Zero Income Form for Section 8

What is the zero income form for Section 8

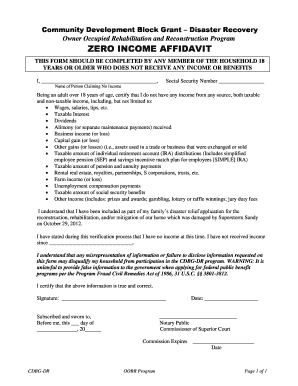

The zero income form for Section 8 is a document that individuals must complete to declare that they have no income. This form is essential for those applying for housing assistance under the Section 8 program, which aims to provide affordable housing options for low-income families. By submitting this affidavit, applicants can demonstrate their financial situation to housing authorities, ensuring they receive the appropriate support. The form typically requires personal information, including the applicant's name, address, and details about household members.

How to use the zero income form for Section 8

Using the zero income form for Section 8 involves several straightforward steps. First, download or request the form from your local housing authority. Next, fill out the form accurately, ensuring all required fields are completed. It is important to provide truthful information, as any discrepancies may lead to penalties or delays in processing. Once completed, submit the form according to your housing authority's guidelines, which may include online submission, mailing, or delivering it in person.

Steps to complete the zero income form for Section 8

Completing the zero income form for Section 8 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from your local housing authority.

- Fill in your personal information, including your name, address, and contact details.

- List all household members and their relationship to you.

- Clearly indicate that you have no income by checking the appropriate box or writing a statement.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form as instructed by your housing authority.

Legal use of the zero income form for Section 8

The zero income form for Section 8 is legally binding when completed and submitted correctly. It serves as a formal declaration of your financial status, which housing authorities rely on to determine eligibility for assistance. To ensure the form is legally recognized, it must be signed and dated by the applicant. Additionally, the use of electronic signatures through platforms like signNow enhances the legal validity of the document, as it complies with relevant eSignature laws.

Key elements of the zero income form for Section 8

Understanding the key elements of the zero income form for Section 8 is crucial for accurate completion. The form typically includes:

- Personal Information: Name, address, and contact details of the applicant.

- Household Members: Names and relationships of all individuals living in the household.

- Income Declaration: A statement indicating that the applicant has no income.

- Signature: The applicant's signature and date to validate the information provided.

Eligibility criteria for the zero income form for Section 8

To qualify for the zero income form for Section 8, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being a resident of the United States.

- Meeting the income limits set by the local housing authority.

- Providing accurate and truthful information on the application.

- Being a member of a household that requires housing assistance.

Quick guide on how to complete zero income form for section 8

Effortlessly Complete Zero Income Form For Section 8 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Zero Income Form For Section 8 on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to Modify and Electronically Sign Zero Income Form For Section 8 with Ease

- Find Zero Income Form For Section 8 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Zero Income Form For Section 8 and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zero income form for section 8

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a zero income affidavit?

A zero income affidavit is a legal document that states an individual has no income during a specific period. This affidavit is often required for various applications, such as housing assistance or loan applications. It helps to clarify your financial situation to relevant authorities.

-

How can airSlate SignNow help me create a zero income affidavit?

airSlate SignNow provides easy-to-use templates for creating a zero income affidavit that can be customized to fit your needs. The platform allows you to fill out the document digitally and electronically sign it with just a few clicks. This makes the process quick, efficient, and hassle-free.

-

Is airSlate SignNow a cost-effective solution for managing a zero income affidavit?

Yes, airSlate SignNow is known for its cost-effective pricing plans, making it an ideal choice for individuals and businesses needing a zero income affidavit. You can take advantage of all features without breaking the bank, ensuring that you receive high-quality document management and eSigning capabilities.

-

What features does airSlate SignNow offer for zero income affidavits?

airSlate SignNow offers a variety of features for managing zero income affidavits, including document templates, eSignature capabilities, and secure file storage. Additionally, you can track the status of your documents in real-time, ensuring you stay updated on their progress. These features simplify the process of sending and managing your documents.

-

Can I integrate airSlate SignNow with other applications for zero income affidavits?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. This allows you to streamline your workflow when working with zero income affidavits and other documents, making it easier to access and manage your files in one place.

-

How secure is airSlate SignNow when sending a zero income affidavit?

When using airSlate SignNow, your zero income affidavit is protected with industry-standard encryption and security protocols. This ensures that your sensitive information remains confidential throughout the signing process. The platform's commitment to security provides peace of mind while handling important documents.

-

What are the benefits of using airSlate SignNow for zero income affidavits?

Using airSlate SignNow for your zero income affidavit offers several benefits, including improved efficiency, cost savings, and enhanced accessibility. You can create, send, and sign documents from anywhere, making the process faster and easier. This modern approach to document management accelerates your workflow and eliminates unnecessary paperwork.

Get more for Zero Income Form For Section 8

Find out other Zero Income Form For Section 8

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online