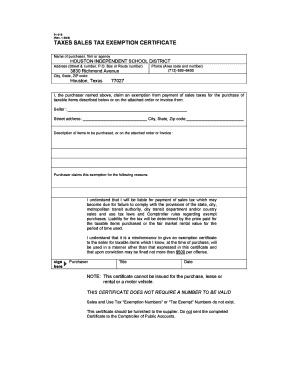

Houston Isd Tax Office Form

What is the Houston ISD Tax Office

The Houston Independent School District (HISD) Tax Office is responsible for managing property tax assessments and collections for the district. This office ensures that property taxes are accurately assessed and collected to fund educational services and programs within the district. The HISD Tax Office plays a crucial role in maintaining transparency and compliance with local tax laws, providing residents with the necessary information regarding their property tax obligations.

How to Use the Houston ISD Tax Office

Utilizing the Houston ISD Tax Office involves several steps to ensure that property taxes are managed effectively. Residents can access information about their property tax assessments, payment options, and any available exemptions. The office provides resources for taxpayers to understand their rights and responsibilities, including how to appeal assessments if necessary. Additionally, the HISD Tax Office offers online tools for checking tax bills and making payments, streamlining the process for taxpayers.

Required Documents

When dealing with the Houston ISD Tax Office, certain documents are essential for various processes, such as filing for exemptions or making payments. Commonly required documents include:

- Property tax statements

- Proof of residency

- Identification documents

- Exemption application forms

Having these documents ready can facilitate smoother interactions with the tax office and help ensure compliance with tax regulations.

Filing Deadlines / Important Dates

Staying informed about filing deadlines and important dates is crucial for property owners in Houston. The HISD Tax Office typically sets specific deadlines for property tax payments, exemption applications, and appeals. Key dates may include:

- January 1: Assessment date for property taxes

- April 30: Deadline for filing for exemptions

- July 31: Deadline for appealing property assessments

- January 31: Final payment deadline for property taxes

Taxpayers should mark these dates on their calendars to avoid penalties and ensure timely compliance.

Penalties for Non-Compliance

Failure to comply with property tax obligations can result in various penalties imposed by the Houston ISD Tax Office. These penalties may include:

- Late payment fees

- Interest on unpaid taxes

- Possible legal action for tax lien or foreclosure

Understanding these potential consequences can motivate property owners to stay current with their tax responsibilities and seek assistance from the tax office when needed.

Eligibility Criteria

Eligibility for certain exemptions and programs offered by the Houston ISD Tax Office is determined by specific criteria. Common eligibility factors may include:

- Age of the property owner (e.g., senior citizens)

- Disability status

- Income levels

- Type of property owned (e.g., primary residence)

Meeting these criteria is essential for taxpayers looking to reduce their property tax burden through available exemptions.

Quick guide on how to complete houston isd tax office

Manage Houston Isd Tax Office effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Houston Isd Tax Office on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Houston Isd Tax Office effortlessly

- Obtain Houston Isd Tax Office and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal standing as a conventional handwritten signature.

- Verify the information and click on the Done button to store your changes.

- Choose how you want to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Houston Isd Tax Office and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the houston isd tax office

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for managing hisd property tax documents?

airSlate SignNow provides an efficient platform for managing hisd property tax documents by allowing users to easily send, sign, and store important documents. This user-friendly tool simplifies the process, helping you keep track of all relevant paperwork effectively. With a secure electronic signature feature, you can sign your hisd property tax forms with confidence.

-

How can airSlate SignNow help with the filing of hisd property tax returns?

The airSlate SignNow platform streamlines the filing of hisd property tax returns by enabling you to quickly prepare and sign documents online. Its automated workflows ensure that you never miss a deadline, making tax season less stressful. Plus, you can collaborate with team members in real-time to finalize your returns promptly.

-

What pricing plans are available for airSlate SignNow related to hisd property tax services?

airSlate SignNow offers multiple pricing plans designed to fit various organizational needs, including those focused on hisd property tax services. Each plan includes features tailored to enhance productivity, such as unlimited sending of documents and advanced signing options. You can choose a plan that best suits your business requirements and budget.

-

Are there any integrations available with airSlate SignNow for managing hisd property tax?

Yes, airSlate SignNow integrates with various applications, enhancing your ability to manage hisd property tax efficiently. With seamless connectivity to popular platforms like Google Drive and Dropbox, you can easily store and retrieve necessary documents. This integration makes document management simpler and more organized.

-

What features does airSlate SignNow offer to assist with hisd property tax management?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure electronic signatures, all essential for effective hisd property tax management. These tools help reduce errors and speed up the signing process, ensuring that your documents are handled efficiently. Additionally, the platform is designed to be user-friendly for everyone involved.

-

How does airSlate SignNow ensure the security of hisd property tax documents?

Security is a top priority for airSlate SignNow when handling hisd property tax documents. The platform utilizes advanced encryption protocols and complies with legal standards to ensure that your sensitive information is protected. You can rest assured that your documents are secure from unauthorized access.

-

Can I access airSlate SignNow from multiple devices for my hisd property tax needs?

Absolutely! airSlate SignNow is designed to be accessible from various devices, allowing you to manage your hisd property tax documents on-the-go. Whether you are using a smartphone, tablet, or desktop, you can send and sign documents anytime, anywhere. This flexibility is crucial for busy professionals managing property taxes.

Get more for Houston Isd Tax Office

- Affidavit of transfer of aircrafthelicopter state of tennessee tn form

- 5006 declaration re notice upon ex parte application for orders solano courts ca form

- Petition dss 158 form

- Synnex corporation multijurisdiction resale certificate 07 01 13pdf form

- Application to rent the rental girl form

- Hcd 476 6g 2015 form

- Mv 47 form

- Scope of work construction management cdot form

Find out other Houston Isd Tax Office

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement