Utah State Tax Commission Request to Reconvene Board of Equalization Form 2010

What is the Utah State Tax Commission Request To Reconvene Board Of Equalization Form

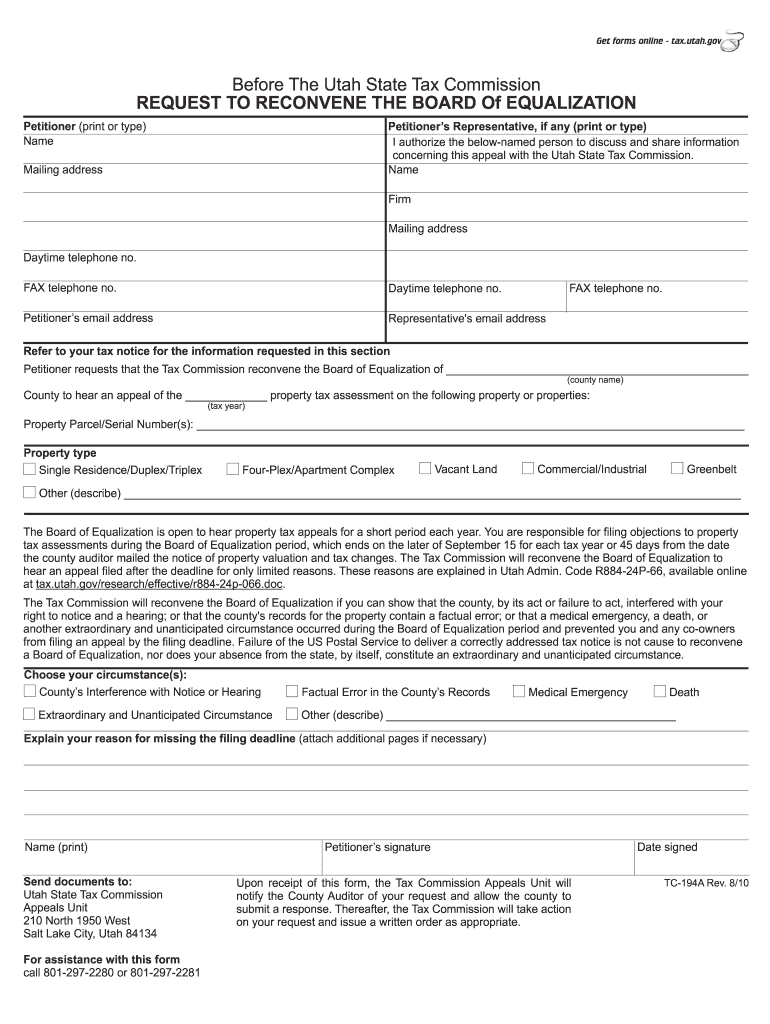

The Utah State Tax Commission Request To Reconvene Board Of Equalization Form is a crucial document used by taxpayers seeking to contest property tax assessments. This form allows individuals to formally request a review of their property tax evaluations by the Board of Equalization. It is designed to ensure that taxpayers have a fair opportunity to present their case regarding property value assessments that they believe are inaccurate or unjust. Understanding this form is essential for anyone wishing to engage in the property tax appeal process in Utah.

How to use the Utah State Tax Commission Request To Reconvene Board Of Equalization Form

Using the Utah State Tax Commission Request To Reconvene Board Of Equalization Form involves several steps. First, you need to obtain the form, which can be accessed online or through the Utah State Tax Commission office. After acquiring the form, fill it out with accurate information regarding your property and the reasons for your request. Ensure that all required fields are completed, as incomplete forms may lead to delays or rejection. Once filled, submit the form according to the instructions provided, either online or by mail, ensuring you keep a copy for your records.

Steps to complete the Utah State Tax Commission Request To Reconvene Board Of Equalization Form

Completing the Utah State Tax Commission Request To Reconvene Board Of Equalization Form involves the following steps:

- Download the form from the Utah State Tax Commission website or request a hard copy.

- Provide your personal information, including your name, address, and contact details.

- Enter the property details, including the parcel number and address.

- Clearly state your reasons for requesting a reconvene, citing any relevant evidence or documentation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the appropriate Board of Equalization office.

Key elements of the Utah State Tax Commission Request To Reconvene Board Of Equalization Form

Several key elements must be included in the Utah State Tax Commission Request To Reconvene Board Of Equalization Form to ensure its validity. These elements include:

- Taxpayer Information: Full name, address, and contact information.

- Property Details: Parcel number, property address, and description.

- Reason for Request: A detailed explanation of why you believe the assessment is incorrect.

- Supporting Documentation: Any evidence that supports your claim, such as recent appraisals or comparable property assessments.

- Signature: The form must be signed and dated by the taxpayer or authorized representative.

Eligibility Criteria

To be eligible to use the Utah State Tax Commission Request To Reconvene Board Of Equalization Form, taxpayers must meet specific criteria. Generally, this includes being the property owner or an authorized representative. Additionally, the request must be made within the designated timeframe following the initial assessment notice. Familiarizing yourself with these criteria is essential to ensure that your request is valid and will be considered by the Board of Equalization.

Form Submission Methods (Online / Mail / In-Person)

The Utah State Tax Commission Request To Reconvene Board Of Equalization Form can be submitted through various methods. Taxpayers have the option to submit the form online via the Utah State Tax Commission's website, which is often the fastest method. Alternatively, the form can be mailed to the appropriate Board of Equalization office or submitted in person. Each submission method has its own guidelines, so it is important to follow the instructions carefully to ensure proper processing of your request.

Quick guide on how to complete utah state tax commission request to reconvene board of equalization form

Your assistance manual on how to prepare your Utah State Tax Commission Request To Reconvene Board Of Equalization Form

If you’re wondering how to generate and submit your Utah State Tax Commission Request To Reconvene Board Of Equalization Form, here are a few brief guidelines on how to simplify tax submission.

To begin, you only need to set up your airSlate SignNow profile to modify how you manage documents online. airSlate SignNow is an extremely intuitive and robust document solution that enables you to modify, create, and finalize your tax documents effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and revert to modify information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Utah State Tax Commission Request To Reconvene Board Of Equalization Form within a few minutes:

- Establish your account and commence working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your Utah State Tax Commission Request To Reconvene Board Of Equalization Form in our editor.

- Populate the required fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save revisions, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Remember that submitting on paper can lead to increased return errors and delayed refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct utah state tax commission request to reconvene board of equalization form

FAQs

-

CA Reply to Franchise Tax Board Form re Tax Yr 2011: What income is stated in question 2 of section G? CA income only? Or out of state income?

The question asks for your gross income from all sources. If you had been a California resident in 2011, you would have filled out Schedule CA, and the amount that appears on line 22 in Column C is the amount that California considers to be your gross income, your total Federal income adjusted for differences between California law and Federal law. That number - the one you compute by filling out Part I of Schedule CA as though you had been a resident of California - is what you put on the Request for Tax Return. That includes all of the income you earned outside of California as well as any that you earned inside of California. If you want to simplify the process you can just put the amount from line 22 of your 1040 on the form, reduced by any taxable state tax refund on line 10 that you received from California in 2011, any unemployment compensation on line 19, and any taxable social security benefits on line 20(b). Those are the most common adjustments to California income. If you had a small business or earned capital gains, you might have to do a little more detailed computation, and at that point you're probably best served by consulting a professional.

-

How do you get the Franchise Tax Board to enforce the law when they refuse to act after you have given them all the evidence they need about tax evaders who took millions out of State TAX FREE?

You don't, because you don't know whether or not the FTB is in the process of taking action.Once you have provided your information to the FTB, the Board is prohibited by law from sharing information with you on the status of its investigation, whether action is taken or not. It may very well take years for the FTB to complete its investigation.Realize that information that appears to be cut-and-dried to you may not rise to the standard of a legal prosecution for tax evasion or fraud, which requires proof not only that taxes were legally due, but of intent to evade payment of taxes legally due.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

Create this form in 5 minutes!

How to create an eSignature for the utah state tax commission request to reconvene board of equalization form

How to generate an eSignature for your Utah State Tax Commission Request To Reconvene Board Of Equalization Form online

How to make an eSignature for the Utah State Tax Commission Request To Reconvene Board Of Equalization Form in Google Chrome

How to make an electronic signature for putting it on the Utah State Tax Commission Request To Reconvene Board Of Equalization Form in Gmail

How to make an electronic signature for the Utah State Tax Commission Request To Reconvene Board Of Equalization Form straight from your smartphone

How to create an eSignature for the Utah State Tax Commission Request To Reconvene Board Of Equalization Form on iOS

How to create an eSignature for the Utah State Tax Commission Request To Reconvene Board Of Equalization Form on Android OS

People also ask

-

What is the Utah State Tax Commission Request To Reconvene Board Of Equalization Form?

The Utah State Tax Commission Request To Reconvene Board Of Equalization Form is a legal document used by property owners in Utah to formally request a review of their property tax assessment. This form is essential for ensuring that taxpayers have an opportunity to contest their tax valuation in front of the Board of Equalization.

-

How can airSlate SignNow assist with the Utah State Tax Commission Request To Reconvene Board Of Equalization Form?

airSlate SignNow simplifies the process of completing and submitting the Utah State Tax Commission Request To Reconvene Board Of Equalization Form by providing an easy-to-use platform for eSigning and document management. You can quickly fill out the form, add your electronic signature, and send it directly to the appropriate authority, all within a few clicks.

-

Is there a cost associated with using airSlate SignNow for the Utah State Tax Commission Request To Reconvene Board Of Equalization Form?

Yes, while airSlate SignNow offers various subscription plans, many users find them to be cost-effective compared to traditional document signing services. You can choose a plan that fits your needs, ensuring you have access to all features necessary for managing the Utah State Tax Commission Request To Reconvene Board Of Equalization Form efficiently.

-

What features does airSlate SignNow offer for managing the Utah State Tax Commission Request To Reconvene Board Of Equalization Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for the Utah State Tax Commission Request To Reconvene Board Of Equalization Form. These tools help streamline the documentation process, making it easier to manage your property tax appeals.

-

Can I integrate airSlate SignNow with other applications for the Utah State Tax Commission Request To Reconvene Board Of Equalization Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow when handling the Utah State Tax Commission Request To Reconvene Board Of Equalization Form. Whether you use CRM systems, cloud storage, or project management tools, integration options are available to suit your business needs.

-

How secure is airSlate SignNow when submitting the Utah State Tax Commission Request To Reconvene Board Of Equalization Form?

Security is a top priority for airSlate SignNow. When submitting the Utah State Tax Commission Request To Reconvene Board Of Equalization Form, your data is protected with encryption and secure access protocols, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for the Utah State Tax Commission Request To Reconvene Board Of Equalization Form?

Using airSlate SignNow for the Utah State Tax Commission Request To Reconvene Board Of Equalization Form offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. With the ability to sign documents electronically, you can save time and resources while ensuring a smooth submission process.

Get more for Utah State Tax Commission Request To Reconvene Board Of Equalization Form

- Change of beneficiary request new york life form

- Benefitmall change request form innovative benefit solutions

- Community service form norland

- Application for show approval american quarter horse association western info form

- Manufactured home purchase order and federal disclosure statement form

- Printable self employment forms

- Application for employment cactus club cafe form

- Tbssct 5946 form

Find out other Utah State Tax Commission Request To Reconvene Board Of Equalization Form

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT