form helps businesses maintain transparency and legality in their international transactions.

-

How does airSlate SignNow simplify the FATCA form submission process?

airSlate SignNow streamlines the FATCA form submission process by providing an intuitive platform for eSigning and sending documents. Users can easily upload their FATCA forms, gather signatures, and send them securely all in one place. This saves time and reduces the risk of errors compared to traditional methods.

-

Is there a cost associated with using airSlate SignNow for FATCA forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, allowing users to choose the most cost-effective solution for managing FATCA forms. Plans vary based on features and the volume of documents processed. Users can explore the pricing page for detailed information and options.

-

What features does airSlate SignNow offer for managing FATCA forms?

airSlate SignNow provides several features for managing FATCA forms, including customizable templates, bulk sending, automatic reminders, and integrations with popular apps. These features enhance efficiency and ensure that users can handle FATCA forms seamlessly. Additionally, advanced security measures protect sensitive information during the process.

-

Can airSlate SignNow integrate with other software for FATCA form management?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enabling users to manage their FATCA forms alongside other business tools. This connectivity enhances workflow efficiency and ensures that all necessary data is synchronized across platforms. Popular integrations include CRM systems and financial software.

-

What are the benefits of using airSlate SignNow for FATCA form management?

Using airSlate SignNow for FATCA form management offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced compliance with regulatory requirements. The user-friendly interface encourages ease of use for all team members. Additionally, the platform's security features help in safeguarding sensitive data.

-

Is it easy to track the status of FATCA forms in airSlate SignNow?

Yes, airSlate SignNow provides robust tracking capabilities, allowing users to monitor the status of their FATCA forms in real-time. You can easily see when forms are sent, viewed, signed, and completed. This transparency helps maintain accountability and ensures timely processing of all documents.

Get more for Fatca Full Form

Find out other Fatca Full Form

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template