Ej 160 2009-2026

What is the EJ 160?

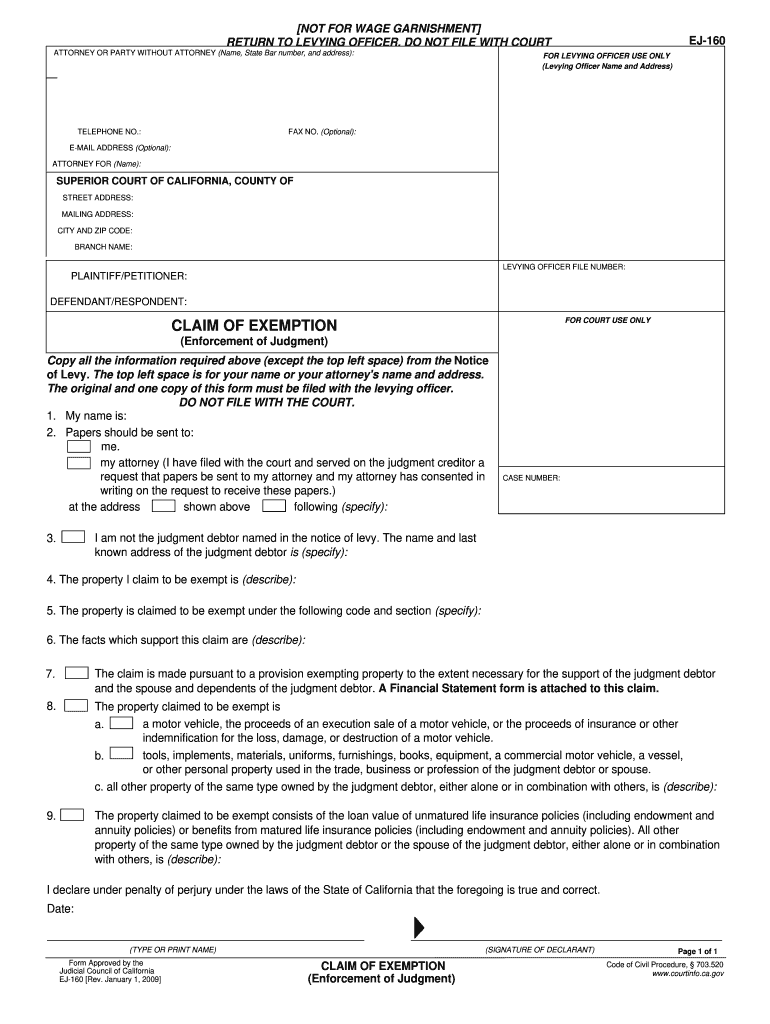

The EJ 160 is a legal document known as the claim of exemption form, primarily used in California. It allows individuals to assert their right to exempt certain assets from being seized or garnished, particularly in cases involving wage garnishment or bank levies. This form is essential for those who believe that their financial situation qualifies them for protection under state law. Understanding the purpose of the EJ 160 is crucial for anyone facing potential financial hardships or legal actions that might affect their income or assets.

How to Use the EJ 160

Using the EJ 160 involves several steps to ensure that the form is filled out correctly and submitted appropriately. First, gather all necessary information regarding your financial situation, including income details and any applicable exemptions. Next, complete the form by providing accurate information in the required fields. After filling out the form, review it to ensure there are no errors. Finally, submit the completed EJ 160 to the appropriate court or agency handling your case. This process helps protect your rights and ensures that your claim for exemption is considered.

Steps to Complete the EJ 160

Completing the EJ 160 involves a systematic approach to ensure accuracy and compliance with legal requirements. Follow these steps:

- Obtain the latest version of the EJ 160 form from a reliable source.

- Fill in your personal information, including your name, address, and contact details.

- Detail your income sources and amounts, ensuring to include any exemptions you qualify for.

- Sign and date the form to validate your claim.

- Make copies of the completed form for your records before submission.

Legal Use of the EJ 160

The legal use of the EJ 160 is vital for individuals seeking to protect their assets from garnishment or levy actions. This form must be submitted to the court handling your case, and it serves as a formal declaration of your claim for exemption. It's important to understand that submitting the EJ 160 does not automatically guarantee exemption; the court will review your claim based on the information provided and relevant state laws. Proper legal use ensures that your rights are upheld during financial proceedings.

Eligibility Criteria

To successfully file a claim using the EJ 160, individuals must meet specific eligibility criteria. Generally, this includes demonstrating financial hardship, such as low income or essential living expenses that exceed available income. Additionally, certain types of income, such as social security or disability payments, may be exempt from garnishment. Understanding these criteria is essential for determining whether you qualify to use the EJ 160 to protect your assets.

Required Documents

When filing the EJ 160, certain documents may be required to support your claim for exemption. These documents can include:

- Proof of income, such as pay stubs or tax returns.

- Bank statements to demonstrate your financial situation.

- Documentation of any debts or financial obligations.

- Any relevant court orders or legal notices related to garnishment or levy.

Having these documents ready can streamline the process and strengthen your claim.

Form Submission Methods

The EJ 160 can typically be submitted through various methods, depending on the court's requirements. Common submission methods include:

- Online submission through the court's electronic filing system.

- Mailing the completed form to the appropriate court address.

- In-person delivery to the court clerk's office.

Each method has its own guidelines and potential processing times, so it is advisable to check with the relevant court for specific instructions.

Quick guide on how to complete claim exemption form

Finalize and submit your Ej 160 swiftly

Robust tools for digital document interchange and endorsement are crucial for process enhancement and the continuous evolution of your forms. When handling legal documents and signing a Ej 160, the appropriate signature solution can conserve your time and reduce paper usage with every submission.

Search, complete, modify, endorse, and distribute your legal documents with airSlate SignNow. This platform provides everything required to create efficient document submission processes. Its vast library of legal forms and user-friendly navigation can assist you in obtaining your Ej 160 rapidly, and the editor featuring our signature capability will enable you to finalize and approve it instantly.

Authorize your Ej 160 in a few easy steps

- Locate the Ej 160 you need in our library using search or catalog pages.

- Examine the form details and preview it to ensure it meets your requirements and complies with state regulations.

- Click Get form to proceed to editing.

- Fill in the form using the comprehensive toolbar.

- Verify the information you provided and click the Sign tool to validate your document.

- Choose one of three options to insert your signature.

- Complete the editing process and save the document in your files, then download it to your device or share it directly.

Simplify every phase of your document preparation and endorsement with airSlate SignNow. Experience a more effective online solution that encompasses all aspects of managing your documents.

Create this form in 5 minutes or less

FAQs

-

What sorts of things do I have to declare in customs when returning to the U.S.?

Dick and Sarah are both correct -- thanks to the $800 exemption you can do a fair amount of shopping without having to pay any duty. Also, certain items (books and printed materials, for example) are exempt (so if you buy books abroad you only have to worry about how much they weigh!).I'm a lawyer ("an officer of the court") so I always declare everything. Also I was raised with a lot of guilt so it would drive me crazy to know that they might open my bag and find stuff I didn't declare. I just use some of that time on the long flight home to make a list and add it all up and then figure out how to fit it all onto the little Customs form. I divide purchases into categories: stationery, apparel/accessories, souvenirs, home items, etc., and total up each category on a different line of the form to avoid using more than one form. Customs is totally OK with that although they might ask you for examples of items you classified on each line. If you say "Food," they will ask more questions, depending upon where you've been and what's prohibited, so if it's really just chocolates, for example, say that, and they won't be as concerned.My experience, having done a LOT of overseas shopping, is that even if you do declare more than $800, even considerably more, they will generally just thank you for your honesty and wave you through. I came back from a five week vacation to Australia, Thailand, and Cambodia with three large checked bags (having left the country with only one, although they didn't know that), and reported over $2000 in purchases. They asked me some questions about what I had bought (mainly to make sure I wasn't bringing in illegal stuff or importing for the purpose of sale), but when I showed them my list and talked through the various people I had bought gifts for they just sent me on my way.I can only think of one time when I was asked to pay anything. I was coming back from somewhere in Asia and US Customs at SFO collected about $20 from me (10% of a $200 overage). There is very little downside to declaring everything, and potentially a bad downside to not doing so. I strongly recommend declaring everything, always, and letting the chips fall where they may.

-

How do I show exempted income under sec 10 (16) in ITR 1 form? How do I specify court rulings if any?

You must understand that you are filing tax returns by claiming exemption under section 10. There is a Schedule EI for you to enter your exempt income. The schedule EI has various categories of income and if your income doesn't fall under any of those specific categories they have a “Others” column in schedule EI where you can fill out the exempt income.The court rulings / advance ruling from income tax department are all the documents for your reference. If the income tax department asks you to show the proof / details of how you claimed that particular amount as exempt income only then you need to submit those rulings etc along with other documents.Just like you cannot attach your form 16 or 80c proofs on a tax return, you cannot attach court rulings as well. You just need to prepare the tax return as per the rules. If the department feels the need they will question you.Hope this helps.Follow me on my blog TaxYogiContact me for any help@9043414847 / yogeshjain392@outlook.com

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

In what cases do you have to fill out an insurance claim form?

Ah well let's see. An insurance claim form is used to make a claim against your insurance for financial, repair or replacement of something depending on your insurance. Not everything will qualify so you actually have to read the small print.

-

How do I fill out the disability forms so well that my claim is approved?

Contact Barbara Case, the founder of USA: Providing Free Advocacy & Support She's incredible!

Create this form in 5 minutes!

How to create an eSignature for the claim exemption form

How to make an electronic signature for the Claim Exemption Form in the online mode

How to make an eSignature for your Claim Exemption Form in Google Chrome

How to generate an eSignature for signing the Claim Exemption Form in Gmail

How to make an eSignature for the Claim Exemption Form from your smartphone

How to generate an electronic signature for the Claim Exemption Form on iOS devices

How to make an electronic signature for the Claim Exemption Form on Android

People also ask

-

What is the Ej 160 feature in airSlate SignNow?

The Ej 160 feature in airSlate SignNow allows users to create and manage electronic signatures effortlessly. This powerful tool ensures that your documents are signed securely and efficiently, streamlining your workflow. With Ej 160, you can send documents for eSigning in just a few clicks.

-

How does airSlate SignNow's Ej 160 improve document management?

The Ej 160 feature enhances document management by providing a centralized platform for sending, signing, and tracking documents. This means you can easily monitor the signing process and ensure that all documents are completed on time. By utilizing Ej 160, businesses can reduce delays and improve overall efficiency.

-

What pricing options are available for airSlate SignNow with Ej 160?

airSlate SignNow offers flexible pricing plans that include access to the Ej 160 feature. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget and needs. Our pricing is competitive, making it a cost-effective solution for electronic document signing.

-

Can I integrate Ej 160 with other software solutions?

Yes, Ej 160 in airSlate SignNow seamlessly integrates with various software solutions, enhancing your existing workflows. You can connect Ej 160 with CRM systems, cloud storage services, and more, ensuring a smooth user experience. This integration capability allows businesses to maximize their productivity.

-

What are the benefits of using Ej 160 for electronic signatures?

Using Ej 160 for electronic signatures provides numerous benefits, including increased security, faster turnaround times, and reduced paper usage. With Ej 160, you can obtain legally binding signatures quickly, making it ideal for businesses looking to streamline their processes. Additionally, it enhances customer satisfaction by providing a hassle-free signing experience.

-

Is Ej 160 compliant with legal regulations?

Yes, Ej 160 in airSlate SignNow is fully compliant with eSignature laws, ensuring that your electronic signatures are legally binding. This compliance helps protect your business and guarantees the integrity of your documents. You can confidently use Ej 160 for all your signing needs.

-

How user-friendly is the Ej 160 feature?

The Ej 160 feature is designed with user-friendliness in mind, making it accessible for everyone, regardless of technical expertise. The intuitive interface allows users to navigate easily and complete tasks quickly. Whether you're sending documents or signing them, Ej 160 simplifies the entire process.

Get more for Ej 160

- Notice of non renewal for lease form

- Anthem hcr survey form

- Non reimbursement anti dumping form

- Affidavit of heirship ny surrogate court form

- Inquiry about status of i 551 alien registration card form

- Land registration reform act ontario

- Co applicant request form

- Home replacement cost evaluation formpdf

Find out other Ej 160

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF