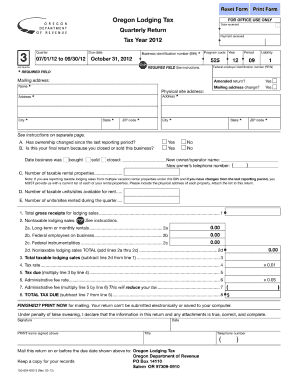

Oregon Lodging Tax Quarterly Return Form

What is the Oregon Lodging Tax Quarterly Return Form

The Oregon Lodging Tax Quarterly Return Form is a tax document required for lodging providers in Oregon to report and remit lodging taxes collected from guests. This form is essential for compliance with state tax regulations and ensures that lodging businesses contribute to local and state funding initiatives. The form typically includes sections for reporting gross receipts, tax calculations, and any applicable deductions or exemptions.

How to use the Oregon Lodging Tax Quarterly Return Form

To effectively use the Oregon Lodging Tax Quarterly Return Form, lodging providers should first gather all necessary financial records, including receipts and transaction logs. The form requires accurate reporting of total lodging revenue and the corresponding tax amount collected. After filling out the form, it must be submitted by the specified deadline to avoid penalties. Digital submission options are available, which streamline the process and enhance record-keeping.

Steps to complete the Oregon Lodging Tax Quarterly Return Form

Completing the Oregon Lodging Tax Quarterly Return Form involves several key steps:

- Gather all relevant financial documents, including sales records for the quarter.

- Calculate the total lodging revenue and the applicable tax amount based on current rates.

- Fill out the form accurately, ensuring all sections are completed, including any deductions.

- Review the form for accuracy to prevent errors that could lead to penalties.

- Submit the form by the deadline, either online or via mail, as preferred.

Legal use of the Oregon Lodging Tax Quarterly Return Form

The legal use of the Oregon Lodging Tax Quarterly Return Form is critical for lodging providers to maintain compliance with state tax laws. Proper completion and timely submission of this form ensure that businesses fulfill their tax obligations. Failure to submit the form can result in penalties, interest on unpaid taxes, and potential audits by state tax authorities. It is advisable for businesses to keep copies of submitted forms for their records.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Lodging Tax Quarterly Return Form are typically set for the last day of the month following the end of each quarter. Important dates include:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

Lodging providers have multiple options for submitting the Oregon Lodging Tax Quarterly Return Form. The available methods include:

- Online Submission: Many providers offer a digital platform for easy and secure online filing.

- Mail: Completed forms can be printed and sent via postal service to the designated tax authority.

- In-Person: Some businesses may choose to submit the form directly at local tax offices for immediate processing.

Quick guide on how to complete oregon lodging tax quarterly return form

Prepare Oregon Lodging Tax Quarterly Return Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and store it securely online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without any delays. Manage Oregon Lodging Tax Quarterly Return Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign Oregon Lodging Tax Quarterly Return Form with ease

- Obtain Oregon Lodging Tax Quarterly Return Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Edit and eSign Oregon Lodging Tax Quarterly Return Form and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon lodging tax quarterly return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Lodging Tax Quarterly Return Form?

The Oregon Lodging Tax Quarterly Return Form is a document that lodging providers in Oregon must use to report and remit lodging taxes collected from guests. This form ensures compliance with Oregon tax laws and helps businesses accurately account for their tax obligations. Using the Oregon Lodging Tax Quarterly Return Form streamlines the tax filing process, making it easier for businesses to stay compliant.

-

How can I obtain the Oregon Lodging Tax Quarterly Return Form?

You can obtain the Oregon Lodging Tax Quarterly Return Form directly from the Oregon Department of Revenue website. Additionally, airSlate SignNow offers a user-friendly platform where you can create, fill out, and sign this form electronically, simplifying the process. Our solution ensures you have easy access to necessary documentation at all times.

-

What features does airSlate SignNow offer for the Oregon Lodging Tax Quarterly Return Form?

airSlate SignNow provides a range of features tailored for completing the Oregon Lodging Tax Quarterly Return Form, including templates, eSignature capabilities, and secure document storage. Our platform allows for easy sharing and collaboration, ensuring that your team can work efficiently on the form. You can also track the status of your submissions to ensure timely compliance.

-

Is there a cost associated with using airSlate SignNow for the Oregon Lodging Tax Quarterly Return Form?

Yes, airSlate SignNow offers affordable pricing plans that cater to different business needs when using the Oregon Lodging Tax Quarterly Return Form. Our cost-effective solutions provide value through time-saving features and enhanced security for your documents. We also offer a free trial, allowing businesses to explore our services before committing.

-

Can I integrate airSlate SignNow with other software for my Oregon Lodging Tax Quarterly Return Form?

Absolutely! airSlate SignNow easily integrates with various business applications, making it simple to incorporate the Oregon Lodging Tax Quarterly Return Form into your existing workflows. Whether you use CRM software or accounting tools, our integrations ensure a seamless experience. This capability enhances efficiency and organization when managing your tax documents.

-

How does airSlate SignNow enhance the eSignature process for the Oregon Lodging Tax Quarterly Return Form?

airSlate SignNow simplifies the eSignature process for the Oregon Lodging Tax Quarterly Return Form by allowing users to sign documents electronically in just a few clicks. Our platform complies with legal standards, ensuring that your eSignatures are valid and secure. This not only speeds up the signing process but also reduces the need for physical paperwork.

-

What are the benefits of using airSlate SignNow for the Oregon Lodging Tax Quarterly Return Form?

Using airSlate SignNow for the Oregon Lodging Tax Quarterly Return Form offers several benefits, including increased accuracy in tax reporting, reduced paperwork, and enhanced compliance with state laws. Our platform is designed to save you time and effort, enabling you to focus on running your business. Additionally, the convenience of electronic signatures makes the process more efficient.

Get more for Oregon Lodging Tax Quarterly Return Form

Find out other Oregon Lodging Tax Quarterly Return Form

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement