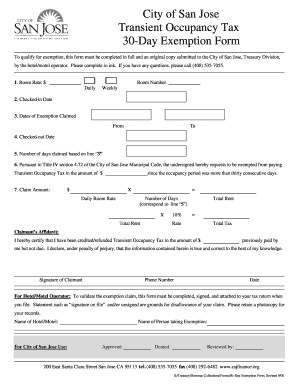

City of San Jose Transient Occupancy Tax 30 Day Exemption Form Www3 Csjfinance

Understanding the San Jose Transient Occupancy Tax Exemption Form

The City of San Jose offers a transient occupancy tax exemption for individuals who stay in a lodging facility for 30 days or more. This exemption is designed to relieve long-term guests from the burden of paying transient occupancy taxes, which are typically assessed on short-term stays. The exemption form is essential for qualifying guests to formally request this benefit, ensuring compliance with local tax regulations.

Steps to Complete the San Jose Transient Occupancy Tax Exemption Form

Filling out the San Jose transient occupancy tax exemption form involves several straightforward steps:

- Gather necessary information, including personal identification and details about your stay.

- Access the form through the official city finance website or designated local offices.

- Fill in all required fields accurately, ensuring that all information matches your identification documents.

- Review the form for completeness and accuracy before submission.

- Submit the form according to the instructions provided, either online or in person.

Eligibility Criteria for the San Jose Transient Occupancy Tax Exemption

To qualify for the transient occupancy tax exemption, applicants must meet specific criteria:

- Stay in a lodging facility for a minimum of 30 consecutive days.

- Provide proof of residency or identification that supports the claim of long-term stay.

- Ensure that the lodging facility is registered and compliant with city regulations.

Required Documents for the San Jose Transient Occupancy Tax Exemption Form

When applying for the transient occupancy tax exemption, certain documents are necessary to support your application:

- A valid government-issued identification, such as a driver's license or passport.

- Proof of your long-term stay, which may include a lease agreement or rental contract.

- Any additional documentation requested by the city finance department to verify eligibility.

Form Submission Methods for the San Jose Transient Occupancy Tax Exemption

The completed transient occupancy tax exemption form can be submitted through various methods:

- Online submission via the city finance website, where you can upload your completed form and required documents.

- Mailing the form and documents to the designated city finance office address.

- In-person submission at the city finance department during business hours for immediate processing.

Legal Use of the San Jose Transient Occupancy Tax Exemption Form

The transient occupancy tax exemption form is a legally binding document that must be completed accurately to ensure compliance with local tax laws. Misrepresentation or incomplete information may lead to penalties or denial of the exemption. It is important to understand the legal implications of the form and to ensure that all information provided is truthful and verifiable.

Quick guide on how to complete city of san jose transient occupancy tax 30 day exemption form www3 csjfinance

Complete City Of San Jose Transient Occupancy Tax 30 Day Exemption Form Www3 Csjfinance effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage City Of San Jose Transient Occupancy Tax 30 Day Exemption Form Www3 Csjfinance on any device with airSlate SignNow's Android or iOS apps and enhance any document-focused process today.

The easiest way to edit and eSign City Of San Jose Transient Occupancy Tax 30 Day Exemption Form Www3 Csjfinance with ease

- Locate City Of San Jose Transient Occupancy Tax 30 Day Exemption Form Www3 Csjfinance and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Edit and eSign City Of San Jose Transient Occupancy Tax 30 Day Exemption Form Www3 Csjfinance and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of san jose transient occupancy tax 30 day exemption form www3 csjfinance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a transient occupancy tax exemption?

A transient occupancy tax exemption allows qualifying short-term rental hosts to waive local taxes that apply to guests staying for limited periods. This exemption is essential for property owners as it can signNowly reduce operational costs and enhance profitability. Understanding how to apply for and maintain this exemption is crucial for managing your rental business effectively.

-

How can I apply for a transient occupancy tax exemption?

To apply for a transient occupancy tax exemption, you'll typically need to submit specific forms to your local tax authority, along with any required documentation that proves your eligibility. The application process may vary by jurisdiction, so it's essential to consult your local regulations. Using airSlate SignNow can streamline the document signing process involved in your application.

-

What features does airSlate SignNow offer for managing transient occupancy tax exemption documents?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning documents related to transient occupancy tax exemptions. Features include customizable templates, automated workflows, and secure cloud storage, allowing for efficient and organized management of your tax exemption paperwork. These tools help ensure you meet all compliance requirements.

-

How can I benefit from using airSlate SignNow in relation to transient occupancy tax exemption?

Using airSlate SignNow for your transient occupancy tax exemption process saves you time and reduces paperwork errors, enhancing overall operational efficiency. The platform's integration with various business applications allows for smooth data transfer, ensuring that all your documents are accurately processed and stored. This makes it simpler to stay compliant while reaping the financial benefits of tax exemptions.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to accommodate different business sizes and needs. You can choose a plan that fits your budget, and there are various tiers depending on the features you require for managing documents like transient occupancy tax exemption forms. Reviewing the pricing options helps you find the most cost-effective solution for your business.

-

Can airSlate SignNow integrate with other software for managing transient occupancy tax exemptions?

Yes, airSlate SignNow seamlessly integrates with numerous business applications, allowing you to connect with other tools essential for managing transient occupancy tax exemptions. This integration capability enhances your operational efficiency by automating data flow between platforms, reducing manual entry, and improving tracking of your tax exemption status. It's an essential feature for modern businesses.

-

What are the advantages of getting a transient occupancy tax exemption for my rental property?

Obtaining a transient occupancy tax exemption can provide signNow financial benefits by lowering your tax liability on short-term rentals. This means more profitability and better cash flow management for your rental business. Additionally, being informed about tax exemptions can make your business more competitive in the rental market.

Get more for City Of San Jose Transient Occupancy Tax 30 Day Exemption Form Www3 Csjfinance

- Virginia mason medical center abridged harvard isites harvard form

- Schoolcentercamp name schools nyc form

- Amis0160 certified reference material copper cobalt oxide ore mukondo drc certificate of analysis recommended concentrations form

- Petition to probate will in solemn form amp for letters of

- Worksheet domains and ranges of relations and functions rhsweb form

- Application for admission stamford westhill high school form

- Chj 121 medical release form

- Disclosure statement and agreement sierra credit form

Find out other City Of San Jose Transient Occupancy Tax 30 Day Exemption Form Www3 Csjfinance

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF