Rew $ $ $ $ $ 1 Form

What is the Rew $ $ $ $ $ 1 Form

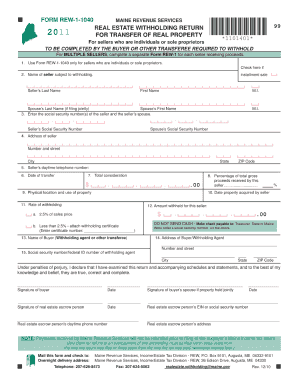

The Rew $ $ $ $ $ 1 Form is a specific document used primarily in financial transactions and reporting. It serves as a means for individuals or businesses to declare certain financial information to the appropriate authorities. This form is essential for maintaining compliance with tax regulations and ensuring accurate reporting of income or expenses. Understanding its purpose is crucial for anyone involved in financial activities that require formal documentation.

How to use the Rew $ $ $ $ $ 1 Form

Using the Rew $ $ $ $ $ 1 Form involves several steps to ensure accurate completion. First, gather all necessary financial documents that will support the information you need to provide. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form according to the guidelines provided by the issuing authority, whether online, by mail, or in person.

Steps to complete the Rew $ $ $ $ $ 1 Form

Completing the Rew $ $ $ $ $ 1 Form requires attention to detail. Follow these steps:

- Gather required documents, such as previous financial statements and identification.

- Fill out your personal and financial information as requested on the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form as required.

- Submit the form through the designated method outlined by the issuing authority.

Legal use of the Rew $ $ $ $ $ 1 Form

The Rew $ $ $ $ $ 1 Form is legally binding when completed and submitted according to the relevant regulations. It must be filled out truthfully and accurately to avoid potential legal repercussions. Compliance with federal and state laws is essential, as inaccuracies or omissions can lead to penalties or audits. Understanding the legal implications of this form helps ensure that it serves its intended purpose effectively.

Key elements of the Rew $ $ $ $ $ 1 Form

Key elements of the Rew $ $ $ $ $ 1 Form include:

- Personal identification information, including name and address.

- Financial details relevant to the form's purpose, such as income or expenses.

- Signature and date fields to validate the information provided.

- Instructions for submission and any additional documentation required.

Filing Deadlines / Important Dates

Filing deadlines for the Rew $ $ $ $ $ 1 Form vary depending on the specific requirements set by the issuing authority. It is important to be aware of these dates to ensure timely submission. Missing a deadline can result in penalties or complications with financial reporting. Always check the latest guidelines for the most accurate information regarding important dates related to this form.

Quick guide on how to complete rew 1 form

Complete Rew $ $ $ $ $ 1 Form effortlessly on any device

Digital document management has gained immense traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without holdups. Manage Rew $ $ $ $ $ 1 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Rew $ $ $ $ $ 1 Form seamlessly

- Locate Rew $ $ $ $ $ 1 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your updates.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Rew $ $ $ $ $ 1 Form while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rew 1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Rew $ $ $ $ $ 1 Form used for?

The Rew $ $ $ $ $ 1 Form is designed to streamline the signing process for your important documents. It allows users to electronically sign forms with ease, reducing the time and effort required for traditional signing methods. Businesses can leverage this form to enhance their workflows and ensure compliance with eSignature laws.

-

How does airSlate SignNow pricing for the Rew $ $ $ $ $ 1 Form work?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, including those who want to use the Rew $ $ $ $ $ 1 Form. The pricing model is designed to be cost-effective, allowing you to choose a plan that fits your budget while providing access to essential features. Visit our website for detailed pricing information.

-

What features are included with the Rew $ $ $ $ $ 1 Form?

The Rew $ $ $ $ $ 1 Form comes with a variety of features including customizable templates, secure eSigning, and real-time tracking. Users can also automate their workflows and integrate with existing applications to improve efficiency. These features make the form user-friendly and effective for business operations.

-

Are there any benefits to using the Rew $ $ $ $ $ 1 Form?

Using the Rew $ $ $ $ $ 1 Form offers numerous benefits such as faster document turnaround times and enhanced security through encryption. It eliminates the need for physical documents, which can save time and reduce costs. Additionally, it helps improve user experience by making signing simpler and more accessible.

-

Can I integrate the Rew $ $ $ $ $ 1 Form with other software?

Yes, the Rew $ $ $ $ $ 1 Form seamlessly integrates with a variety of software applications. This includes popular CRM systems, cloud storage services, and productivity tools, allowing businesses to maintain their preferred workflows. The ability to integrate enhances the efficiency of document management and signing processes.

-

Is the Rew $ $ $ $ $ 1 Form legally binding?

Absolutely! The Rew $ $ $ $ $ 1 Form complies with all major eSignature laws, making it a legally binding document. This ensures that businesses can trust the signatures collected through airSlate SignNow for legal agreements and contracts. The platform also provides audit trails for added security and trust.

-

How can I access the Rew $ $ $ $ $ 1 Form?

Accessing the Rew $ $ $ $ $ 1 Form is easy through the airSlate SignNow platform. Simply sign up for an account, choose your preferred plan, and you can start creating and sending forms instantly. The user interface is intuitive, ensuring a smooth experience even for first-time users.

Get more for Rew $ $ $ $ $ 1 Form

- Pa change form

- Affidavit of legal interest city of star staridaho form

- Temporary event notice form lichfield district council lichfielddc gov

- Lifeview financial goal analysis and financial morgan stanley form

- Patient implant passport straumann form

- Form a 1 request and agreement to arbitrate

- Samples form

- Snhu student program modification forms

Find out other Rew $ $ $ $ $ 1 Form

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online