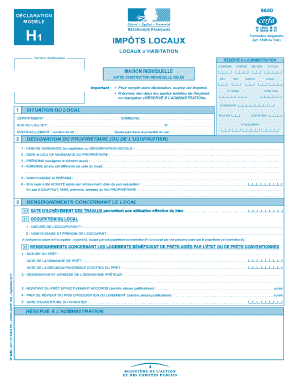

Cerfa 6650 Form

What is the Cerfa 6650

The Cerfa 6650 is a specific French administrative form used primarily for tax purposes. It is essential for individuals and businesses to report certain financial information to the French tax authorities. Understanding the function of this form is crucial for compliance with tax regulations, particularly for those with financial interests in France. The form helps ensure that all necessary data is accurately submitted, aiding in the assessment of taxes owed or refunds due.

How to use the Cerfa 6650

Using the Cerfa 6650 involves several steps to ensure that all required information is filled out correctly. Begin by gathering all relevant financial documents, such as income statements and expense reports. Next, accurately complete each section of the form, ensuring that all figures are correct and reflective of your financial situation. Once the form is filled out, it can be submitted electronically or via traditional mail, depending on the guidelines provided by the tax authorities.

Steps to complete the Cerfa 6650

Completing the Cerfa 6650 requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, including income and expense records.

- Fill out the personal information section accurately.

- Detail your income sources in the designated sections.

- Include any deductions or credits applicable to your situation.

- Review the entire form for accuracy before submission.

- Submit the form electronically or by mail, following the specific instructions provided.

Legal use of the Cerfa 6650

The legal use of the Cerfa 6650 is governed by French tax law. It is important to ensure that the form is completed accurately and submitted within the designated timeframes to avoid penalties. The form serves as a binding document that can be used in legal proceedings if necessary. Compliance with the legal requirements surrounding the Cerfa 6650 helps protect individuals and businesses from potential legal issues related to tax obligations.

Key elements of the Cerfa 6650

Several key elements must be included in the Cerfa 6650 to ensure its validity. These include:

- Accurate personal identification information.

- A detailed breakdown of income sources.

- Any applicable deductions or credits.

- Signature and date to verify the authenticity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Cerfa 6650 are critical to avoid penalties. Typically, the form must be submitted by a specific date each year, often aligned with the annual tax filing period. It is essential to stay informed about any changes to these deadlines, as they can vary based on individual circumstances or changes in tax law. Marking these dates on a calendar can help ensure timely submissions.

Quick guide on how to complete cerfa 6650

Complete Cerfa 6650 effortlessly on any device

Online document management has become highly regarded among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Cerfa 6650 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Cerfa 6650 with ease

- Obtain Cerfa 6650 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Modify and eSign Cerfa 6650 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cerfa 6650

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cerfa 6650 form used for?

The cerfa 6650 form is commonly used for formal requests and declarations in various administrative processes in France. It serves as a crucial document for specific transactions, ensuring compliance with legal requirements. Understanding the cerfa 6650 is essential for businesses dealing with regulatory matters.

-

How can airSlate SignNow facilitate the filling out of the cerfa 6650?

With airSlate SignNow, you can easily fill out and sign the cerfa 6650 digitally, saving time and eliminating paperwork. The platform offers customizable templates and an intuitive interface, making the process seamless. This ensures that your documents are completed accurately and efficiently.

-

What features does airSlate SignNow offer for managing the cerfa 6650?

airSlate SignNow provides a suite of features that simplify the management of the cerfa 6650, including document editing, eSigning, and secure storage. You can collaborate with team members in real-time and track document progress effortlessly. This enhances productivity and ensures that your forms are processed without delays.

-

Is there a cost associated with using airSlate SignNow for the cerfa 6650?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. The pricing plans cater to various needs and budgets, making it accessible for companies looking to manage the cerfa 6650. You can choose a plan that fits your requirements for document management and eSigning.

-

Can I integrate airSlate SignNow with other software for handling the cerfa 6650?

Absolutely! airSlate SignNow offers integration capabilities with various software solutions and platforms. This allows you to streamline your workflow when handling the cerfa 6650, ensuring that all your tools work together seamlessly to enhance efficiency and organization.

-

What are the benefits of using airSlate SignNow for the cerfa 6650 process?

Using airSlate SignNow for the cerfa 6650 process brings numerous benefits, including time savings, reduced errors, and enhanced security. The platform allows for easy sharing and collaboration, which helps to expedite approvals. Additionally, electronic records of your transactions improve accessibility and accountability.

-

How secure is using airSlate SignNow for the cerfa 6650?

airSlate SignNow prioritizes the security of your documents, including the cerfa 6650. The platform employs advanced encryption and secure cloud storage, ensuring that your sensitive information is protected. You can trust airSlate SignNow to handle your documents with the highest levels of security.

Get more for Cerfa 6650

- Ls 1575 transferencias al exterior bbva form

- 2017 2018 cau cheer try out application clark atlanta university form

- Employee disciplinary form hr wise llc

- Eform 4 2017

- Mclean high school student services department transcript release form fcps

- Disability services application james madison university jmu form

- Upper trinity groundwater conservation district 2014 water form

- Pediatric immunization record and history california department bb www2 co fresno ca form

Find out other Cerfa 6650

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online