Form 101 State of North Dakota Taxhow

What is the Form 101 State of North Dakota Taxhow

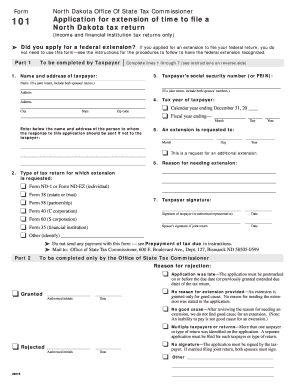

The Form 101 State of North Dakota Taxhow is a specific tax form utilized by individuals and businesses in North Dakota for reporting income and calculating tax liabilities. This form is essential for ensuring compliance with state tax regulations and is typically required for various tax filings. Understanding its purpose is crucial for accurate tax reporting and fulfilling legal obligations.

How to use the Form 101 State of North Dakota Taxhow

Using the Form 101 involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, fill out the form with the required information, including personal details and financial data. It is important to review the form for accuracy before submission to avoid potential penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the state.

Steps to complete the Form 101 State of North Dakota Taxhow

Completing the Form 101 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents.

- Enter personal information, such as your name and address.

- Report your income accurately, including wages, interest, and other earnings.

- Calculate deductions and credits applicable to your situation.

- Review the completed form for any errors.

- Submit the form electronically or by mail, as per state instructions.

Legal use of the Form 101 State of North Dakota Taxhow

The legal use of the Form 101 is governed by North Dakota tax laws, which stipulate how the form should be filled out and submitted. To ensure that your submission is legally binding, it must comply with the relevant regulations, including accurate reporting of income and adherence to filing deadlines. Utilizing an electronic signature solution can further enhance the legitimacy of your submission by providing an audit trail and ensuring compliance with eSignature laws.

Key elements of the Form 101 State of North Dakota Taxhow

Key elements of the Form 101 include:

- Personal identification information.

- Income reporting sections for various sources of income.

- Deductions and credits applicable to the taxpayer.

- Signature section for verification of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 101 are crucial for compliance with North Dakota tax regulations. Typically, the form must be submitted by April fifteenth of each year. However, taxpayers should verify specific deadlines each year, as they may vary. Late submissions can result in penalties and interest on unpaid taxes, making it essential to stay informed about these important dates.

Quick guide on how to complete form 101 state of north dakota taxhow

Effortlessly prepare Form 101 State Of North Dakota Taxhow on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without hassle. Manage Form 101 State Of North Dakota Taxhow on any device using the airSlate SignNow Android or iOS applications, streamlining any document-related process today.

Steps to modify and eSign Form 101 State Of North Dakota Taxhow effortlessly

- Find Form 101 State Of North Dakota Taxhow and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your alterations.

- Choose how you wish to send your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 101 State Of North Dakota Taxhow to ensure exceptional communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 101 state of north dakota taxhow

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 101 North Dakota and why do I need it?

Form 101 North Dakota is a critical document used for various business and legal processes in the state. It is required for tax filings, compliance, and official record-keeping. Utilizing airSlate SignNow allows you to complete and eSign form 101 North Dakota efficiently, ensuring you meet all state requirements.

-

How does airSlate SignNow simplify the process of filling out form 101 North Dakota?

airSlate SignNow streamlines the process of completing form 101 North Dakota by providing an intuitive, user-friendly interface. You can easily upload, edit, and eSign your form, minimizing the chances of errors. Our platform saves you time and helps you submit your forms quickly and accurately.

-

What are the pricing options for using airSlate SignNow to handle form 101 North Dakota?

airSlate SignNow offers a range of pricing plans designed to fit various business needs, making it cost-effective for handling form 101 North Dakota. We have options for small businesses and larger enterprises, ensuring everyone can benefit from our eSigning solution without overspending. Visit our pricing page to find a plan that suits your requirements.

-

Can I integrate airSlate SignNow with my existing tools when working with form 101 North Dakota?

Yes, airSlate SignNow offers seamless integrations with a variety of tools and applications. This means you can easily connect your document management systems and customer relationship management software while working on form 101 North Dakota. Enhanced integrations streamline your workflow and enhance productivity.

-

What security measures does airSlate SignNow implement for form 101 North Dakota?

Your security is our priority at airSlate SignNow. We implement top-notch security measures, including encrypted connections and secure data storage when handling form 101 North Dakota. This ensures that your sensitive information remains protected while you eSign and share your documents.

-

Is it legal to eSign form 101 North Dakota with airSlate SignNow?

Absolutely! eSigning form 101 North Dakota using airSlate SignNow is entirely legal and compliant with state laws. Our platform adheres to regulations regarding electronic signatures, helping you ensure the legality and validity of your signed documents.

-

What are the benefits of using airSlate SignNow for form 101 North Dakota?

Using airSlate SignNow for form 101 North Dakota brings several advantages, including faster processing times, reduced paperwork, and enhanced collaboration among team members. The platform enables easy tracking of document status, ensuring that you remain organized throughout the signing process.

Get more for Form 101 State Of North Dakota Taxhow

- Iowa medicaid enterprise iowa department of human services dhs iowa form

- Incident id form

- Idaho practitioner application 2014 2019 form

- Credentialing application bcidahocom form

- Prime therapeutics prior authorization fax number 2009 2019 form

- Project submission form for hospitals

- Masshealth medical records release form english mass

- Mcps form sr 6 2016 2019

Find out other Form 101 State Of North Dakota Taxhow

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document