Texas Dyed Diesel Bonded User Fuels Tax Report Form

What is the Texas Dyed Diesel Bonded User Fuels Tax Report

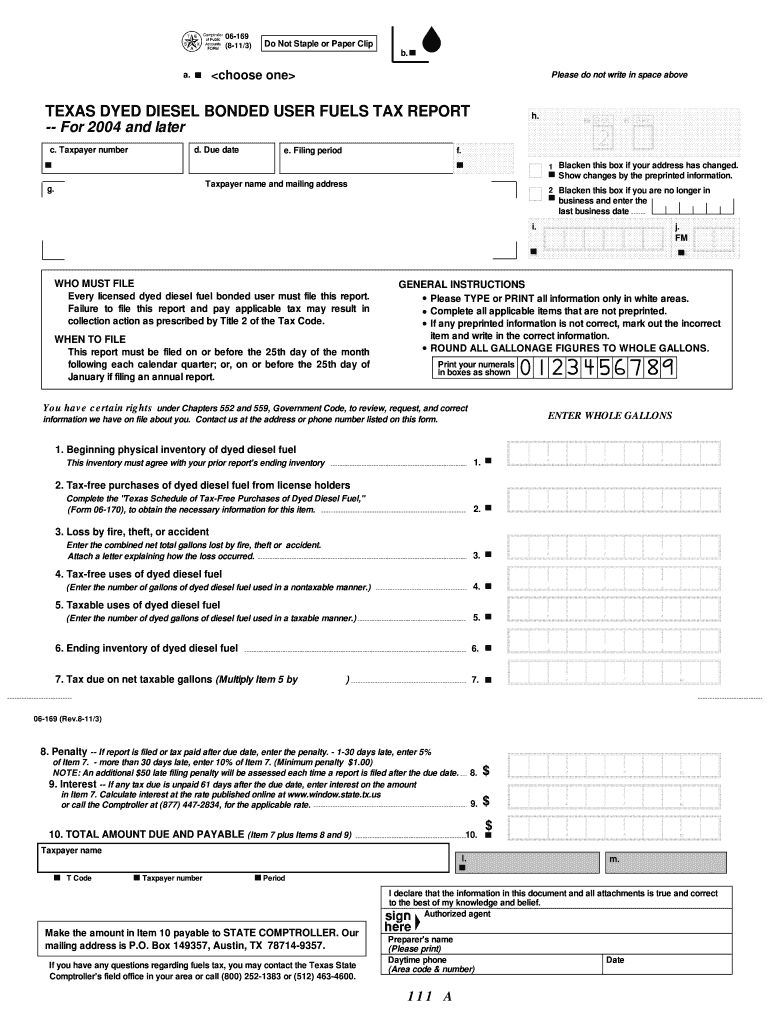

The Texas Dyed Diesel Bonded User Fuels Tax Report is a crucial document required for individuals and businesses that purchase dyed diesel fuel in Texas. This report serves to account for the tax obligations associated with the use of dyed diesel, which is typically exempt from state fuel taxes when used for specific purposes, such as off-road applications. Understanding this report is essential for compliance with Texas tax regulations and to avoid potential penalties.

How to obtain the Texas Dyed Diesel Bonded User Fuels Tax Report

Obtaining the Texas Dyed Diesel Bonded User Fuels Tax Report involves a straightforward process. Individuals or businesses must first ensure they are registered as bonded users with the Texas Comptroller’s office. This registration can typically be completed online or via mail. Once registered, users can access the report through the Texas Comptroller's website or by contacting their office directly for assistance. It is important to keep this report updated to reflect any changes in fuel usage or tax obligations.

Steps to complete the Texas Dyed Diesel Bonded User Fuels Tax Report

Completing the Texas Dyed Diesel Bonded User Fuels Tax Report requires careful attention to detail. Here are the key steps:

- Gather all necessary documentation, including purchase invoices and records of dyed diesel usage.

- Fill out the report accurately, ensuring all fields are completed as required.

- Calculate the total amount of dyed diesel fuel purchased and the corresponding tax exemptions.

- Review the report for accuracy before submission.

- Submit the report to the Texas Comptroller by the designated deadline, either online or by mail.

Legal use of the Texas Dyed Diesel Bonded User Fuels Tax Report

The legal use of the Texas Dyed Diesel Bonded User Fuels Tax Report is vital for compliance with state fuel tax laws. This report must be filed correctly to demonstrate that the dyed diesel fuel was used in accordance with Texas regulations. Failure to adhere to these legal requirements can result in fines or penalties, making it essential for users to understand their obligations and maintain accurate records of their fuel purchases and usage.

Penalties for Non-Compliance

Non-compliance with the Texas Dyed Diesel Bonded User Fuels Tax Report can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action from the Texas Comptroller’s office. It is crucial for users to file their reports on time and ensure accuracy to avoid these consequences. Regular audits may also be conducted to verify compliance, further emphasizing the importance of maintaining proper documentation.

Required Documents

To complete the Texas Dyed Diesel Bonded User Fuels Tax Report, several documents are required. These typically include:

- Invoices for dyed diesel fuel purchases.

- Records of fuel usage, detailing how and where the fuel was utilized.

- Previous tax reports, if applicable, to ensure consistency and accuracy.

Having these documents readily available will streamline the reporting process and help ensure compliance with state regulations.

Quick guide on how to complete 06 169 dyed diesel bonded user fuels tax report window state tx

Complete Texas Dyed Diesel Bonded User Fuels Tax Report easily on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed paperwork, as you can find the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Texas Dyed Diesel Bonded User Fuels Tax Report on any platform using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to edit and eSign Texas Dyed Diesel Bonded User Fuels Tax Report effortlessly

- Obtain Texas Dyed Diesel Bonded User Fuels Tax Report and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign function, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in a few clicks from any device you choose. Edit and eSign Texas Dyed Diesel Bonded User Fuels Tax Report and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 06 169 dyed diesel bonded user fuels tax report window state tx

How to generate an eSignature for your 06 169 Dyed Diesel Bonded User Fuels Tax Report Window State Tx in the online mode

How to create an electronic signature for the 06 169 Dyed Diesel Bonded User Fuels Tax Report Window State Tx in Chrome

How to create an eSignature for signing the 06 169 Dyed Diesel Bonded User Fuels Tax Report Window State Tx in Gmail

How to generate an electronic signature for the 06 169 Dyed Diesel Bonded User Fuels Tax Report Window State Tx straight from your smart phone

How to create an electronic signature for the 06 169 Dyed Diesel Bonded User Fuels Tax Report Window State Tx on iOS

How to create an electronic signature for the 06 169 Dyed Diesel Bonded User Fuels Tax Report Window State Tx on Android

People also ask

-

What is a Texas dyed diesel permit search?

A Texas dyed diesel permit search allows users to verify the validity of dyed diesel permits required for operating vehicles using dyed diesel fuel in Texas. This search is essential for businesses to ensure compliance with state regulations regarding fuel usage. By conducting a texas dyed diesel permit search, companies can avoid penalties and operate legally.

-

How can I perform a Texas dyed diesel permit search using airSlate SignNow?

To perform a texas dyed diesel permit search with airSlate SignNow, simply navigate to the designated section on our platform. Enter the necessary details such as permit number or business information to retrieve relevant data. Our user-friendly interface makes it quick and easy to find the information you need.

-

What are the benefits of using airSlate SignNow for my Texas dyed diesel permit search?

Using airSlate SignNow for your texas dyed diesel permit search provides a streamlined process that enhances efficiency and accuracy. Our platform integrates eSignature capabilities, allowing you to instantaneously sign necessary documents once you retrieve permit information. This comprehensive approach saves time and simplifies compliance management.

-

Are there any fees associated with the Texas dyed diesel permit search?

While the texas dyed diesel permit search via airSlate SignNow is designed to be cost-effective, certain features may be subject to fees depending on your subscription plan. We recommend reviewing our pricing options for detailed information on any applicable fees. Rest assured, we aim to deliver a valuable service without hidden costs.

-

Can I integrate airSlate SignNow with other tools to manage my Texas dyed diesel permits?

Yes, airSlate SignNow offers various integrations that allow you to connect with other tools and systems for managing your Texas dyed diesel permits efficiently. This can help streamline your workflow, keeping all related documents and permits in one place. Explore our integrations to find what best fits your business needs.

-

What features does airSlate SignNow offer for managing Texas dyed diesel permits?

airSlate SignNow provides features such as eSigning, document management, and the ability to perform a texas dyed diesel permit search. These tools enable businesses to handle all aspects of permit management efficiently, from searching for permits to signing necessary documents securely. Take advantage of our robust features to simplify your processes.

-

How does using airSlate SignNow ensure compliance with Texas tinted diesel regulations?

airSlate SignNow helps ensure compliance with Texas tinted diesel regulations by providing reliable and up-to-date information gathered during your texas dyed diesel permit search. Our platform also offers automated reminders for renewal of permits and crucial updates regarding regulatory changes. This keeps your business compliant and reduces the risk of fines.

Get more for Texas Dyed Diesel Bonded User Fuels Tax Report

- Ada claim form 134967

- Pirkimo pardavimo sutartis form

- Refund agreement sample form

- Guide to equitable sharing for foreign countries and federal state and local law enforcement agencies guide to equitable form

- Funeral services application for aish clients application form to determine eligibility for a funeral services benefit for a 627381245

- Lost wage verification form home page

- The vacancy notice complete posting rhode island public defender ripd form

- Event sponsor contract template form

Find out other Texas Dyed Diesel Bonded User Fuels Tax Report

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later