Nys Form Char001 Lt

What is the Nys Form Char001 Lt

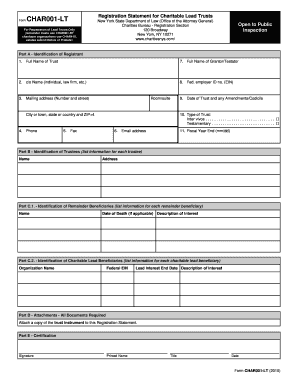

The Nys Form Char001 Lt is a specific document used in New York State for various legal and administrative purposes. This form is typically associated with the registration and reporting requirements for certain organizations and entities. Understanding its purpose is crucial for compliance with state regulations. It serves as a formal declaration of an organization's status and activities, ensuring transparency and accountability in operations.

How to use the Nys Form Char001 Lt

Using the Nys Form Char001 Lt involves several steps to ensure accurate completion and submission. First, gather all necessary information about your organization, including its legal name, address, and purpose. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements outlined by the state.

Steps to complete the Nys Form Char001 Lt

Completing the Nys Form Char001 Lt requires attention to detail. Follow these steps for a successful submission:

- Collect necessary organizational information, including identification numbers and contact details.

- Access the form through the appropriate state website or authorized source.

- Fill out the form, ensuring that all required fields are completed.

- Double-check for accuracy and completeness.

- Submit the form according to the specified submission methods, either online, by mail, or in person.

Legal use of the Nys Form Char001 Lt

The legal use of the Nys Form Char001 Lt is vital for maintaining compliance with state laws. This form must be filled out accurately to reflect the true nature of the organization’s activities. Failure to complete and submit the form correctly can lead to penalties or legal repercussions. It is essential to familiarize yourself with the specific legal requirements associated with this form to ensure that your organization operates within the bounds of the law.

Key elements of the Nys Form Char001 Lt

Several key elements must be included in the Nys Form Char001 Lt for it to be considered valid. These elements typically include:

- Legal name of the organization

- Address and contact information

- Purpose of the organization

- Identification numbers, such as the Employer Identification Number (EIN)

- Signature of an authorized representative

Form Submission Methods

The Nys Form Char001 Lt can be submitted through various methods, providing flexibility for organizations. Options typically include:

- Online submission via the designated state portal

- Mailing the completed form to the appropriate state office

- In-person submission at designated state offices

Quick guide on how to complete nys form char001 lt

Prepare Nys Form Char001 Lt effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Nys Form Char001 Lt on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to edit and eSign Nys Form Char001 Lt hassle-free

- Obtain Nys Form Char001 Lt and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Nys Form Char001 Lt and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys form char001 lt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nys form char001 lt, and why is it important?

The nys form char001 lt is a crucial document for organizations operating in New York State, as it is required for certain tax-exempt forms. Understanding how to correctly fill out the nys form char001 lt ensures compliance with state regulations and avoids potential penalties.

-

How can airSlate SignNow help with the nys form char001 lt?

airSlate SignNow streamlines the process of sending and signing the nys form char001 lt by providing a user-friendly interface that simplifies document management. With SignNow, users can easily eSign the form, ensuring that all signatures are secure and legally binding.

-

What are the pricing options for using airSlate SignNow for the nys form char001 lt?

airSlate SignNow offers competitive pricing plans that cater to various business needs, making it an affordable option for handling the nys form char001 lt. Monthly and annual subscriptions are available, with discounts for larger teams, ensuring flexibility as your organization grows.

-

Does airSlate SignNow offer templates for the nys form char001 lt?

Yes, airSlate SignNow provides customizable templates, including for the nys form char001 lt. This feature allows users to save time and ensure accuracy by using pre-formatted templates tailored for their specific needs.

-

Can airSlate SignNow integrate with other software for managing the nys form char001 lt?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM and document management systems, which can enhance your workflow when handling the nys form char001 lt. This integration facilitates better data management and streamlines the signing process.

-

What are the benefits of using airSlate SignNow for the nys form char001 lt?

Using airSlate SignNow for the nys form char001 lt provides various benefits, including increased efficiency, reduced turnaround time, and enhanced security for your documents. With eSigning capabilities, you can achieve compliance faster while minimizing the risk of document mismanagement.

-

Is it easy to use airSlate SignNow for new users unfamiliar with the nys form char001 lt?

Yes, airSlate SignNow is designed with a user-friendly interface that makes it easy for new users to navigate and manage their documents, including the nys form char001 lt. Our platform includes helpful resources and support to guide you through the eSigning process.

Get more for Nys Form Char001 Lt

- Visa debit dispute form suncorp bank

- Referral form central manchester university hospitals nhs

- Skytech security interview form

- Licensed to soar real estate express form

- Private upland easement application florida department of floridadep form

- Embassy suites form

- Illinois dot employment application prairie material form

- Appendix d 1 cpa ca ordre des comptables agr s du qu bec form

Find out other Nys Form Char001 Lt

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online