Abatement of Taxes Kansas Form

What is the Abatement Of Taxes Kansas Form

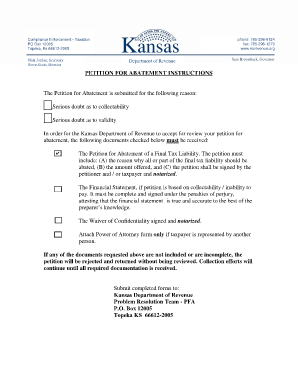

The Abatement Of Taxes Kansas Form is an official document used by taxpayers in Kansas to request a reduction or cancellation of property taxes. This form is typically utilized when a taxpayer believes that their property has been overvalued or when there are extenuating circumstances that justify a tax abatement. It is essential for individuals and businesses to understand the purpose of this form, as it can significantly impact their tax liabilities.

How to use the Abatement Of Taxes Kansas Form

Using the Abatement Of Taxes Kansas Form involves several steps to ensure proper completion and submission. First, taxpayers should gather all necessary documentation that supports their request for abatement, such as property assessments and any relevant financial statements. Next, fill out the form accurately, providing all required information, including property details and the reasons for the abatement request. Once completed, the form must be submitted to the appropriate local tax authority for review.

Steps to complete the Abatement Of Taxes Kansas Form

Completing the Abatement Of Taxes Kansas Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including past tax bills and property assessments.

- Provide accurate property information, including the address and parcel number.

- Clearly state the reasons for the abatement request, supported by evidence.

- Sign and date the form to validate your request.

- Submit the form to your local tax authority by the designated deadline.

Key elements of the Abatement Of Taxes Kansas Form

The Abatement Of Taxes Kansas Form includes several key elements that must be addressed for a successful submission. These elements typically include:

- Taxpayer's name and contact information.

- Property identification details, such as the legal description and parcel number.

- Specific reasons for requesting the abatement, including supporting evidence.

- Signature of the taxpayer or authorized representative.

Eligibility Criteria

To qualify for an abatement using the Abatement Of Taxes Kansas Form, taxpayers must meet certain eligibility criteria. Generally, these criteria may include:

- Demonstrating that the property has been overvalued compared to similar properties.

- Providing evidence of financial hardship or other extenuating circumstances.

- Meeting any local requirements set by the tax authority.

Form Submission Methods

The Abatement Of Taxes Kansas Form can be submitted through various methods, depending on the local tax authority's guidelines. Common submission methods include:

- Online submission through the local tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at the local tax office during business hours.

Quick guide on how to complete abatement of taxes kansas form

Prepare Abatement Of Taxes Kansas Form with ease on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Abatement Of Taxes Kansas Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Abatement Of Taxes Kansas Form effortlessly

- Obtain Abatement Of Taxes Kansas Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Abatement Of Taxes Kansas Form to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the abatement of taxes kansas form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Abatement Of Taxes Kansas Form?

The Abatement Of Taxes Kansas Form is a document used by property owners in Kansas to request a reduction or cancellation of their property taxes. This form is essential for those who believe their tax assessment is inaccurate or unfair. By submitting this form, taxpayers can initiate a review of their tax liabilities.

-

How do I obtain the Abatement Of Taxes Kansas Form?

You can easily obtain the Abatement Of Taxes Kansas Form from your local county treasurer's office or download it from the official Kansas government website. Additionally, using airSlate SignNow, you can access digital versions of various forms, including the Abatement Of Taxes Kansas Form, simplifying the process signNowly.

-

What are the requirements for filing the Abatement Of Taxes Kansas Form?

To file the Abatement Of Taxes Kansas Form, you must meet certain eligibility criteria, including being the property owner and having a valid reason for the abatement request, such as errors in tax assessments. It's important to provide supporting documentation to strengthen your claim. Failure to meet these requirements may result in your form being rejected.

-

Is there a fee associated with the Abatement Of Taxes Kansas Form?

Generally, there is no fee to file the Abatement Of Taxes Kansas Form; however, some counties may have specific regulations or fees tied to its submission. It’s advisable to check with your local county office for any potential costs. Using airSlate SignNow ensures you can manage these forms without hidden fees.

-

How long does it take to process the Abatement Of Taxes Kansas Form?

The processing time for the Abatement Of Taxes Kansas Form varies by county and can range from a few weeks to several months, depending on the backlog and complexity of the case. After submitting your form, you should receive a notification regarding the status of your application. Keeping track of the submission through airSlate SignNow helps you stay informed.

-

What benefits does airSlate SignNow provide for handling the Abatement Of Taxes Kansas Form?

AirSlate SignNow provides an intuitive platform to easily fill, sign, and share the Abatement Of Taxes Kansas Form digitally. This not only speeds up the process but also ensures that your documents are secure and accessible. Additionally, it allows for integration with various applications, simplifying your paperwork needs.

-

Can I track my submission of the Abatement Of Taxes Kansas Form with airSlate SignNow?

Yes, using airSlate SignNow enables you to track the progress of your Abatement Of Taxes Kansas Form submission conveniently. You can receive notifications when your document is viewed and signed, ensuring you stay updated. This feature streamlines communication with county offices and reduces uncertainty.

Get more for Abatement Of Taxes Kansas Form

- 2015 michigan schedule 1 form

- 2016 michigan schedule 1 form

- Form 3676 affidavit attesting that qualified state of michigan

- Form 3676 2014

- Michigan department of treasury 4640 rev 12 10 2018 2019 form

- Michigan department of treasury 4640 rev 12 10 2015 form

- 2018 michigan adjustments of capital gains and losses mi 1040d form

- 2014 michigan mi 1040 individual income tax state of michigan form

Find out other Abatement Of Taxes Kansas Form

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation