Wisconsin 1099 G Form

What is the Wisconsin 1099 G

The Wisconsin 1099 G is a tax form used to report certain types of income, including state tax refunds, unemployment compensation, and other government payments. This form is particularly important for individuals who have received funds from the state and need to report this income on their federal tax returns. The 1099 G form meaning is essential for understanding how these payments affect your overall tax liability.

How to obtain the Wisconsin 1099 G

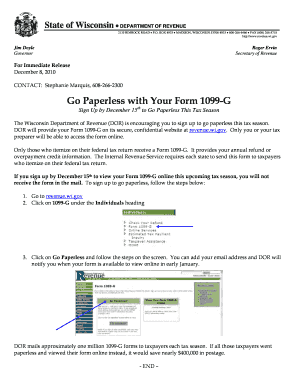

To obtain your Wisconsin 1099 G, you can access it online through the Wisconsin Department of Revenue's website. You may also receive a physical copy by mail if you have provided your information to the relevant state agency. If you need to retrieve your 1099 G online, you will typically need to provide personal details such as your Social Security number and other identifying information to verify your identity.

Steps to complete the Wisconsin 1099 G

Completing the Wisconsin 1099 G involves several steps:

- Gather necessary information, including your Social Security number and details about the payments you received.

- Fill out the form accurately, ensuring that you report all applicable income types.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority, either electronically or by mail.

Legal use of the Wisconsin 1099 G

The Wisconsin 1099 G must be completed and submitted in compliance with state and federal tax laws. This form serves as a record of income received from state sources, and failure to report this income can lead to penalties. Ensuring that the form is filled out correctly and submitted on time is crucial for maintaining compliance with tax regulations.

Key elements of the Wisconsin 1099 G

Key elements of the Wisconsin 1099 G include:

- Payee information, including name, address, and Social Security number.

- Type of payment received, such as unemployment benefits or state tax refunds.

- Total amount paid during the tax year.

- State agency issuing the payment.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Wisconsin 1099 G. Typically, the form must be submitted to the state by January thirty-first of the year following the tax year in question. Additionally, recipients should receive their copies of the form by the same date to ensure timely reporting on their federal tax returns.

Quick guide on how to complete 1099 g wisconsin

Easily prepare 1099 g wisconsin on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage whats a 1099 g on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign 1099 g meaning effortlessly

- Find wisconsin 1099 g and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your selected device. Edit and eSign wisconsin 1099 form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to wisconsin 1099g

Create this form in 5 minutes!

How to create an eSignature for the what's a 1099 g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 1099 g state tax refund

-

What is the purpose of the 1099 G in Wisconsin?

The 1099 G in Wisconsin is used to report unemployment compensation and certain other payments made by the state. It's essential for individuals to understand how to manage this form for tax purposes, as it impacts their total taxable income. airSlate SignNow can help streamline the process of signing and submitting these documents efficiently.

-

How can airSlate SignNow assist with filling out a 1099 G form in Wisconsin?

Using airSlate SignNow, users can easily prepare and eSign the 1099 G form in Wisconsin. Our platform offers templates and guides to walk you through the completion process, ensuring you won't miss any critical sections. This saves you time and reduces the risk of errors when filing.

-

Are there any fees associated with using airSlate SignNow for the 1099 G Wisconsin e-filing?

airSlate SignNow provides a cost-effective solution with transparent pricing options. While there may be a nominal fee for premium features, the overall investment is minimal compared to the benefits of streamlined document management and e-signing. This can be particularly valuable when dealing with forms like the 1099 G in Wisconsin.

-

Can I store my 1099 G Wisconsin forms securely with airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your documents by offering secure storage options. Your completed 1099 G Wisconsin forms will be protected with encryption and access controls, ensuring only authorized users can view or edit them. This peace of mind allows you to focus on more important tasks.

-

Is airSlate SignNow user-friendly for beginners to handle the 1099 G form in Wisconsin?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for beginners to navigate the platform. Our intuitive interface simplifies the process of completing and eSigning the 1099 G form in Wisconsin, helping you get your documents squared away without hassle.

-

What integrations does airSlate SignNow offer for managing 1099 G Wisconsin documents?

airSlate SignNow seamlessly integrates with various applications and cloud services, enhancing your workflow for managing 1099 G forms in Wisconsin. Whether you use Google Drive, Dropbox, or other tools, our platform ensures that you can easily access and eSign your documents. This flexibility improves efficiency signNowly.

-

How does e-signing the 1099 G Wisconsin form save time?

E-signing the 1099 G form in Wisconsin with airSlate SignNow expedites the signature collection process. Traditional signing methods can be slow and cumbersome, but electronic signatures allow you to sign from anywhere, eliminating delays in paperwork. This means you can submit your form quickly and keep your tax filings on track.

Get more for what is form 1099g

- Vendor prequalification form

- Application forms orthopedic foundation for animals 521115789

- Application for thyroid database ofaorg form

- Application forms orthopedic foundation for animals 521116002

- Application for dentition database offa form

- Fillable online patient financial assistance application hill form

- Uniform sales amp use tax resale certificate multijurisdiction form

- Application forms orthopedic foundation for animals 521115599

Find out other wisconsin 1099 g lookup

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe