NEW EMPLOYEE PAYROLL FORM

What is the new employee payroll form

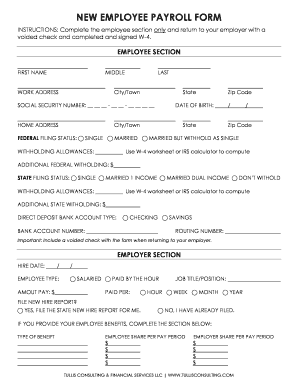

The new employee payroll form is a critical document used by employers to gather essential information from new hires. This form typically includes personal details such as the employee's name, address, Social Security number, and tax withholding preferences. It serves as the foundation for setting up payroll and ensuring compliance with federal and state tax regulations. By accurately completing this form, employers can facilitate timely and correct compensation for their employees while adhering to legal obligations.

Key elements of the new employee payroll form

Understanding the key elements of the new employee payroll form is essential for both employers and employees. The form generally includes:

- Personal Information: Name, address, and Social Security number.

- Tax Information: Selection of federal and state tax withholding allowances.

- Direct Deposit Details: Bank account information for payroll deposits.

- Employment Status: Full-time or part-time designation.

- Signature: Employee's signature to validate the information provided.

Steps to complete the new employee payroll form

Completing the new employee payroll form involves several straightforward steps:

- Gather necessary personal information, including your Social Security number and bank details.

- Fill out the personal information section accurately.

- Choose your tax withholding allowances based on your financial situation.

- Provide direct deposit information if applicable.

- Review the completed form for accuracy and sign it.

Legal use of the new employee payroll form

The legal use of the new employee payroll form is governed by various federal and state regulations. To ensure compliance, employers must collect accurate information and maintain confidentiality. Electronic signatures on the form are legally binding under the ESIGN Act and UETA, provided that the signing process meets specific criteria. Employers should also keep the form secure and accessible for record-keeping and auditing purposes.

How to obtain the new employee payroll form

Employers can obtain the new employee payroll form through various means. Many organizations provide a template on their internal HR platforms or websites. Additionally, forms can be downloaded from reputable sources online or created using digital document solutions. Ensuring that the form is the most current version is crucial for compliance with tax laws.

Form submission methods

Submitting the new employee payroll form can be done through several methods, depending on the employer's preferences:

- Online Submission: Many companies allow employees to complete and submit the form electronically through secure HR software.

- Mail: Employees may also print the completed form and send it via postal service to the HR department.

- In-Person: Submitting the form in person can provide immediate confirmation of receipt.

Quick guide on how to complete new employee payroll form

Complete NEW EMPLOYEE PAYROLL FORM effortlessly on any device

Online document management has become prevalent among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage NEW EMPLOYEE PAYROLL FORM on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign NEW EMPLOYEE PAYROLL FORM easily

- Locate NEW EMPLOYEE PAYROLL FORM and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign NEW EMPLOYEE PAYROLL FORM and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new employee payroll form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are employee payroll forms and why are they important?

Employee payroll forms are essential documents that detail the payment information of employees, including tax withholding and benefits. They facilitate accurate payroll processing and compliance with labor laws. Utilizing airSlate SignNow for employee payroll forms streamlines the collection and management of these important documents, ensuring a smooth payroll experience.

-

How can airSlate SignNow help with employee payroll forms?

airSlate SignNow offers a user-friendly platform for creating, sending, and eSigning employee payroll forms. With customizable templates and secure storage, businesses can easily manage payroll documentation. This service reduces processing time and improves accuracy, enhancing overall payroll efficiency.

-

Are there any costs associated with using airSlate SignNow for employee payroll forms?

AirSlate SignNow provides flexible pricing plans tailored for various business sizes. There may be different costs associated with accessing advanced features for managing employee payroll forms. However, the overall investment is designed to save time and resources in managing payroll processes.

-

Can airSlate SignNow integrate with existing payroll systems?

Yes, airSlate SignNow offers integration capabilities with many popular payroll systems. This allows businesses to seamlessly manage employee payroll forms and sync them with existing workflows. The integration enhances efficiency by reducing the need for manual data entry and improving accuracy in payroll processing.

-

What security measures does airSlate SignNow take for employee payroll forms?

AirSlate SignNow prioritizes the security of your documents, including employee payroll forms. The platform implements robust encryption, secure servers, and compliance with legal regulations to protect sensitive information. This ensures that your payroll documents are safe and only accessible to authorized personnel.

-

How can I customize employee payroll forms in airSlate SignNow?

Customizing employee payroll forms in airSlate SignNow is simple and intuitive. Users can utilize the drag-and-drop feature to add or rearrange fields according to their specific payroll requirements. This flexibility allows companies to tailor forms to meet their unique processes, ensuring all necessary information is collected.

-

Can I track the status of employee payroll forms sent through airSlate SignNow?

Absolutely! AirSlate SignNow provides real-time tracking for employee payroll forms. You can monitor when the form is sent, viewed, and signed, giving you peace of mind and ensuring timely processing of payroll documents.

Get more for NEW EMPLOYEE PAYROLL FORM

- Aurisonics endorsement form

- State of new mexico application for excessive size and weight form

- Personal care screening form

- Instructions for form f 11075 prior authorization 2011

- How to fill out a north carolina appendix b building code summary form

- Tennessee fae 172 form

- Aspire job offer j 1 form

- Aws visual acuity form

Find out other NEW EMPLOYEE PAYROLL FORM

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement