Financial Statements of Sole Proprietorship PDF Form

What is the financial statements of sole proprietorship PDF?

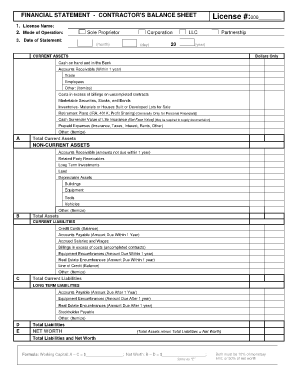

The financial statements of a sole proprietorship PDF serve as a comprehensive record of the financial activities of a sole trader. These documents typically include the income statement, balance sheet, and cash flow statement. The income statement outlines revenues, expenses, and profits over a specified period, while the balance sheet provides a snapshot of the business's assets, liabilities, and equity at a particular point in time. The cash flow statement tracks the inflows and outflows of cash, highlighting the liquidity position of the business. Together, these statements are essential for assessing the financial health of the sole proprietorship and are often required for tax reporting and securing financing.

How to use the financial statements of sole proprietorship PDF

Using the financial statements of a sole proprietorship PDF involves several key steps. First, ensure that all financial data is accurate and up-to-date. This includes gathering receipts, invoices, and bank statements. Next, populate the income statement with total revenues and expenses to determine net income. For the balance sheet, list all assets and liabilities to calculate the owner’s equity. The cash flow statement should be filled out by categorizing cash transactions into operating, investing, and financing activities. Once completed, these documents can be used for personal financial planning, tax preparation, and business evaluations.

Key elements of the financial statements of sole proprietorship PDF

Key elements of the financial statements of a sole proprietorship PDF include the following:

- Income Statement: Total revenues, cost of goods sold, gross profit, operating expenses, and net income.

- Balance Sheet: Current assets, non-current assets, current liabilities, long-term liabilities, and owner’s equity.

- Cash Flow Statement: Cash flows from operating activities, investing activities, and financing activities.

Each of these components provides valuable insights into the financial performance and position of the business, enabling informed decision-making.

Steps to complete the financial statements of sole proprietorship PDF

Completing the financial statements of a sole proprietorship PDF requires a systematic approach. Follow these steps:

- Gather all relevant financial data, including sales records, expense receipts, and bank statements.

- Prepare the income statement by calculating total revenues and deducting total expenses to find net income.

- Compile the balance sheet by listing all assets and liabilities, then calculate the owner’s equity.

- Draft the cash flow statement by categorizing cash transactions into operating, investing, and financing activities.

- Review all statements for accuracy and completeness before saving or printing the PDF.

Legal use of the financial statements of sole proprietorship PDF

The legal use of financial statements of a sole proprietorship PDF is crucial for compliance with tax regulations and business practices. These documents must accurately reflect the business's financial position and adhere to applicable accounting standards. In the United States, the IRS requires sole proprietors to report income and expenses on Schedule C, which relies on the information provided in these financial statements. Additionally, maintaining accurate financial records can protect the owner in legal disputes and facilitate transparent communication with lenders and investors.

Examples of using the financial statements of sole proprietorship PDF

Examples of using the financial statements of a sole proprietorship PDF include:

- Preparing tax returns, where accurate financial statements are essential for reporting income and expenses.

- Applying for loans or credit, as lenders often require financial statements to assess creditworthiness.

- Conducting business evaluations, which can help in determining the value of the business for potential sale or investment.

These examples illustrate the practical applications of financial statements in various business scenarios.

Quick guide on how to complete financial statements of sole proprietorship pdf

Easily Prepare Financial Statements Of Sole Proprietorship Pdf on Any Device

Managing documents online has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents promptly without complications. Handle Financial Statements Of Sole Proprietorship Pdf on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The Easiest Way to Alter and eSign Financial Statements Of Sole Proprietorship Pdf Effortlessly

- Find Financial Statements Of Sole Proprietorship Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specially offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click the Done button to save your adjustments.

- Choose how you would like to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form hunting, or errors that necessitate creating new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Financial Statements Of Sole Proprietorship Pdf and ensure effective communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the financial statements of sole proprietorship pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are sole proprietorship financial statements pdf?

Sole proprietorship financial statements pdf are official documents that summarize the financial performance and position of a sole proprietorship. These statements typically include income statements, balance sheets, and cash flow statements, which are essential for assessing the business's financial health.

-

How can airSlate SignNow help with sole proprietorship financial statements pdf?

airSlate SignNow allows you to easily send, sign, and manage your sole proprietorship financial statements pdf electronically. This streamlines your document workflow, ensuring that you can obtain signatures quickly and securely, enhancing efficiency for your business.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans designed to meet the needs of businesses of all sizes, including those creating sole proprietorship financial statements pdf. Each plan provides features that enhance document management, with user-friendly options at competitive prices.

-

Are there any additional features for managing sole proprietorship financial statements pdf?

Yes, airSlate SignNow includes features like document templates, custom branding, and real-time tracking, all of which are beneficial when handling sole proprietorship financial statements pdf. These features help you maintain consistency and speed up the signing process.

-

Can I integrate airSlate SignNow with other software for accounting?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions to help you manage your sole proprietorship financial statements pdf. This integration allows for a more streamlined process, linking your financial documents with your accounting systems.

-

What are the benefits of using airSlate SignNow for my documents?

Using airSlate SignNow for your sole proprietorship financial statements pdf simplifies document management and enhances security. The platform provides an intuitive interface that saves time and reduces the need for physical paperwork, contributing to a more efficient workflow.

-

Is the airSlate SignNow platform user-friendly for beginners?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for everyone, including those new to managing sole proprietorship financial statements pdf. The straightforward interface allows users to quickly navigate and utilize all features without extensive training.

Get more for Financial Statements Of Sole Proprietorship Pdf

- Kitti municipal government state of pohnpei audit bb opsa form

- Vl156 notice of resignation or retirement vl156 notice of resignation or retirement form

- Cmp 1190 form

- Appendix c ce forms florida building code energy conservation chapter c4commercial energy efficiency form c4022014 alterations

- Form sc 134pdffillercom 2017 2019

- Form 12 905a 2015 2019

- Institutional new account application cor clearing form

- Form w 7a rev january

Find out other Financial Statements Of Sole Proprietorship Pdf

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation