W8ben Uob Form

What is the W8ben Uob Form

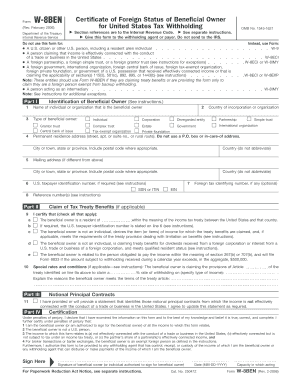

The W8ben Uob form is a document used by foreign individuals and entities to certify their foreign status for U.S. tax purposes. This form is crucial for non-resident aliens who earn income from U.S. sources, as it helps them claim a reduced rate of withholding tax or exemption from withholding under an applicable tax treaty. By submitting the W8ben Uob form, individuals can avoid unnecessary tax deductions from their earnings in the United States.

How to use the W8ben Uob Form

Using the W8ben Uob form involves several steps that ensure accurate completion and submission. First, individuals must gather necessary information, including their name, country of citizenship, and the type of income they receive from U.S. sources. After filling out the form, it should be submitted to the withholding agent or financial institution that requires it. This submission allows the withholding agent to apply the correct tax rates to the income earned.

Steps to complete the W8ben Uob Form

Completing the W8ben Uob form requires careful attention to detail. Here are the essential steps:

- Provide your full name and address in the appropriate sections.

- Indicate your country of citizenship.

- Specify the type of income you are receiving from U.S. sources.

- Claim any applicable tax treaty benefits by referencing the relevant treaty.

- Sign and date the form to certify the information is accurate.

Legal use of the W8ben Uob Form

The legal use of the W8ben Uob form is vital for ensuring compliance with U.S. tax laws. This form serves as a declaration of foreign status and is essential for claiming tax treaty benefits. It is important to ensure that the information provided is accurate and up-to-date, as any discrepancies could lead to penalties or increased withholding tax rates. Proper usage of this form protects both the individual and the withholding agent from legal issues related to tax compliance.

Eligibility Criteria

To be eligible to use the W8ben Uob form, individuals must meet specific criteria. These include being a non-resident alien or foreign entity that receives income from U.S. sources. Additionally, the income must be of a type that is subject to withholding tax, such as dividends, interest, or royalties. Understanding these eligibility criteria is essential for ensuring that the form is used correctly and that the appropriate tax benefits are claimed.

Form Submission Methods

The W8ben Uob form can be submitted through various methods, depending on the requirements of the withholding agent or financial institution. Common submission methods include:

- Online submission through secure portals provided by financial institutions.

- Mailing a physical copy of the completed form to the withholding agent.

- In-person delivery at designated locations, if applicable.

Required Documents

When completing the W8ben Uob form, it is essential to have certain documents on hand to ensure accuracy. Required documents may include:

- Proof of identity, such as a passport or national ID card.

- Tax identification number from your country of residence.

- Any relevant tax treaty documentation that supports your claims.

Quick guide on how to complete w8ben uob form

Complete W8ben Uob Form seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a flawless eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle W8ben Uob Form on any device via the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

How to edit and electronically sign W8ben Uob Form effortlessly

- Obtain W8ben Uob Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Choose your delivery method for the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate creating new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from your selected device. Edit and electronically sign W8ben Uob Form and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w8ben uob form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the UOB W8 Ben form and why is it important?

The UOB W8 Ben form is a tax document used by foreign individuals to signNow their foreign status for U.S. tax purposes. Completing this form is crucial as it helps you avoid taxes on certain types of U.S. income. By using the airSlate SignNow platform, you can easily manage and eSign your UOB W8 Ben form digitally.

-

How can I complete the UOB W8 Ben form using airSlate SignNow?

To complete the UOB W8 Ben form using airSlate SignNow, simply upload the document to our platform, fill in the necessary fields, and sign electronically. Our intuitive interface guides you through each step, ensuring that your UOB W8 Ben form is correctly completed in no time. Enjoy the convenience and efficiency of managing your forms online.

-

Is airSlate SignNow secure for handling the UOB W8 Ben form?

Yes, airSlate SignNow prioritizes the security of your documents, including the UOB W8 Ben form. Our platform uses advanced encryption and security protocols to protect your sensitive information throughout the signing process. You can trust us to ensure that your data remains confidential and secure.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to suit different business needs. Whether you need a basic plan for occasional use or a more comprehensive solution for a larger team, we have options that include features for managing the UOB W8 Ben form effectively. Check our website for detailed pricing and features.

-

Can I estimate tax implications using the UOB W8 Ben form with airSlate SignNow?

While airSlate SignNow provides the tools to easily fill out and eSign the UOB W8 Ben form, it does not provide tax advice. To estimate tax implications, you may want to consult with a tax professional. Our platform simplifies the form-filling process, allowing you to focus on obtaining the right guidance.

-

Can the UOB W8 Ben form be integrated with other tools?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, allowing you to enhance your workflow when dealing with the UOB W8 Ben form. These integrations help streamline processes and manage documents efficiently. Explore our integration options to make your experience even smoother.

-

What are the benefits of using airSlate SignNow for UOB W8 Ben forms?

Using airSlate SignNow to handle UOB W8 Ben forms offers several benefits including ease of use, quick turnaround times, and improved collaboration. Our platform eliminates the hassle of paper forms, allowing you to eSign and manage documentation remotely, which can signNowly increase efficiency. Experience the advantages of digital documentation with airSlate SignNow.

Get more for W8ben Uob Form

- Overview of the probate and family mass legal services masslegalservices form

- Jerry morawski fire chief addison township fire dept form

- Bcdlb a contract bformb metro driving school

- Kent hospital sleep lab form

- Personal physician pre designation form geklaw com

- How to fill out schedule 8812 form 1040

- Form 1040 sp

- Schedule oi form 1040 nr sp

Find out other W8ben Uob Form

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms