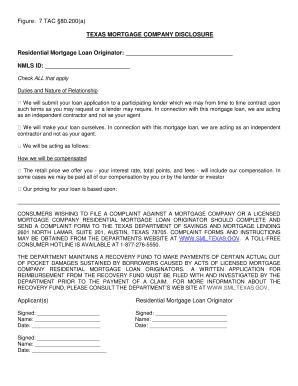

Texas Mortgage Company Disclosure Form

What is the Texas Mortgage Company Disclosure?

The Texas Mortgage Company Disclosure is a legal document that provides essential information regarding the terms and conditions of a mortgage loan. This disclosure ensures that borrowers are fully informed about the costs, risks, and obligations associated with their mortgage. It is a requirement set forth by Texas law to promote transparency in the lending process. The document typically includes details such as the loan amount, interest rate, payment schedule, and any fees associated with the mortgage.

Key Elements of the Texas Mortgage Company Disclosure

Understanding the key elements of the Texas Mortgage Company Disclosure is crucial for borrowers. The document generally encompasses the following components:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the loan balance.

- Monthly Payments: The amount due each month, including principal and interest.

- Fees: Any additional costs associated with the loan, such as origination fees or closing costs.

- Prepayment Penalties: Information about any penalties for paying off the loan early.

Steps to Complete the Texas Mortgage Company Disclosure

Completing the Texas Mortgage Company Disclosure involves several important steps to ensure accuracy and compliance. Here are the typical steps involved:

- Gather necessary information about your mortgage, including loan details and personal identification.

- Fill out the disclosure form with accurate data, ensuring all fields are completed.

- Review the completed form for any errors or omissions.

- Sign the document electronically or in person, depending on the submission method.

- Submit the disclosure to the appropriate lender or financial institution.

Legal Use of the Texas Mortgage Company Disclosure

The Texas Mortgage Company Disclosure is legally binding when completed correctly. To ensure its legal validity, the document must comply with federal and state regulations governing mortgage disclosures. This includes adherence to the Electronic Signatures in Global and National Commerce (ESIGN) Act, which allows electronic signatures to hold the same legal weight as traditional handwritten signatures. Proper execution of the disclosure protects both the lender and borrower in the event of disputes.

How to Obtain the Texas Mortgage Company Disclosure

Obtaining the Texas Mortgage Company Disclosure is a straightforward process. Borrowers can request the form directly from their mortgage lender or financial institution. Additionally, many lenders provide the disclosure as part of their loan application package. It is also possible to find templates online, but it is advisable to use the official version provided by your lender to ensure compliance with Texas regulations.

Digital vs. Paper Version of the Texas Mortgage Company Disclosure

Both digital and paper versions of the Texas Mortgage Company Disclosure are valid, but there are distinct advantages to using the digital format. Digital documents can be completed and signed electronically, which enhances convenience and speeds up the process. Furthermore, electronic submissions often come with built-in security features, such as encryption and audit trails, ensuring that the information remains confidential and secure.

Quick guide on how to complete texas mortgage company disclosure

Effortlessly Prepare Texas Mortgage Company Disclosure on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents promptly and without any delays. Manage Texas Mortgage Company Disclosure on any device with the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to Modify and Electronically Sign Texas Mortgage Company Disclosure with Ease

- Obtain Texas Mortgage Company Disclosure and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Texas Mortgage Company Disclosure to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas mortgage company disclosure

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas mortgage company disclosure?

A Texas mortgage company disclosure is a legal requirement that informs borrowers about the terms and costs associated with their mortgage. It ensures transparency between the Texas mortgage company and the client, outlining critical details that need to be understood before signing any documents.

-

How can airSlate SignNow help with Texas mortgage company disclosures?

airSlate SignNow streamlines the process of preparing and signing Texas mortgage company disclosures. Our platform allows for easy eSigning and document management, ensuring that all disclosures meet regulatory compliance efficiently.

-

What features does airSlate SignNow offer for Texas mortgage documentation?

airSlate SignNow offers various features tailored for Texas mortgage documentation, including customizable templates, audit trails, and advanced security measures. These features enhance the preparation and management of Texas mortgage company disclosures to ensure a smooth experience.

-

Is there a cost associated with using airSlate SignNow for Texas mortgage company disclosures?

Yes, while airSlate SignNow offers competitive pricing for our services, the cost depends on the features you choose. Utilizing our platform for Texas mortgage company disclosures is generally cost-effective and can lead to signNow time and resource savings.

-

What are the benefits of using airSlate SignNow for managing disclosures?

Using airSlate SignNow for managing Texas mortgage company disclosures provides several benefits, including increased efficiency and reduced paperwork. Our platform allows you to automate workflows, minimizing the risk of errors and expediting the signing process.

-

Can airSlate SignNow integrate with other tools for mortgage processing?

Yes, airSlate SignNow offers integrations with various mortgage processing tools and platforms. This allows Texas mortgage companies to incorporate eSigning for disclosures seamlessly into their existing workflows, enhancing overall productivity.

-

How does airSlate SignNow ensure the security of Texas mortgage company disclosures?

airSlate SignNow prioritizes security by implementing robust encryption and providing secure access controls. This means that all Texas mortgage company disclosures are safeguarded against unauthorized access during the signing process.

Get more for Texas Mortgage Company Disclosure

Find out other Texas Mortgage Company Disclosure

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later