W 4 Form Indiana

What is the W-4 Form Indiana

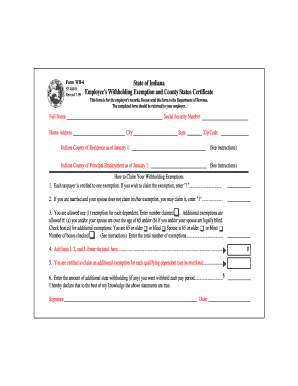

The W-4 Form Indiana is a tax form used by employees in the state of Indiana to inform their employer about their tax withholding preferences. This form is essential for determining how much federal income tax should be withheld from an employee's paycheck. By accurately completing the W-4, employees can ensure that they are not overpaying or underpaying their taxes throughout the year, which can lead to a refund or a tax bill when filing their annual tax return.

Steps to Complete the W-4 Form Indiana

Completing the W-4 Form Indiana involves several key steps to ensure accuracy and compliance with tax regulations. Here are the steps to follow:

- Personal Information: Fill in your name, address, Social Security number, and filing status. This information helps identify you for tax purposes.

- Multiple Jobs or Spouse Works: If you have more than one job or your spouse works, indicate this on the form. This section helps calculate the correct withholding amount.

- Claim Dependents: If you have qualifying dependents, you can claim them to reduce your withholding amount. This can result in a higher take-home pay.

- Other Adjustments: If applicable, you can indicate any additional income, deductions, or extra withholding amounts to further tailor your tax withholding.

- Signature: Finally, sign and date the form to validate your information.

How to Obtain the W-4 Form Indiana

The W-4 Form Indiana can be easily obtained through various channels. You can download the form directly from the official IRS website or request it from your employer. Most employers provide this form as part of the onboarding process for new employees. Additionally, many tax preparation software programs include the W-4 Form Indiana, making it accessible for those who prefer to complete their tax forms digitally.

Legal Use of the W-4 Form Indiana

The W-4 Form Indiana is legally binding when completed accurately and submitted to your employer. It is crucial to ensure that all information provided is truthful and up-to-date, as incorrect information can lead to penalties or issues with the IRS. The form adheres to federal guidelines and state-specific regulations, making it a vital document for tax compliance in Indiana.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the W-4 Form Indiana is essential for effective tax planning. While the W-4 itself does not have a specific submission deadline, it should be completed and submitted to your employer as soon as you start a new job or experience a significant life change, such as marriage or the birth of a child. Keeping your W-4 up to date ensures that your tax withholding reflects your current financial situation.

Form Submission Methods (Online / Mail / In-Person)

The W-4 Form Indiana can be submitted through various methods, depending on your employer's preferences. Typically, employers allow you to submit the form in person, via email, or through a secure online portal. It is important to confirm with your employer how they prefer to receive the completed form. If submitting by mail, ensure that you send it to the correct address provided by your employer.

Quick guide on how to complete w 4 form indiana

Effortlessly Prepare W 4 Form Indiana on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage W 4 Form Indiana on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign W 4 Form Indiana with Ease

- Obtain W 4 Form Indiana and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing fresh document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Edit and eSign W 4 Form Indiana to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 4 form indiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W 4 form Indiana, and why is it important?

The W 4 form Indiana is a tax document that employees in Indiana use to indicate their tax withholding preferences. It is essential because it helps ensure that the correct amount of state and federal taxes are withheld from your paycheck, impacting your take-home pay and tax refund.

-

How can I easily eSign my W 4 form Indiana with airSlate SignNow?

With airSlate SignNow, you can upload your W 4 form Indiana and use our intuitive eSigning tools to complete the document digitally. This makes it fast and convenient to sign and send your tax forms without needing to print or scan.

-

Are there any costs associated with using airSlate SignNow for the W 4 form Indiana?

airSlate SignNow offers a cost-effective solution for managing your W 4 form Indiana. Pricing plans vary based on features, but there are options to accommodate both individuals and businesses, ensuring you can find a plan that fits your budget.

-

What features does airSlate SignNow offer for filling out the W 4 form Indiana?

airSlate SignNow includes features like customizable templates, automated workflows, and real-time collaboration to streamline the process of completing your W 4 form Indiana. These tools enhance efficiency and accuracy when managing your tax documents.

-

Is my W 4 form Indiana data secure with airSlate SignNow?

Yes, airSlate SignNow prioritizes security and employs industry-standard encryption and compliance measures to protect your W 4 form Indiana and other sensitive documents. You can trust that your data is safe while using our platform.

-

Can I track the status of my W 4 form Indiana after sending it for eSignature?

Absolutely! airSlate SignNow allows you to track the status of your W 4 form Indiana after sending it for eSignature. You'll receive notifications when the document is viewed and signed, ensuring you're always informed throughout the process.

-

What integrations does airSlate SignNow offer for managing the W 4 form Indiana?

airSlate SignNow integrates seamlessly with various third-party applications, such as Google Drive, Dropbox, and CRM systems, making it flexible for managing your W 4 form Indiana alongside other essential business tools. This enhances productivity and document management.

Get more for W 4 Form Indiana

Find out other W 4 Form Indiana

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now