NJ Division of Taxation Income TaxHow and When to File an Form

What is the NJ Division Of Taxation Income TaxHow And When To File An

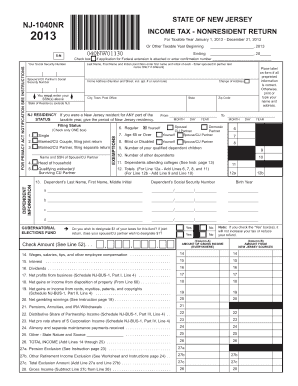

The NJ Division of Taxation Income TaxHow and When To File An form is essential for New Jersey residents to report their income and determine their tax obligations. This form is used to calculate the amount of state income tax owed, based on the taxpayer's earnings during the year. Understanding this form is crucial for compliance with state tax laws and for ensuring that individuals pay the correct amount of tax. The form includes sections for personal information, income details, deductions, and credits, which collectively contribute to the final tax calculation.

Steps to complete the NJ Division Of Taxation Income TaxHow And When To File An

Completing the NJ Division of Taxation Income TaxHow and When To File An form involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that all figures match your documentation.

- Claim any deductions or credits for which you qualify, such as property tax deductions or credits for education expenses.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the NJ Division of Taxation Income TaxHow and When To File An form. Typically, the deadline for filing state income tax returns is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of estimated tax payment deadlines if they expect to owe tax for the year. Keeping track of these dates helps avoid penalties and interest for late filing or payment.

Required Documents

To successfully complete the NJ Division of Taxation Income TaxHow and When To File An form, certain documents are required. These include:

- W-2 forms from employers for reporting wages.

- 1099 forms for reporting other income, such as freelance work or interest earned.

- Documentation for any deductions or credits claimed, such as receipts for medical expenses or educational costs.

- Last year’s tax return, which can provide a useful reference.

Form Submission Methods (Online / Mail / In-Person)

The NJ Division of Taxation Income TaxHow and When To File An form can be submitted through various methods. Taxpayers may choose to file online using approved e-filing software, which often streamlines the process and reduces errors. Alternatively, the form can be mailed to the appropriate address provided by the NJ Division of Taxation. For those who prefer in-person assistance, local tax offices may offer support for completing and submitting the form. Each method has its own benefits, and taxpayers should select the one that best meets their needs.

Penalties for Non-Compliance

Failing to file the NJ Division of Taxation Income TaxHow and When To File An form on time can result in penalties and interest charges. The state imposes a failure-to-file penalty, which typically starts at five percent of the unpaid tax amount for each month the return is late. Additionally, interest accrues on any unpaid taxes, compounding the total amount owed. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete nj division of taxation income taxhow and when to file an

Prepare NJ Division Of Taxation Income TaxHow And When To File An effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle NJ Division Of Taxation Income TaxHow And When To File An on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign NJ Division Of Taxation Income TaxHow And When To File An with ease

- Find NJ Division Of Taxation Income TaxHow And When To File An and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, or invite link, or download it to your computer.

Disregard concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign NJ Division Of Taxation Income TaxHow And When To File An to ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj division of taxation income taxhow and when to file an

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NJ Division Of Taxation Income TaxHow And When To File An?

The NJ Division Of Taxation Income TaxHow And When To File An refers to the processes and timelines involved in submitting income tax returns in New Jersey. Understanding these details helps individuals and businesses ensure compliance and avoid penalties. airSlate SignNow offers easy eSigning options to streamline your filing processes.

-

How does airSlate SignNow assist with NJ Division Of Taxation Income TaxHow And When To File An?

airSlate SignNow provides a user-friendly platform for electronically signing and sending documents related to NJ Division Of Taxation Income TaxHow And When To File An. With features tailored for tax documents, users can quickly complete their submissions without hassle. This efficiency helps save time during tax season.

-

What are the pricing options for using airSlate SignNow in relation to NJ Division Of Taxation Income TaxHow And When To File An?

Our pricing is designed to be cost-effective, making it easy for users to access essential tools for managing NJ Division Of Taxation Income TaxHow And When To File An. We offer various plans based on the number of users and features needed, ensuring you find the right fit for your business. Check our website for detailed pricing information.

-

Are there any key features in airSlate SignNow that support NJ Division Of Taxation Income TaxHow And When To File An?

Yes, airSlate SignNow includes essential features like document templates, real-time tracking, and eSignature capabilities specifically designed to simplify NJ Division Of Taxation Income TaxHow And When To File An. These features enhance your workflow, making it easier to manage tax documents efficiently. Users can also collaborate seamlessly with their tax professionals.

-

What benefits does airSlate SignNow offer for filing NJ Division Of Taxation Income TaxHow And When To File An?

By using airSlate SignNow for NJ Division Of Taxation Income TaxHow And When To File An, you benefit from quick and secure document handling. The intuitive platform helps reduce errors and speeds up the filing process, leading to timely submissions. Additionally, you can track the status of your documents and receive notifications.

-

Can I integrate airSlate SignNow with other tools to help with NJ Division Of Taxation Income TaxHow And When To File An?

Absolutely! airSlate SignNow offers integrations with various applications that enhance your workflow for NJ Division Of Taxation Income TaxHow And When To File An. This means you can connect your existing tools and automate your processes, resulting in a more streamlined experience when filing taxes.

-

Is it safe to use airSlate SignNow for NJ Division Of Taxation Income TaxHow And When To File An?

Yes, safety is a priority for airSlate SignNow when dealing with NJ Division Of Taxation Income TaxHow And When To File An. We implement advanced security measures, including encryption and compliance with industry standards, ensuring that your sensitive tax documents are protected. You can rely on us for secure transactions.

Get more for NJ Division Of Taxation Income TaxHow And When To File An

- Florida affidavit form

- Order form 02_24_12bf revpdf acro pharmaceutical

- Photovoltaic installation agreement solar 4r schools solar4rschools form

- Winnebago county application for employment co winnebago wi form

- Proxy marriage form

- Summary administration s3amazonawscom form

- Puc 03 010 form

- Hawaii state immunization epi forms

Find out other NJ Division Of Taxation Income TaxHow And When To File An

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile