PRIVATE MORTGAGE INSURANCE DISCLOSURE LENDER PAID Form

What is the lender paid mortgage insurance disclosure?

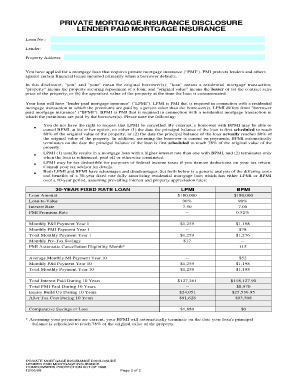

The lender paid mortgage insurance disclosure is a document that informs borrowers about the terms and conditions of mortgage insurance that a lender pays on their behalf. This type of insurance protects the lender in case the borrower defaults on the loan. Unlike borrower-paid mortgage insurance, where the borrower directly pays for coverage, lender paid mortgage insurance (LPMI) is typically included in the loan's interest rate. Understanding this disclosure is crucial for borrowers to grasp the total cost of their mortgage and the implications of LPMI on their monthly payments.

Key elements of the lender paid mortgage insurance disclosure

Several important components are typically included in the lender paid mortgage insurance disclosure. These elements provide essential information for borrowers:

- Insurance Coverage Amount: Specifies the amount of coverage provided by the lender.

- Loan-to-Value Ratio: Details the ratio of the loan amount to the appraised value of the property.

- Impact on Interest Rates: Explains how the inclusion of LPMI may affect the interest rate of the loan.

- Cancellation Terms: Outlines the conditions under which the mortgage insurance can be canceled.

- Disclosure of Costs: Provides a clear breakdown of any additional costs associated with the LPMI.

Steps to complete the lender paid mortgage insurance disclosure

Completing the lender paid mortgage insurance disclosure involves several straightforward steps:

- Gather Necessary Information: Collect all relevant personal and financial information, including income, credit history, and property details.

- Review the Disclosure: Carefully read through the lender paid mortgage insurance disclosure to understand all terms and conditions.

- Provide Required Signatures: Sign the document electronically, ensuring that all signatures are valid and comply with eSignature laws.

- Submit the Disclosure: Send the completed disclosure to your lender through the designated submission method, which may include online or physical submission.

Legal use of the lender paid mortgage insurance disclosure

The lender paid mortgage insurance disclosure is legally binding when executed correctly. To ensure its legality, it must comply with federal and state regulations regarding mortgage disclosures. This includes adherence to the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA). Using a reliable electronic signing platform can help maintain compliance with legal standards, ensuring that the disclosure is recognized as valid in a court of law.

How to use the lender paid mortgage insurance disclosure

Using the lender paid mortgage insurance disclosure effectively requires understanding its purpose and implications. Borrowers should use this document to:

- Assess Financial Impact: Evaluate how LPMI affects overall loan costs and monthly payments.

- Compare Loan Options: Use the disclosure to compare different mortgage products and their associated costs.

- Make Informed Decisions: Understand the benefits and drawbacks of choosing a loan with lender paid mortgage insurance.

State-specific rules for the lender paid mortgage insurance disclosure

Each state may have specific regulations governing lender paid mortgage insurance disclosures. It is essential for borrowers to be aware of these variations, as they can impact the terms of the mortgage and the insurance coverage. Checking with local housing authorities or legal experts can provide clarity on any state-specific requirements that must be met when completing and submitting this disclosure.

Quick guide on how to complete private mortgage insurance disclosure lender paid

Prepare PRIVATE MORTGAGE INSURANCE DISCLOSURE LENDER PAID effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage PRIVATE MORTGAGE INSURANCE DISCLOSURE LENDER PAID on any platform using airSlate SignNow Android or iOS applications and streamline any document-oriented process today.

The easiest way to modify and eSign PRIVATE MORTGAGE INSURANCE DISCLOSURE LENDER PAID effortlessly

- Obtain PRIVATE MORTGAGE INSURANCE DISCLOSURE LENDER PAID and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choosing. Modify and eSign PRIVATE MORTGAGE INSURANCE DISCLOSURE LENDER PAID and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the private mortgage insurance disclosure lender paid

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is lender paid mortgage insurance disclosure?

Lender paid mortgage insurance disclosure refers to the documentation provided to borrowers explaining the lender's responsibility in covering mortgage insurance. This type of disclosure outlines how lender paid mortgage insurance affects your mortgage costs and may save you money. It’s essential for understanding your financial obligations.

-

How does lender paid mortgage insurance disclosure impact my monthly payments?

The lender paid mortgage insurance disclosure can signNowly impact your monthly payments by potentially eliminating upfront costs associated with mortgage insurance. However, it may also lead to slightly higher interest rates. Understanding these details through your disclosure helps you better manage your financial planning.

-

Why is lender paid mortgage insurance disclosure important for home buyers?

For home buyers, lender paid mortgage insurance disclosure is crucial as it clarifies how mortgage insurance will be handled in your financing. It helps you determine the overall cost of your mortgage and makes comparing loan options easier. A clear understanding of this disclosure can lead to smarter financial decisions.

-

What information is typically included in a lender paid mortgage insurance disclosure?

A typical lender paid mortgage insurance disclosure includes the cost of insurance, how it is paid, and the impact on your loan terms. It may also provide scenarios to help you understand how this insurance affects your total loan amount and monthly payments. Always review this information closely before signing.

-

Are there different types of lender paid mortgage insurance disclosures?

Yes, there are different types of lender paid mortgage insurance disclosures based on the loan structure, terms, and lender policies. Variations can exist in the coverage amounts and how these costs are integrated into your mortgage. It's essential to read the specific terms presented in your lender's disclosure.

-

Can I negotiate lender paid mortgage insurance terms?

While lender paid mortgage insurance terms are often set by your lender, you may have options for negotiation. Factors such as your credit score, financial situation, and loan type can play a role in this process. Discussing your lender paid mortgage insurance disclosure with your lender might uncover potential adjustments.

-

How do I review a lender paid mortgage insurance disclosure effectively?

To review a lender paid mortgage insurance disclosure effectively, break down each section and highlight key information related to costs and impacts. Compare this disclosure against other offers to see where you might get better terms. If anything is unclear, don’t hesitate to ask your lender for clarification.

Get more for PRIVATE MORTGAGE INSURANCE DISCLOSURE LENDER PAID

- Special event liability application limits of liability form

- Paramedic student clinical rotation evaluation hsc stonybrook form

- Marketplace eligibility appeal request step 1 whose form

- Dr110 25 fillable pdf form

- For a duplicate title refer to the application for missouri title and license form 108

- Virginia form 760pypart year residentindivi

- Renew your vehicleamp039s registration form

- Ex 1120rev459bconsent to transfer adjust or cor form

Find out other PRIVATE MORTGAGE INSURANCE DISCLOSURE LENDER PAID

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form