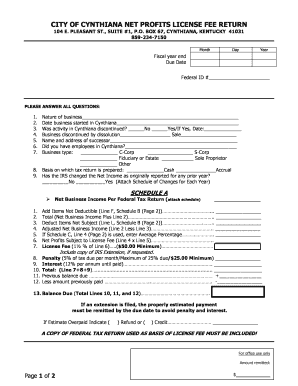

CITY of CYNTHIANA NET PROFITS LICENSE FEE RETURN Form

What is the Harrison County KY net profit license fee return?

The Harrison County KY net profit license fee return is a tax form used by businesses operating within Harrison County, Kentucky, to report their net profits and calculate the associated license fees. This form is essential for ensuring compliance with local tax regulations and helps the county assess the revenue generated by businesses. It typically requires detailed financial information, including income, expenses, and the calculation of net profit, which ultimately determines the fee owed to the county.

Steps to complete the Harrison County KY net profit license fee return

Completing the Harrison County KY net profit license fee return involves several key steps:

- Gather financial records, including profit and loss statements, balance sheets, and any relevant documentation of income and expenses.

- Calculate your net profit by subtracting total expenses from total income.

- Fill out the form accurately, ensuring all required fields are completed, including your business information, financial data, and net profit calculation.

- Review the completed form for accuracy before submission to avoid any potential penalties.

- Submit the form by the designated deadline, either electronically or via mail, as per the county's regulations.

Legal use of the Harrison County KY net profit license fee return

The Harrison County KY net profit license fee return is legally binding when completed and submitted in accordance with local tax laws. To ensure its legal validity, businesses must adhere to specific guidelines, including accurate reporting of financial data and timely submission. The use of electronic signatures, compliant with ESIGN and UETA regulations, can also enhance the legal standing of the submitted document, providing a secure and verifiable method of signing.

Filing deadlines / Important dates

It is crucial for businesses to be aware of the filing deadlines associated with the Harrison County KY net profit license fee return. Typically, the form is due on a specified date each year, often aligned with the end of the fiscal year for many businesses. Missing the deadline can result in penalties or interest on unpaid fees. It is advisable to check the county’s official guidelines for the exact due date each year to ensure timely compliance.

Form submission methods (Online / Mail / In-Person)

The Harrison County KY net profit license fee return can be submitted through various methods to accommodate different preferences. Businesses may choose to file online, which often provides a quicker processing time and immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate county office or submitted in person, depending on the local regulations. Each method has its own set of instructions and requirements, so it is important to follow the guidelines provided by the county.

Penalties for non-compliance

Failure to comply with the requirements of the Harrison County KY net profit license fee return can result in significant penalties. These may include late fees, interest on unpaid amounts, and potential legal action for continued non-compliance. It is essential for businesses to understand these consequences and prioritize timely and accurate filing to avoid any financial repercussions.

Quick guide on how to complete harrison county ky net profit license fee return

Complete harrison county ky net profit license fee return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle harrison county ky net profit license fee return on any platform through airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The easiest way to modify and eSign harrison county ky net profit license fee return without any hassle

- Locate harrison county ky net profit license fee return and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to store your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign harrison county ky net profit license fee return and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to harrison county ky net profit license fee return

Create this form in 5 minutes!

How to create an eSignature for the harrison county ky net profit license fee return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask harrison county ky net profit license fee return

-

What is the harrison county ky net profit license fee return?

The harrison county ky net profit license fee return is a tax return filed by businesses operating in Harrison County, Kentucky. It calculates the net profit and any accompanying license fees that need to be paid based on that profit. Understanding this requirement is essential for compliance with local tax regulations.

-

How can airSlate SignNow help me with my harrison county ky net profit license fee return?

airSlate SignNow provides a seamless way to prepare and sign documents related to the harrison county ky net profit license fee return. Its user-friendly interface allows you to gather signatures and share documents securely, ensuring that your tax filings can be completed efficiently and accurately.

-

Are there any costs associated with using airSlate SignNow for my harrison county ky net profit license fee return?

Yes, while airSlate SignNow offers a variety of pricing plans, the costs are generally competitive for businesses looking to streamline their documentation process. Investing in airSlate SignNow can save you time and potential penalties associated with filing your harrison county ky net profit license fee return incorrectly.

-

Is airSlate SignNow compliant with regulations for the harrison county ky net profit license fee return?

Absolutely! airSlate SignNow is designed to comply with industry standards and regulations, making it a reliable tool for handling documents related to the harrison county ky net profit license fee return. You can trust that your documents will be managed securely while meeting local tax compliance requirements.

-

Can I integrate airSlate SignNow with my accounting software for the harrison county ky net profit license fee return?

Yes, airSlate SignNow offers integrations with various accounting software solutions. This allows you to streamline the process of preparing your harrison county ky net profit license fee return while ensuring that all financial data is synchronized correctly for easier management and filing.

-

What features does airSlate SignNow provide for managing my harrison county ky net profit license fee return?

airSlate SignNow provides features such as document templates, secure e-signatures, and team collaboration tools. These features help simplify the process of completing your harrison county ky net profit license fee return, ensuring you stay organized and compliant with all required submissions.

-

How secure is airSlate SignNow for filing the harrison county ky net profit license fee return?

Security is a top priority for airSlate SignNow. The platform utilizes encryption and advanced security measures to protect your sensitive information related to your harrison county ky net profit license fee return. You can rest assured that your data remains confidential and secure throughout the process.

Get more for harrison county ky net profit license fee return

- New york commissioner health form

- Ireland health service executive 576625006 form

- Microchip registration form

- Islamic will template form

- Typeprint missouri department of health certificate of form

- Hurtigruten ship manifest information form

- Ford form permission slip girl scouts

- National rental affordability scheme form

Find out other harrison county ky net profit license fee return

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement