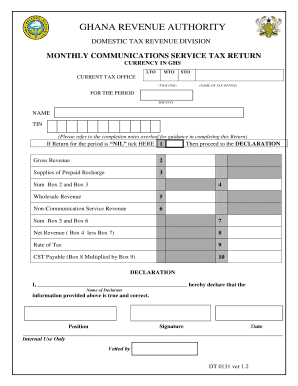

Domestic Tax Revenue Division Form

What is the Domestic Tax Revenue Division

The Domestic Tax Revenue Division is a key component of the Ghana Revenue Authority responsible for managing and collecting domestic taxes. This division oversees various tax types, including income tax, value-added tax (VAT), and corporate tax. Its primary goal is to ensure compliance with tax laws and regulations, thereby contributing to national revenue generation. Understanding its functions is essential for individuals and businesses to navigate their tax obligations effectively.

How to use the Domestic Tax Revenue Division

Utilizing the Domestic Tax Revenue Division involves several steps, starting with determining your tax obligations. Taxpayers can access resources and guidance through the Ghana Revenue Authority's official channels. This includes understanding the types of taxes applicable to their situation and the necessary forms to complete. Additionally, taxpayers should familiarize themselves with the division's online services, which allow for easier submission and tracking of tax documents.

Steps to complete the Domestic Tax Revenue Division

Completing the necessary forms for the Domestic Tax Revenue Division involves a systematic approach:

- Identify the specific form required for your tax situation, such as income tax returns or VAT declarations.

- Gather all necessary documentation, including financial statements and identification information.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the appropriate channel, whether online, by mail, or in person.

Required Documents

When engaging with the Domestic Tax Revenue Division, certain documents are essential for accurate processing. Commonly required documents include:

- Proof of identification, such as a national ID or passport.

- Financial statements, including income statements and balance sheets.

- Previous tax returns, if applicable, to provide context for current filings.

- Any relevant receipts or invoices that support claimed deductions or credits.

Legal use of the Domestic Tax Revenue Division

The legal framework governing the Domestic Tax Revenue Division ensures that all tax processes adhere to established laws. Taxpayers must comply with the regulations set forth by the Ghana Revenue Authority, which includes timely filing and accurate reporting of income. Failure to comply can result in penalties, making it crucial for individuals and businesses to understand their legal obligations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting forms to the Domestic Tax Revenue Division. These methods include:

- Online Submission: Utilizing the Ghana Revenue Authority's online portal for electronic filing, which offers convenience and faster processing.

- Mail Submission: Sending completed forms via postal service, ensuring they are sent to the correct address for processing.

- In-Person Submission: Visiting a local Ghana Revenue Authority office to submit forms directly, which can be beneficial for complex inquiries.

Quick guide on how to complete domestic tax revenue division

Complete Domestic Tax Revenue Division seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, enabling you to access the needed form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Domestic Tax Revenue Division on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Domestic Tax Revenue Division effortlessly

- Locate Domestic Tax Revenue Division and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Domestic Tax Revenue Division to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the domestic tax revenue division

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the GRA Domestic Tax Revenue Division in e-signing processes?

The GRA Domestic Tax Revenue Division plays a crucial role in ensuring compliance for businesses that utilize e-signatures. By understanding tax regulations related to digital signatures, businesses can enhance their processes while remaining compliant. Leveraging airSlate SignNow helps streamline this integration effectively.

-

How can airSlate SignNow help with the GRA Domestic Tax Revenue Division requirements?

airSlate SignNow offers features that support compliance with GRA Domestic Tax Revenue Division standards. It provides secure e-signing capabilities and keeps records of all transactions, ensuring that businesses can meet tax reporting requirements seamlessly. This is crucial for maintaining regulatory compliance.

-

What are the pricing options for airSlate SignNow, especially for businesses dealing with GRA Domestic Tax Revenue Division?

airSlate SignNow provides flexible pricing options tailored for businesses of all sizes, including those navigating through GRA Domestic Tax Revenue Division compliance. With affordable plans that grow with your business, it ensures that you can efficiently manage document signing while being cost-effective. Transparent pricing makes budgeting easier for tax compliance activities.

-

What features of airSlate SignNow are specifically beneficial for GRA Domestic Tax Revenue Division?

Key features of airSlate SignNow that benefit businesses working with the GRA Domestic Tax Revenue Division include customizable workflows and secure document storage. These features help in automating processes while ensuring that all relevant documents are easily accessible and secure. This not only enhances productivity but also supports compliance with tax obligations.

-

Can airSlate SignNow integrate with other software to assist with GRA Domestic Tax Revenue Division?

Yes, airSlate SignNow offers integrations with popular business tools that can assist in streamlining processes related to the GRA Domestic Tax Revenue Division. Integrating with accounting and CRM systems allows for seamless data transfer, which helps keep your tax-related documents organized and compliant. This provides added efficiency during tax season.

-

What benefits does using airSlate SignNow provide for companies focused on GRA Domestic Tax Revenue Division?

Using airSlate SignNow allows companies to benefit from enhanced efficiency in their document signing processes. By leveraging a secure and compliant platform, businesses can focus on their core operations without worrying about the complexities of the GRA Domestic Tax Revenue Division. This not only saves time but also minimizes the risk of errors during tax preparation.

-

Is airSlate SignNow suitable for small businesses that interact with the GRA Domestic Tax Revenue Division?

Absolutely, airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses navigating the GRA Domestic Tax Revenue Division. Its scalable features allow small businesses to manage their e-signatures and documents efficiently without excessive costs. This democratizes access to powerful tools for tax compliance.

Get more for Domestic Tax Revenue Division

- Mfp cbay treatment choice form georgia department of dch georgia

- Application for wall certificate georgia secretary of state sos georgia form

- Impact resource family evaluation questionnaire division of dfcs dhs georgia form

- Beneficiary claimant statement gotobennet form

- Next of kin form

- Register of wills of sussex county 1 file form 600 rw sussexcountyde

- Eglin access form

- Ga vaccine form

Find out other Domestic Tax Revenue Division

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer