1098 C Form

What is the 1098 C?

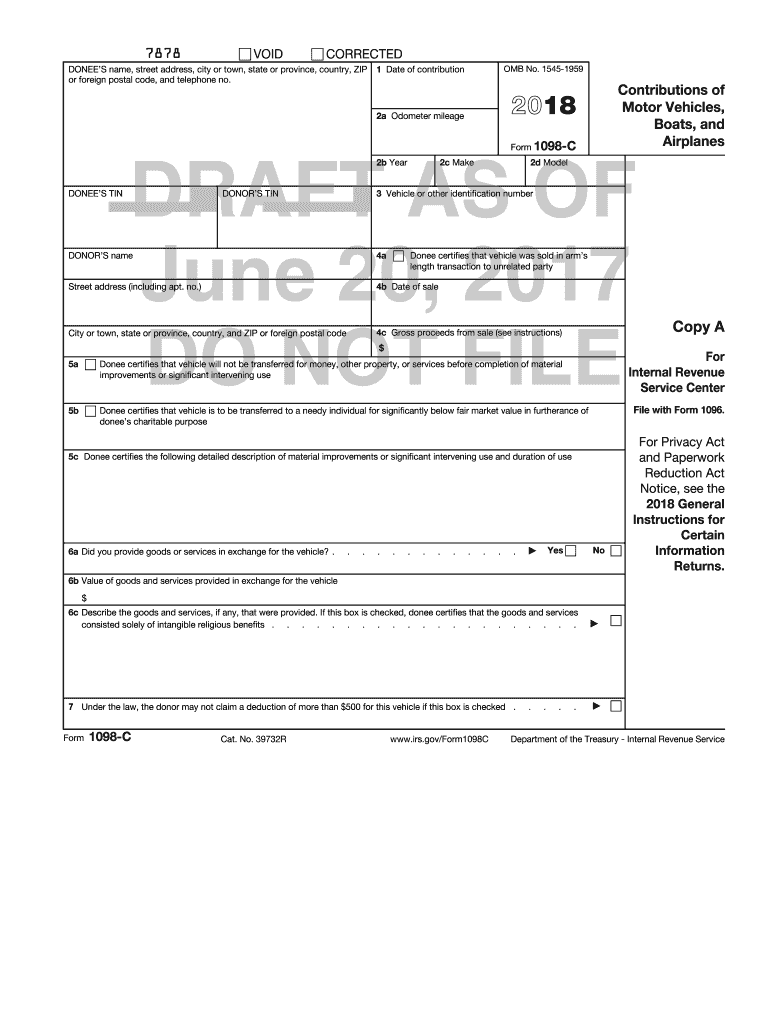

The 1098 C is a tax form used in the United States to report contributions made to a qualified vehicle donation program. Specifically, it is issued by organizations that receive donated vehicles, allowing donors to claim a tax deduction based on the fair market value of the vehicle. This form is essential for both the donor and the organization, as it provides necessary documentation for tax purposes.

How to obtain the 1098 C

To obtain the 1098 C form, donors should first ensure that they are donating to a qualified organization that is authorized to issue this form. After the donation is made, the organization is responsible for completing and providing the 1098 C to the donor. Donors can request a copy directly from the organization if it is not received within a reasonable timeframe. It is important to keep this form for tax filing purposes.

Steps to complete the 1098 C

Completing the 1098 C involves several steps to ensure accuracy and compliance with IRS regulations. Donors should follow these steps:

- Gather necessary information about the vehicle, including its make, model, year, and VIN.

- Determine the fair market value of the vehicle at the time of donation.

- Fill out the form with the required details, including the donor's information and the vehicle's specifics.

- Sign and date the form to validate the donation.

- Submit the completed form to the IRS along with the donor's tax return.

Legal use of the 1098 C

The legal use of the 1098 C is crucial for ensuring that both the donor and the organization comply with tax laws. The IRS requires that the form accurately reflects the details of the vehicle donation. Donors must use the form to substantiate their tax deductions, while organizations must maintain records of all issued forms for compliance audits. Failure to adhere to these legal requirements can result in penalties or disallowed deductions.

Key elements of the 1098 C

Several key elements must be included in the 1098 C to ensure it is valid and complete:

- Donor's name, address, and taxpayer identification number (TIN).

- Organization's name, address, and TIN.

- Details of the vehicle, including make, model, year, and VIN.

- The date of the donation and the fair market value of the vehicle.

- A statement regarding the use of the vehicle by the organization, if applicable.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 1098 C form. Donors must understand the rules surrounding vehicle donations, including the requirements for claiming deductions. The IRS stipulates that donors can only deduct the fair market value of the vehicle or the amount the organization sells it for, whichever is less. It is essential to refer to the latest IRS publications for any updates or changes to these guidelines.

Quick guide on how to complete 1098 c

Accomplish 1098 C easily on any device

Online document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without hold-ups. Handle 1098 C on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to alter and eSign 1098 C with ease

- Obtain 1098 C and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign 1098 C and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1098 c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1098 c 2018 form, and how can airSlate SignNow help?

The 1098 c 2018 form is used to report vehicle donations to the IRS. With airSlate SignNow, you can easily create, send, and eSign your 1098 c 2018 documents, ensuring compliance and efficiency in your tax reporting.

-

How does airSlate SignNow ensure the security of my 1098 c 2018 documents?

airSlate SignNow employs bank-level encryption and secure cloud storage to protect your 1098 c 2018 documents. This means your sensitive information remains safe during the signing process and after.

-

What features does airSlate SignNow offer for managing 1098 c 2018 forms?

With airSlate SignNow, you can customize templates for the 1098 c 2018 form, automate sending reminders, and track the signing process in real-time. These features streamline the completion of important documents.

-

Is airSlate SignNow affordable for small businesses processing 1098 c 2018 forms?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for small businesses handling 1098 c 2018 forms. You can choose a plan based on your volume of documents and specific business needs.

-

Can I integrate airSlate SignNow with other software for handling 1098 c 2018 forms?

Absolutely! airSlate SignNow integrates with various applications such as Google Drive, Salesforce, and more, allowing seamless management of your 1098 c 2018 forms alongside your other business processes.

-

What are the benefits of using airSlate SignNow for 1098 c 2018 document handling?

Using airSlate SignNow for your 1098 c 2018 documents saves time and enhances accuracy in signing. It reduces manual errors and paperwork, allowing your team to focus on more important tasks.

-

How can I track the status of my 1098 c 2018 documents in airSlate SignNow?

With airSlate SignNow, you have the ability to track the status of your 1098 c 2018 documents in real-time. You'll receive notifications when a document is viewed or signed, keeping you informed throughout the process.

Get more for 1098 C

Find out other 1098 C

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney