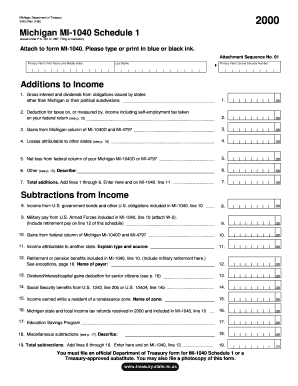

Mi 1040 Schedule 1 Form

What is the Michigan 1040 Schedule 1?

The Michigan 1040 Schedule 1 is a tax form used by residents of Michigan to report additional income and adjustments to income that are not included on the standard Michigan 1040 form. This schedule is essential for accurately calculating state income tax obligations. It captures various types of income, such as business income, rental income, and other sources that may affect a taxpayer's overall income calculation. Understanding this form is crucial for ensuring compliance with state tax laws and for maximizing potential deductions.

Steps to complete the Michigan 1040 Schedule 1

Completing the Michigan 1040 Schedule 1 involves several key steps:

- Gather necessary documentation: Collect all relevant financial documents, including W-2s, 1099s, and any records of additional income.

- Fill out personal information: Begin by entering your name, address, and Social Security number at the top of the form.

- Report additional income: Complete the sections related to various types of income, ensuring that you accurately report amounts from all sources.

- Calculate adjustments: Identify and apply any adjustments to income, such as contributions to retirement accounts or health savings accounts.

- Review and verify: Double-check all entries for accuracy to avoid errors that could lead to penalties or delays.

How to obtain the Michigan 1040 Schedule 1

The Michigan 1040 Schedule 1 can be obtained through several methods:

- Online: Visit the Michigan Department of Treasury website to download the form in PDF format.

- Tax preparation software: Many tax preparation programs include the Michigan 1040 Schedule 1 as part of their offerings.

- Local tax offices: You can also request a physical copy at local tax offices or libraries that provide tax resources.

Legal use of the Michigan 1040 Schedule 1

The Michigan 1040 Schedule 1 is legally recognized as a valid document for reporting income and adjustments for state tax purposes. To ensure its legal standing, it must be completed accurately and submitted in accordance with Michigan tax laws. Using electronic signatures through platforms like signNow can further enhance the validity of the submission, as eSignatures are compliant with legal frameworks such as ESIGN and UETA. This compliance ensures that the document is treated as a legally binding agreement.

Required Documents

When preparing to complete the Michigan 1040 Schedule 1, certain documents are essential:

- W-2 forms: These report wages and tax withholdings from employers.

- 1099 forms: These are necessary for reporting income from freelance work, investments, or other non-employment sources.

- Receipts for deductions: Keep records of any expenses that may qualify as deductions, such as business expenses or medical costs.

- Previous year’s tax return: This can provide a helpful reference for completing the current year’s schedule.

Filing Deadlines / Important Dates

It is important to be aware of key deadlines when filing the Michigan 1040 Schedule 1:

- Tax filing deadline: Typically, the deadline for filing state income tax returns, including the Michigan 1040 Schedule 1, is April 15.

- Extension requests: If you need more time, you can file for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete mi 1040 schedule 1

Effortlessly Prepare Mi 1040 Schedule 1 on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Mi 1040 Schedule 1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to Modify and Electronically Sign Mi 1040 Schedule 1 with Ease

- Locate Mi 1040 Schedule 1 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Alter and electronically sign Mi 1040 Schedule 1 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi 1040 schedule 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the MI 1040 Schedule 1?

The MI 1040 Schedule 1 is a supplemental form required for Michigan taxpayers to report specific types of income and adjustments to their primary MI 1040 form. This includes details on items like pensions, rental income, and student loans. Accurately filling out the MI 1040 Schedule 1 ensures compliance with state tax regulations.

-

How can airSlate SignNow help with MI 1040 Schedule 1 submissions?

airSlate SignNow facilitates a streamlined process for filling out and submitting your MI 1040 Schedule 1. With its easy-to-use interface, users can quickly fill out forms, sign them electronically, and submit them directly to tax authorities. This can save time and reduce errors during the filing process.

-

Is there a cost associated with using airSlate SignNow for MI 1040 Schedule 1?

Yes, airSlate SignNow offers a range of pricing plans tailored to different business needs. While there may be a nominal fee to use its services, the cost is often offset by the time savings and increased efficiency gained in managing your MI 1040 Schedule 1 and other tax forms. A free trial is also available to help you evaluate its features.

-

What features does airSlate SignNow offer for managing MI 1040 Schedule 1?

AirSlate SignNow provides features such as customizable templates, electronic signatures, document sharing, and real-time tracking to manage your MI 1040 Schedule 1 efficiently. These features help ensure that your documents are completed accurately and securely, making the filing process seamless. Additionally, the platform integrates with other tools to keep your workflow organized.

-

Can I integrate airSlate SignNow with my accounting software for MI 1040 Schedule 1?

Yes, airSlate SignNow offers integrations with various accounting software solutions that can enhance your experience while filing the MI 1040 Schedule 1. By connecting your preferred accounting tools, you can easily sync data, reducing manual entry and minimizing errors. This integration streamlines the entire tax preparation process.

-

What are the benefits of using airSlate SignNow for MI 1040 Schedule 1?

Using airSlate SignNow for your MI 1040 Schedule 1 offers several benefits, including enhanced efficiency, reduced paper usage, and improved compliance. The platform’s easy electronic signature capabilities help speed up the process, ensuring you can meet deadlines. Plus, electronic storage and retrieval save both time and money.

-

Is airSlate SignNow secure for handling MI 1040 Schedule 1 information?

Absolutely! AirSlate SignNow prioritizes security, implementing advanced encryption technologies to safeguard your MI 1040 Schedule 1 and other sensitive documents. The platform complies with industry standards, ensuring your data remains confidential and protected from unauthorized access. You can trust airSlate SignNow to keep your information secure.

Get more for Mi 1040 Schedule 1

Find out other Mi 1040 Schedule 1

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU