Schedule 1 Tax Form

What is the Schedule 1 Tax Form

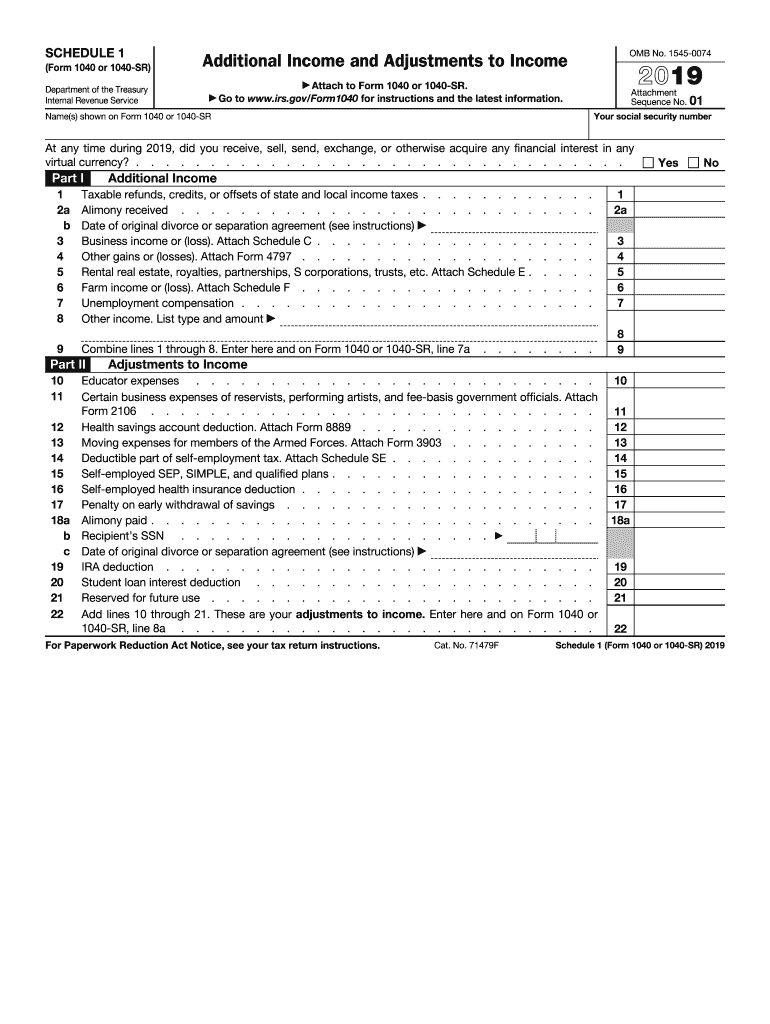

The Schedule 1 tax form, officially known as Form 1040 Schedule 1, is a supplemental form used by U.S. taxpayers to report additional income and adjustments to income that are not included directly on the main Form 1040. This form is essential for individuals who have specific types of income, such as unemployment compensation, rental income, or business income, as well as those who are claiming adjustments like educator expenses or student loan interest deductions. Understanding how to accurately complete this form is crucial for ensuring compliance with IRS regulations and maximizing potential tax benefits.

How to obtain the Schedule 1 Tax Form

Taxpayers can easily obtain the Schedule 1 form through various methods. The most common way is to download it directly from the IRS website, where it is available in PDF format. Additionally, many tax preparation software programs provide access to the Schedule 1 form as part of their services. For those who prefer physical copies, local IRS offices and certain libraries may offer printed versions of the form. It's important to ensure you are using the correct version for the current tax year, as forms may be updated annually.

Steps to complete the Schedule 1 Tax Form

Completing the Schedule 1 tax form involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any records related to additional income or adjustments.

- Fill in personal information: Start by entering your name, Social Security number, and other identifying details at the top of the form.

- Report additional income: Complete the sections that pertain to any additional income you need to report, ensuring accuracy in the amounts.

- Claim adjustments to income: If applicable, fill out the adjustments section to claim deductions such as educator expenses or health savings account contributions.

- Review and verify: Double-check all entries for accuracy and completeness before submitting the form.

Legal use of the Schedule 1 Tax Form

The Schedule 1 tax form is legally binding when filled out and signed correctly. To ensure its legal validity, taxpayers must adhere to specific guidelines set forth by the IRS. This includes providing accurate information and ensuring that all required signatures are present. Additionally, utilizing a reliable eSignature solution can enhance the legal standing of the completed form, as it provides a digital certificate and maintains compliance with relevant eSignature laws, such as ESIGN and UETA.

Key elements of the Schedule 1 Tax Form

Several key elements make up the Schedule 1 tax form, which are crucial for accurate completion:

- Part I - Additional Income: This section includes various types of income that must be reported, such as unemployment compensation and business income.

- Part II - Adjustments to Income: Here, taxpayers can claim specific deductions that reduce their taxable income, including student loan interest and contributions to retirement accounts.

- Signature and Date: The form must be signed and dated to be considered valid, confirming that the information provided is accurate to the best of the taxpayer's knowledge.

Filing Deadlines / Important Dates

The filing deadline for the Schedule 1 tax form aligns with the main Form 1040 submission date, which is typically April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be mindful of any changes in deadlines or extensions that may occur, especially in light of special circumstances or IRS announcements. Filing on time is crucial to avoid penalties and ensure compliance with tax obligations.

Quick guide on how to complete schedule 1 tax form

Prepare Schedule 1 Tax Form seamlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Schedule 1 Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to adjust and eSign Schedule 1 Tax Form effortlessly

- Obtain Schedule 1 Tax Form and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your updates.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, time-consuming form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from your preferred device. Modify and eSign Schedule 1 Tax Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 1 tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040 Schedule 1?

Form 1040 Schedule 1 is a tax form used for reporting additional income and adjustments to income for your federal tax return. It helps you declare income types not covered on the main 1040 form, such as unemployment compensation and various deductions. Completing this form accurately is essential to ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with Form 1040 Schedule 1?

airSlate SignNow streamlines the process of sending and signing Form 1040 Schedule 1 electronically. Its user-friendly interface allows users to easily customize and securely share documents for eSignature, ensuring that your tax forms are signed promptly. This can save you time and help alleviate the stress of managing tax-related paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 1040 Schedule 1?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose from free trials to subscription options that provide additional features for handling forms like Form 1040 Schedule 1. This cost-effective solution ensures you get access to essential signing capabilities, enhancing your workflow.

-

What features does airSlate SignNow provide for managing Form 1040 Schedule 1?

airSlate SignNow includes features such as eSignature capabilities, cloud storage, and easy document tracking for Form 1040 Schedule 1. You can create templates, set reminders for signers, and collaborate in real-time. These features enhance efficiency and make it simpler to manage your tax forms.

-

Can I integrate airSlate SignNow with other applications for Form 1040 Schedule 1?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage Form 1040 Schedule 1 alongside your existing software solutions. Whether you need to sync data with your CRM or accounting software, these integrations help streamline your processes and improve productivity.

-

How secure is airSlate SignNow for handling sensitive documents like Form 1040 Schedule 1?

airSlate SignNow employs industry-leading security measures to protect sensitive documents such as Form 1040 Schedule 1. With encryption and secure storage in place, you can trust that your data remains confidential. Compliance with regulations ensures a safe experience for your electronic signature needs.

-

What benefits does using airSlate SignNow offer for completing Form 1040 Schedule 1?

Using airSlate SignNow for Form 1040 Schedule 1 provides numerous benefits, including speed, efficiency, and ease of use. It eliminates the need for printing, signing, and scanning paper documents, signNowly reducing turnaround times. This not only streamlines your tax filing process but also enhances overall productivity.

Get more for Schedule 1 Tax Form

Find out other Schedule 1 Tax Form

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple