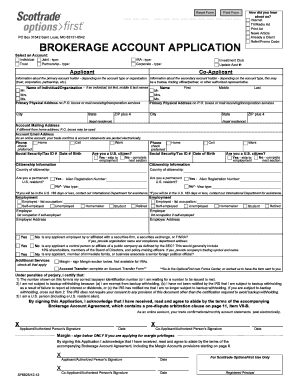

Brokerage Account Application Form

What is the Brokerage Account Application

The brokerage account application is a formal document that individuals or entities complete to open a brokerage account. This account allows users to buy and sell securities, such as stocks and bonds, through a brokerage firm. The application typically requires personal information, financial details, and investment objectives to assess the applicant's suitability for various investment products. Understanding the components of this application is crucial for ensuring compliance and making informed investment decisions.

Steps to Complete the Brokerage Account Application

Completing a brokerage account application involves several key steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather necessary documents, including identification and financial information.

- Fill out the application form, providing personal details such as name, address, and Social Security number.

- Specify the type of account you wish to open, such as individual, joint, or retirement account.

- Review the investment objectives and risk tolerance sections to align with your financial goals.

- Sign and date the application, ensuring all information is accurate before submission.

Following these steps carefully can help streamline the application process and reduce the likelihood of delays.

Legal Use of the Brokerage Account Application

The brokerage account application serves as a legally binding document once submitted and accepted by the brokerage firm. It is essential that applicants provide truthful and accurate information, as any discrepancies can lead to legal consequences, including account denial or closure. The application must comply with relevant regulations, such as those set forth by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Understanding these legal implications can help applicants navigate the process more effectively.

Key Elements of the Brokerage Account Application

A comprehensive brokerage account application includes several key elements that facilitate the account opening process:

- Personal Information: Full name, address, date of birth, and Social Security number.

- Financial Information: Employment status, annual income, net worth, and investment experience.

- Investment Objectives: Goals such as growth, income, or speculation, which help the brokerage tailor recommendations.

- Risk Tolerance: Assessment of how much risk the applicant is willing to take on in their investment strategy.

- Account Type: Selection of individual, joint, or retirement accounts, depending on the applicant's needs.

These elements are crucial for both the applicant and the brokerage to ensure a suitable investment relationship.

Form Submission Methods

Submitting a brokerage account application can typically be done through various methods, accommodating different preferences:

- Online Submission: Most brokerages offer a digital platform for completing and submitting applications securely.

- Mail: Applicants can print the completed form and send it via postal service to the brokerage's designated address.

- In-Person: Some brokerages allow applicants to visit a local branch to submit their application directly.

Choosing the right submission method can enhance the efficiency of the application process and ensure timely processing.

Required Documents

When completing a brokerage account application, several documents are typically required to verify identity and financial status. Commonly required documents include:

- Government-issued ID: Such as a driver's license or passport to confirm identity.

- Proof of Address: Utility bills or bank statements that validate the applicant's current residence.

- Financial Statements: Recent pay stubs or tax returns may be needed to assess income and financial stability.

Having these documents ready can expedite the application process and help avoid potential delays.

Eligibility Criteria

Eligibility criteria for opening a brokerage account can vary by firm but generally include the following:

- Age Requirement: Applicants must typically be at least eighteen years old to open an account independently.

- Residency Status: Most brokerages require applicants to be U.S. residents or citizens.

- Financial Suitability: Applicants may need to demonstrate sufficient income or assets to qualify for certain account types.

Understanding these criteria is essential for prospective investors to determine their eligibility before initiating the application process.

Quick guide on how to complete brokerage account application

Effortlessly Prepare Brokerage Account Application on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, modify, and eSign your files swiftly without any delays. Handle Brokerage Account Application on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

Easily Edit and eSign Brokerage Account Application

- Obtain Brokerage Account Application and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent parts of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs within a few clicks from any device of your selection. Edit and eSign Brokerage Account Application to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the brokerage account application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a brokerage form and how is it used in business transactions?

A brokerage form is a crucial document used by brokers to facilitate transactions between buyers and sellers. It typically contains essential details regarding the sale or purchase of property or services. Using airSlate SignNow, businesses can easily create, send, and eSign brokerage forms, streamlining the entire transaction process.

-

How much does it cost to use airSlate SignNow for brokerage forms?

Pricing for using airSlate SignNow varies based on the plan you choose. Each plan offers different features designed for businesses of any size, ensuring you can manage your brokerage forms effectively. For specific pricing details, visit our pricing page to find the best option for your needs.

-

What features does airSlate SignNow offer for managing brokerage forms?

airSlate SignNow provides a variety of features tailored for managing brokerage forms, including customizable templates, real-time collaboration, and secure eSigning options. These features help enhance productivity and ensure compliance by keeping all documents organized and accessible. Integrating these functionalities into your workflow can signNowly simplify the process.

-

Can I integrate airSlate SignNow with other tools for handling brokerage forms?

Yes, airSlate SignNow seamlessly integrates with popular tools and applications, enhancing your ability to manage brokerage forms. You can connect it with CRMs, cloud storage solutions, and other productivity software. This ensures that your brokerage forms are easily accessible and manageable within your existing systems.

-

What are the benefits of using airSlate SignNow for brokerage forms?

Using airSlate SignNow for brokerage forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The solution allows users to easily create and eSign forms from anywhere, which helps speed up transactions. Additionally, the platform offers robust tracking features, so you can monitor the status of brokerage forms in real-time.

-

How does airSlate SignNow ensure the security of brokerage forms?

airSlate SignNow places a strong emphasis on security, utilizing encryption protocols to protect your brokerage forms during transmission and storage. Compliance with industry standards, such as GDPR and HIPAA, ensures that your data is handled with the utmost care. This dedication to security helps create a trustworthy environment for all your eSignatures.

-

Is it easy to create a brokerage form with airSlate SignNow?

Absolutely! airSlate SignNow provides user-friendly tools and templates that make it easy to create brokerage forms without any technical expertise. You can customize templates to fit your specific needs and ensure that all necessary information is included, streamlining the document preparation process.

Get more for Brokerage Account Application

- Kokstad college application forms 2018

- Build a food web activity kehsscienceorg form

- Space above this line for recorders use declaration form

- The edison innovation literacy blueprint power patterns form

- Form ppq 0 2011 2019

- Application for smart steps child care payment assistance tn form

- Michigan writ 2016 2019 form

- Michigan form notice 2015 2019

Find out other Brokerage Account Application

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease