538s Tax Form

What is the 538s Tax Form

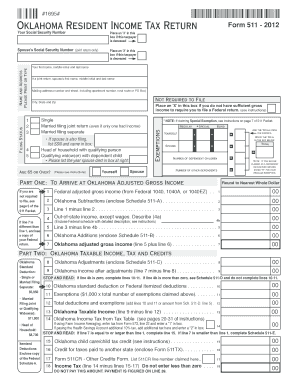

The 538s tax form is a specific document used for reporting certain tax-related information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with federal tax regulations. It helps in accurately reporting income, deductions, and credits, which are crucial for determining tax liabilities. Understanding the purpose and requirements of the 538s tax form is vital for anyone looking to file their taxes correctly.

How to use the 538s Tax Form

Using the 538s tax form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, carefully fill out the form, following the provided instructions to avoid errors. It is important to review the completed form for accuracy before submission. Finally, submit the form to the IRS by the designated deadline, ensuring that you retain a copy for your records.

Steps to complete the 538s Tax Form

Completing the 538s tax form requires a systematic approach. Begin by downloading the form from the IRS website or obtaining a physical copy. Next, follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, interest, and other sources.

- Claim any eligible deductions and credits by following the guidelines.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the 538s Tax Form

The legal use of the 538s tax form is governed by IRS regulations. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal issues. The form serves as a formal declaration of your financial situation to the IRS, and its proper use is essential for maintaining compliance with tax laws. Additionally, electronic signatures on the form are recognized as legally binding, provided they meet the necessary requirements.

Filing Deadlines / Important Dates

Filing deadlines for the 538s tax form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the IRS website or consult a tax professional for any updates on deadlines or changes in filing requirements. Being aware of these dates helps ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The 538s tax form can be submitted through various methods, offering flexibility for taxpayers. The options include:

- Online submission: Many taxpayers prefer to file electronically, which can expedite processing and reduce errors.

- Mail: For those who prefer traditional methods, the form can be printed and mailed to the IRS, ensuring it is sent well before the deadline.

- In-person: Some individuals may choose to submit their forms in person at local IRS offices, where assistance may also be available.

Quick guide on how to complete 538s tax form

Complete 538s Tax Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents rapidly without any delays. Handle 538s Tax Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to alter and electronically sign 538s Tax Form effortlessly

- Locate 538s Tax Form and then click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to save your modifications.

- Decide how you want to deliver your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device you prefer. Edit and electronically sign 538s Tax Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 538s tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow's 538s?

The key features of airSlate SignNow's 538s include intuitive eSignature capabilities, customizable templates, and advanced document management. With its user-friendly interface, businesses can easily send, sign, and store documents securely. These features streamline the signing process and enhance productivity.

-

How does pricing work for airSlate SignNow's 538s?

Pricing for airSlate SignNow's 538s is structured to accommodate businesses of all sizes, offering various plans to fit different needs and budgets. You can choose from monthly or annual subscriptions, and there are often discounts for longer commitments. This flexibility ensures that you can find a plan that works for your organization.

-

What benefits does using airSlate SignNow's 538s provide?

Utilizing airSlate SignNow's 538s can signNowly enhance your document workflow, allowing faster turnaround times for approvals and signatures. It also reduces paperwork and administrative burdens, ultimately saving time and costs. With advanced security measures in place, you can trust that your documents are protected.

-

Are there any integrations available with airSlate SignNow's 538s?

Yes, airSlate SignNow's 538s offers seamless integrations with various popular applications, including CRM tools, cloud storage services, and collaboration platforms. This allows for a more streamlined workflow, enabling teams to work within their preferred tools while still utilizing the efficient eSigning capabilities. Integrations help enhance overall productivity.

-

Is the process of sending documents with airSlate SignNow's 538s easy?

Absolutely! Sending documents via airSlate SignNow's 538s is extremely easy and user-friendly. Users can upload documents, specify signers, and send requests in just a few clicks. The clear interface helps guide users through each step to ensure a smooth experience.

-

What types of documents can be signed using airSlate SignNow's 538s?

You can sign various types of documents with airSlate SignNow's 538s, including contracts, agreements, waivers, and forms. The platform supports multiple file formats, ensuring versatility in the types of documents you can manage. This adaptability meets the diverse needs of different sectors.

-

How secure is airSlate SignNow's 538s when handling sensitive documents?

airSlate SignNow's 538s prioritizes security by employing end-to-end encryption and compliance with industry standards. Each document is securely transmitted and stored, ensuring that sensitive information is protected against unauthorized access. Businesses can confidently use the platform knowing their data is safe.

Get more for 538s Tax Form

- Military spouse preference request form

- Dd form 1616

- Punjab medical council registration renewal form 34148322

- Application for appointment or re appointment to macomb county form

- Whole foods online job application form

- Form 341 english san diego county office of education sdcoe

- Calstrs retirement system election form sdcoe

- Standard affirmation and disclosure form

Find out other 538s Tax Form

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy