Tennessee Form Inc 253

What is the Tennessee Form Inc 253

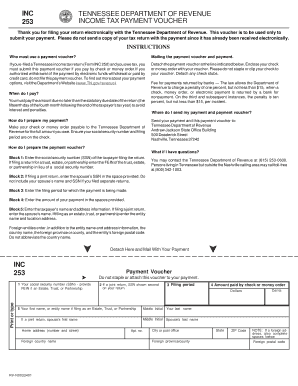

The Tennessee Form Inc 253 is a payment voucher used by businesses to remit various taxes to the state of Tennessee. This form is essential for ensuring that tax payments are processed correctly and efficiently. It is typically utilized by corporations and other business entities to report and pay their franchise and excise taxes. Understanding this form is crucial for compliance with state tax regulations.

How to use the Tennessee Form Inc 253

Using the Tennessee Form Inc 253 involves several straightforward steps. First, ensure that you have the correct version of the form, which can be obtained from the Tennessee Department of Revenue. Next, accurately fill out the required fields, including your business name, address, and the amount of tax being paid. After completing the form, submit it along with your payment to the appropriate address specified by the state. Properly using this form helps avoid potential penalties and ensures timely processing of your tax payment.

Steps to complete the Tennessee Form Inc 253

Completing the Tennessee Form Inc 253 requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the latest version of the form from the Tennessee Department of Revenue.

- Enter your business information, including the legal name and address.

- Specify the tax period for which you are making the payment.

- Calculate the total amount due and enter it in the designated field.

- Review all information for accuracy before submission.

Once completed, ensure that the form is signed and dated if required, and then submit it as directed.

Legal use of the Tennessee Form Inc 253

The Tennessee Form Inc 253 is legally binding when completed and submitted according to state regulations. It is important to understand that electronic signatures are acceptable if the form is submitted online. Compliance with the relevant tax laws is essential to avoid penalties. The form must be submitted by the due date to ensure that your tax obligations are met without incurring interest or late fees.

Key elements of the Tennessee Form Inc 253

Several key elements are essential for the Tennessee Form Inc 253 to be considered complete and valid:

- Business Identification: Accurate details about the business, including name and address.

- Tax Period: The specific period for which the payment is being made.

- Payment Amount: The total tax due must be calculated correctly.

- Signature: Required for paper submissions to validate the form.

Ensuring these elements are correctly filled out will facilitate smooth processing and compliance with tax requirements.

Form Submission Methods

The Tennessee Form Inc 253 can be submitted through various methods, providing flexibility for businesses. These methods include:

- Online Submission: Many businesses opt to submit the form electronically through the Tennessee Department of Revenue's online portal.

- Mail: The completed form can be mailed to the designated address provided by the state.

- In-Person: Businesses may also choose to deliver the form in person at a local Department of Revenue office.

Selecting the appropriate submission method can help ensure timely processing and compliance with deadlines.

Quick guide on how to complete tennessee form inc 253

Easily prepare Tennessee Form Inc 253 on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without any hold-ups. Manage Tennessee Form Inc 253 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to edit and eSign Tennessee Form Inc 253 seamlessly

- Obtain Tennessee Form Inc 253 and then click Get Form to initiate.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Tennessee Form Inc 253 and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tennessee form inc 253

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tennessee Form INC 253 Payment Voucher?

The Tennessee Form INC 253 Payment Voucher is a document used by businesses to submit payments along with their income taxes. It helps ensure that tax payments are accurately processed by the state. Completing the Tennessee Form INC 253 Payment Voucher correctly is crucial for avoiding penalties and ensuring compliance.

-

How can airSlate SignNow assist with the Tennessee Form INC 253 Payment Voucher?

airSlate SignNow simplifies the process of signing and submitting the Tennessee Form INC 253 Payment Voucher by providing a secure, digital platform. Users can create, edit, and eSign their payment vouchers quickly and efficiently. This automation reduces the likelihood of errors and saves valuable time.

-

Is airSlate SignNow cost-effective for handling Tennessee Form INC 253 Payment Voucher transactions?

Yes, airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes, making it a cost-effective solution for managing Tennessee Form INC 253 Payment Voucher transactions. By reducing paperwork and streamlining the signing process, users can also save on administrative costs over time.

-

What features does airSlate SignNow offer for the Tennessee Form INC 253 Payment Voucher?

airSlate SignNow includes features such as templates for the Tennessee Form INC 253 Payment Voucher, eSigning capabilities, and the ability to store documents securely in the cloud. These tools enhance efficiency by allowing for easy access and management of payments and tax-related documents.

-

Can airSlate SignNow integrate with other accounting software for Tennessee Form INC 253 Payment Voucher management?

Yes, airSlate SignNow supports integrations with various accounting and tax software to facilitate the management of the Tennessee Form INC 253 Payment Voucher. This connectivity allows users to streamline their workflows and ensure that their payment information is synchronized across platforms.

-

How secure is airSlate SignNow when dealing with the Tennessee Form INC 253 Payment Voucher?

airSlate SignNow prioritizes security by utilizing advanced encryption and authentication methods to protect sensitive information related to the Tennessee Form INC 253 Payment Voucher. This ensures that all data remains confidential and secure throughout the signing and submission process.

-

Are there any specific benefits of using airSlate SignNow for the Tennessee Form INC 253 Payment Voucher?

Using airSlate SignNow for the Tennessee Form INC 253 Payment Voucher offers benefits such as enhanced efficiency, reduced processing time, and improved organization of tax documents. Additionally, the platform provides an easy-to-use interface that simplifies the entire eSigning process.

Get more for Tennessee Form Inc 253

- Business license application over city of concord cityofconcord form

- Dfa ma 1 2012 2019 form

- Par forms catalog table of contents pennsylvania association of parealtor

- Clean source bakersfield application form

- Cmca study guide form

- Abbott diabetes care retail medicare program form

- Trs form 6 2013

- Exit interview information form rpi

Find out other Tennessee Form Inc 253

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now