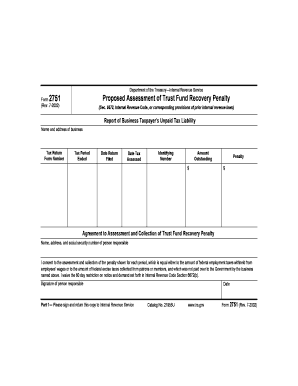

Form 2751

What is the Form 2751

The Form 2751 is an IRS document used primarily for reporting and paying certain taxes. This form is crucial for taxpayers who need to reconcile their tax obligations with the Internal Revenue Service. It serves as a formal declaration of tax liabilities and is essential for maintaining compliance with federal tax laws. Understanding the purpose and requirements of Form 2751 is vital for ensuring accurate tax reporting and avoiding potential penalties.

How to use the Form 2751

Using Form 2751 involves several steps to ensure proper completion and submission. Taxpayers should first gather all necessary financial documents and information related to their tax situation. This includes income statements, deductions, and any previous correspondence with the IRS. Once all information is compiled, the form can be filled out accurately, ensuring that all required fields are completed. After completing the form, it can be submitted either electronically or via mail, depending on the taxpayer's preference and the IRS guidelines.

Steps to complete the Form 2751

Completing the Form 2751 requires careful attention to detail. Here are the essential steps:

- Gather all necessary documentation, including income statements and prior tax returns.

- Fill out the form with accurate information, ensuring all fields are completed correctly.

- Review the form for any errors or omissions before submission.

- Choose a submission method: electronic filing or mailing the completed form to the IRS.

- Keep a copy of the submitted form for your records.

Legal use of the Form 2751

The legal use of Form 2751 is governed by IRS regulations and guidelines. To ensure that the form is legally binding, it must be completed accurately and submitted within the specified deadlines. Compliance with IRS rules is essential to avoid penalties and legal repercussions. Additionally, using a reliable eSignature solution can enhance the legality of the form's submission, providing a digital certificate that verifies the identity of the signer and the integrity of the document.

Filing Deadlines / Important Dates

Filing deadlines for Form 2751 are critical for compliance. Taxpayers should be aware of the specific dates by which the form must be submitted to avoid late fees and penalties. Generally, the IRS sets annual deadlines for tax forms, and it is advisable to check the IRS website or consult a tax professional for the most current information regarding deadlines. Missing these dates can result in complications, including interest on unpaid taxes.

Required Documents

To complete Form 2751, several documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Documentation of deductions and credits.

- Previous tax returns for reference.

- Any IRS correspondence relevant to the tax year.

Having these documents on hand will facilitate a smoother completion process and ensure that all information is accurate.

Quick guide on how to complete form 2751

Complete Form 2751 effortlessly on any device

Online document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Form 2751 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Form 2751 with ease

- Find Form 2751 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 2751 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2751

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2751 and how does airSlate SignNow help with it?

Form 2751 is a tax form used for reporting specific financial information to the IRS. airSlate SignNow simplifies the process of completing and signing form 2751 by providing an easy-to-use platform that allows users to prepare, send, and eSign the document securely. Our solution ensures compliance and helps streamline your tax filing process.

-

Is there a free trial available for using airSlate SignNow for form 2751?

Yes, airSlate SignNow offers a free trial for users who want to evaluate our services, including those needed for form 2751. During the trial period, you can experience the key features that make it easy to create and eSign your documents without any commitment. This allows you to see if our platform meets your needs before subscribing.

-

What pricing plans are available for using airSlate SignNow for form 2751?

airSlate SignNow offers several flexible pricing plans that cater to different needs when dealing with form 2751. Our pricing includes options for individual users as well as businesses, ensuring that everyone can find a plan that fits their budget. Contact our sales team to get detailed pricing information tailored to your requirements.

-

Can I store my completed form 2751 securely on airSlate SignNow?

Absolutely! airSlate SignNow provides a secure cloud storage solution for all your completed documents, including form 2751. You can access your signed forms at any time, ensuring that your information is safe and readily available when you need it. Our platform complies with industry-standard security protocols to protect your data.

-

What features does airSlate SignNow offer for completing form 2751?

airSlate SignNow offers a range of features to facilitate the completion of form 2751, including document templates, eSignature capabilities, and easy editing tools. You can invite others to review and sign the form, track its status in real-time, and obtain a legally binding signature. These features help streamline your workflow and reduce errors in the completing process.

-

Are there any integrations available with airSlate SignNow for form 2751?

Yes, airSlate SignNow integrates with a variety of third-party applications to enhance your experience with form 2751. You can connect our platform with popular software like Google Drive, Dropbox, and many CRMs, which helps in seamless document management. These integrations ensure all your tools work together efficiently when preparing your forms.

-

How does airSlate SignNow improve my efficiency when handling form 2751?

By using airSlate SignNow, you can dramatically improve your efficiency when handling form 2751. Our platform automates many manual processes, enabling you to complete forms quickly and route them for eSignatures instantly. This automation reduces turnaround time and allows you to focus on other essential business tasks.

Get more for Form 2751

- Deschutes restaurant form

- Visible landscape management application deschutes county form

- Lot of record verification application deschutes county oregon form

- Teleserve report city of baton rougeparish of east baton rouge form

- Report for the quarter of 1 form

- Greenville county expungement application form

- Application for ga marriage license online form

- Harford county jury duty form

Find out other Form 2751

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple